Markets | NGI All News Access | NGI Data

Bulls Back In The Saddle For Weekly NatGas Trading

Weekly spot gas prices reversed the prior week’s 2-cent setback and for the week ended August 18 the NGI Weekly National Spot Gas Index posted a healthy 11-cent advance to $2.71.

Most points added between a nickel and a dime, but double-digit gains in the Northeast helped pull the average higher. Of the actively traded points, Transco Zone 6 non-NY North serving southeasternmost Pennsylvania, Trenton, and southern New Jersey rose the most adding 89 cents to $2.76, and the week’s greatest losers went to both Transwestern and Waha with 3-cent losses to $2.55, and $2.63, respectively.

The Northeast and Appalachia proved to be the week’s greatest regional gainers with additions of 65 cents to $2.80 and 19 cents to $1.98, respectively.

The Rockies and California were the softest regionally with gains of a penny to $2.54 for the Rockies and a loss of 6 cents to $2.82 for California.

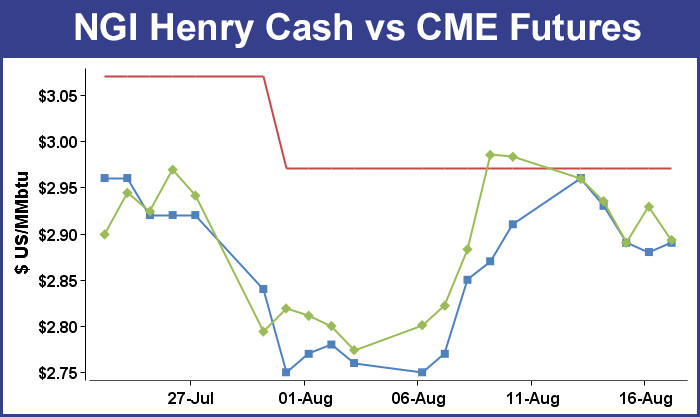

In spite of a bullish storage report Thursday, September futures retreated 9.0 cents to $2.893.

The Thursday’s Energy Information Administration (EIA) storage report prompted a six-cent futures turnaround in the minutes following the 10:30 a.m. EDT release of the weekly storage inventory report, which included a bullish 9 Bcf downward revision to working gas stocks for the week ended Aug. 4.

The market initially seemed unsure of what to do with EIA’s figures. EIA reported an implied 53 Bcf build for the week ended Aug. 11, higher than most estimates and 3 Bcf above the five-year average build of 50 Bcf. The minute the plump weekly injection figure went live, the September contract traded as low as $2.856, about 3 cents down from Wednesday’s settle of $2.890.

But then traders digested EIA’s revisions, which resulted in an average 10-Bcf reduction for the weeks between June 30 and Aug. 4 based on reclassifying working gas to base gas. As a result, EIA reduced the 3,038 Bcf of total working gas stocks in last week’s report down to 3,029 Bcf.

By the close Thursday, September settled up 3.9 cents to $2.929, and October added 4.1 cents on the day to settle at $2.966.

“We had the numbers come out, and it was a little bit of a whipsaw reaction when we first started,” Powerhouse Vice President David Thompson told NGI. The market eventually settled on a move higher “even though we ended with a slightly larger build than expected.”

Thompson said the downward revisions to the June 30-Aug. 4 period could have played a part, but the market may have also been factoring in weather systems developing over the Atlantic.

The National Hurricane Center (NHC) had its eyes on three systems Friday, including Tropical Storm Harvey. At 5 p.m. EDT Harvey was located 130 miles west southwest of St. Lucia and was sporting winds of 40 mph. It was moving to the west at 21 mph and NHC said “slow strengthening” was likely.

An area of low pressure about 600 miles east northeast of the Leeward Islands was showing signs of organization and NHC gave it a 60% chance of tropical storm formation in the next 5 days.

A tropical wave several hundred miles west of the Cabo Verde Islands was given a 40% chance of becoming a tropical storm in the next 5 days.

At first glance Friday it may have looked like weekend and Monday physical natural gas was held to minimal changes, but don’t tell that to traders trying to do deals on Northeast pipes. Most points, however, did trade within a penny or two of unchanged, and the NGI National Spot Gas Average was down 7 cents to $2.74.

Weather expectations and pipeline outages in and around New England sent prices soaring, but gains in there could not offset weakness in Appalachia. Futures bulls suffered another round of unsupportive weather-related indignation, and at the close September had fallen 3.6 cents to $2.893, while October was off 3.6 cents to $2.930. September crude oil jumped $1.42 to $48.51/bbl.

Analyst Stefan Baden at EnergyGPS said the gains in the Northeast were both weather and pipeline related. “Demand in New England Saturday is going to be stronger than Friday which is unusual. The average temperature in Hartford and Boston are going up to 77 degrees and there are some humidity implications as well. That is expected to remain strong through next week.”

Gas at the Algonquin Citygate rose 71 cents to $3.05 and deliveries to Tennessee Zone 6 200 L gained a stout 69 cents to $3.03. Gas on Tetco M-3 Delivery added 27 cents to $2.13 and packages bound for New York City on Transco Zone 6 were quoted 29 cents higher at $2.94.

“There are also some pipeline issues as well. Algonquin traded just above Iroquois Zone 2 [Z2] so it will try to pull or keep from sending gas in that direction. That is likely a direct relation to the outage on Algonquin,” Baden said.

“This signals that the marginal molecule flowing into the AGT system has moved to Z2 and which is ultimately being fed by Canada through Waddington. Outages on the TGP system will reduce flows into the northeast, which surely added some upside to the overall market however looking at the ISO New England load profile over the weekend and for Monday AGT likely would have priced to Z2 regardless. Mass Hub peak demand is expected to hit 21.7 GWs for Monday, which is 2.4 GWs stronger than Wednesday’s load forecast, which drove AGT to $2.80 in cash.”

Other market points weren’t quite so exuberant. Gas at the Chicago Citygate added 3 cents to $2.85 and deliveries to the Henry Hub rose just a penny to $2.89. Packages on Northern Natural Demarcation fell a penny to $2.70.

Gas on CIG came in a penny higher at $2.52 and El Paso S Mainline was quoted at $2.69, up a penny also. PG&E Citygate rose 2 cents to $3.25 and gas priced at the SoCal Citygateshed 4 cents to $2.89.

Technical analysts see no convincing trend at the moment. “We are in limbo land,” said Walter Zimmermann, vice president at United ICAP. “This time of year my rule of thumb is you don’t want to be short natural gas after Labor Day because of the risk of a fall to winter pre-season rally.

“That said the seasonal cycle low the last few years has been migrating from late August to mid-September. The big event of the year is the fall to winter preseason rally so I can’t get excited about selling into this because Labor Day is just around the corner.

“All the bulls need to keep alive the case for a decent rally into the winter is hold above $2.715. We had a recent low at $2.753 and it’s not as if buying here you have to risk a whole lot. As far as the upside goes, I think by November and December we have a shot at the $3.66 to $3.68 area. As long as $2.72 holds, there is a case for $3.67 by Thanksgiving.”

Weather forecasts going into the weekend, however, made it difficult to get enamored of a long natural gas position. “Once again the six to 10 day period forecast is cooler than yesterday’s forecast across the southern and eastern US,” said WSI Corp. in a morning report to clients. “Portions of the West and north-central US are a little warmer.” Continental United States population-weighted cooling degree days “are down 2 to 41.3, which are 5.3 below average.”

WSI cautioned that “even with cooler changes during the past two days, the Plains, Midwest and Northeast have minor cooler risks. The southern states could swing in either direction depending on the amplitude of the flow, timing of the front and wet weather. The GFS offers warmer risks for Texas, but the ECMWF [European model] is cooler.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |