Marcellus | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Appalachia Could Unleash Up to 10 Bcf/d Once Prices, Takeaway Cooperate, Says Genscape

The Northeast has replaced weather as the wildcard in the U.S. natural gas markets because deferred and constrained wells could unleash as much as 10 Bcf/d if prices were to cooperate, a Genscape Inc. expert said Wednesday.

Genscape’s Randall Collum, managing director of supply side analytics, offered his outlook for Lower 48 natural gas production during a panel discussion at the firm’s first Oil & Gas Symposium in Houston.

Two areas are the big drivers, up and down, in the next year: the Marcellus/Utica shales in the Northeast and the associated gas “phenomenon” resulting from unconventional oil wells. Associated gas alone delivered another 2 Bcf/d of additional production in 2014 and should add another 2 Bcf/d this year. And while the Haynesville Shale has moved back on the radar, it doesn’t come anywhere close to the Northeast’s potential.

“The production capacity is there,” Collum said of Appalachia. “If there’s a price high enough, there’s enough gas so that producers can grow potential as much as they can with the well capacity there for years.”

In the Northeast, “not only do you have this huge deferred inventory, but you have a lot of wells that are in this constrained pattern where basically the Northeast is almost acting as a storage reservoir…So if you relieve constraints, and the prices are there, producers will flow the gas and the flows will probably be more…

“There’s nowhere else in North America like this,” he said.

Last year Marcellus/Utica production rose by about 4.2 Bcf/d. This year gas output is expected to decline to around 3.1 Bcf/d from the end of 2014.But the drilled but uncompleted, or DUC, inventory is estimated to have risen by almost 250 wells in the combined Marcellus/Utica. In addition, a few operators earlier this year shuttered more than 1.2 Bcf/d.

A lot of gas is lurking, awaiting its time to jump into the market.

Chesapeake Energy Corp. this year is voluntarily shuttering about 275,000 MMcf/d gross in the Utica Shale and 500 MMcf/d gross in the Marcellus (see Shale Daily,Aug. 5). Cabot Oil & Gas Corp. is curtailing 500 MMcf/d gross as of July (see Shale Daily,July 24).

When all of those price-related shut-ins are brought back online as expected late this year, “that will be the peak of domestic gas production in the Lower 48,” Collum said.

Adding back the producer-related shut-ins would bring this year’s production total to 3.7-3.8 Bcf/d of growth from Appalachia.

But If basin prices were to strengthen, and pipeline takeaway encouraged producers to tie more wells to sales, it may be a flood.

“We believe the potential for all-time high production is high, on high demand, high prices,” Collum said. “We could see spikes in production. We believe it could move as much as 2 Bcf/d.”

In total, Genscape estimates that the DUCs, shut-ins and constraints total as much as 10 Bcf/d.

For the gas operators, “the Northeast is the wildcard,” aid Collum. “If prices are there, producers will flow it, and if not, they won’t…We see that happening all winter this year.”

Another critical component of U.S. gas production in recent years is the arrival of more associated gas volumes, which are fairly straightforward to measure. Output increases or decreases depending on the oil price. As oil prices have stagnated and the rig count has declined, those associated volumes have flattened.

“We believe going forward that’s the piece that’s going to slow down the most,” Collum said.

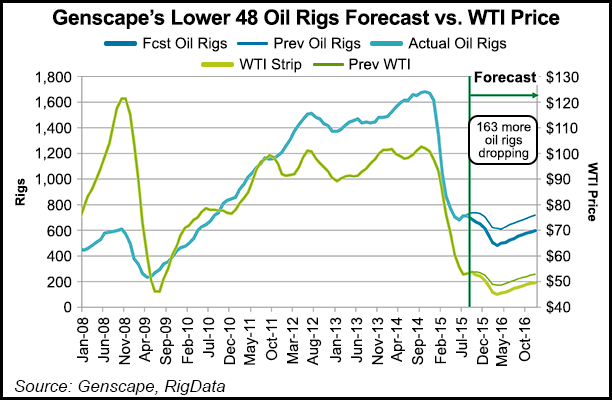

If oil prices were to remain in a range of around $50/bbl, “we think there’s going to be another 160 oil rigs dropped by the end of 1Q2016,” he said. If oil prices were to dive and remain at around $40/bbl, “we actually think it could drop by another 150. So we could see another 300 rigs drop. That would put us below the lows of July 2009 for oil rigs. Right now we’re still about 250 rigs above that.”

There’s a big inventory of associated gas deferred wells. On a six-well average pad, for instance, five onshore oil wells always are in inventory, Collum explained. If 100 rigs were running in the Permian Basin, there would an average of 3-3.5 wells per rig, or roughly 300-350 wells awaiting completion. Cutting the rig count by half still would leave 150-175 DUCs.

To determine when the lag might catch up, Collum used figures from the previous downturn in 2008-2009 to compare to this one. At that time, Texas production peaked about three months after the rigs peaked.

“Impressively, the rigs have been relatively on the same path as the 2008-2009 downturn,” he said. “On a percentage basis, the 2008-2009 downturn declined a little bit more on a percentage basis, but it actually also rebounded much quicker. Right now we flattened out earlier this summer, oil got back to $60, oil crashed again, rig counts started going the opposite way. We actually believe they will continue to decline…

“This time around in Texas we believe there’s more than a six-month lag in the rig count peak and the production peak because of the deferred inventory filling in. We actually believe most of the deferred inventory on the associated gas side will be depleted by the end of this year. That would mean production on the gas side next year is going to decline.”

What’s keeping associated gas from declining too much are the efficiency gains, which have improved some well production by as much as 85%. Drilling improvements in the Permian are “close to 60-70% and next year they will be another 30-35%,” Collum estimated.

Associated gas also was on the rise in the Gulf of Mexico for the first time in a decade, lifted by state-of-the-art deepwater production facilities that include Hadrian South, Lucius and Tubular Bells. But as operators defer drilling offshore, “we will see it decline again.”

Genscape’s team built out 150 individual regions within each gas province region of the Lower 48. At a 10% IRR [internal rate of return] breakeven point, “quite a few aren’t economic…And if you look at a cutoff of 20%, you can see why the rig counts have dropped 60-70%.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |