Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures, Cash Prices Rally on Heels of Rig Count Drop

Natural gas futures traders shrugged off continued mild weather forecasts and elevated supply data, seizing instead on a sharp drop in the weekly rig count to push prices higher for a second day.

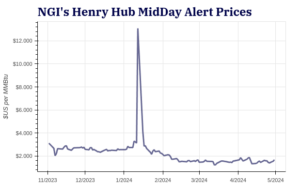

Following a 7.6-cent gain to close out last week’s trading, the June Nymex gas futures contract on Monday advanced 10.9 cents day/day and settled at $2.375/MMBtu. July followed suit, rising 10.4 cents to $2.542.

NGI’s Spot Gas National Avg. jumped 38.5 cents to $2.035, rebounding from losses the prior week.

Production held strong at 100 Bcf/d on Monday, according to Bloomberg’s estimate, within 2 Bcf/d of 2023 highs.

However, the latest Baker Hughes Co. (BKR) data showed natural gas-directed rigs dropped by 16 to 141. The BKR data, released Friday and covering the week ended May 12, pointed to a potential pullback in production later this year. This galvanized bullish market sentiment because it is a sign that producers are beginning to move rigs away from gas-focused areas in response to low prices this year, Marex North America LLC’s Steve Blair, senior account executive, told NGI.

The drop in gas-directed rigs marked the most precipitous decline since 2016 and followed comments during the first quarter 2023 earnings season from several producers that a slowdown loomed. Prices heading into this week were more than 70% lower than the peaks of 2022 in large part because of robust supplies and weak demand through what proved a mostly mild winter.

Blair, however, emphasized that rig counts ebb and flow – and one large weekly drop does not ensure the onset of a trend. He noted that many producers are hesitant to retreat too much because they are confident a spike in LNG demand awaits in coming years. New liquefied natural gas facilities are slated to open over the next few years to support expected long-term global demand for U.S. exports. This, by extension, could bolster prices over the long haul. Producers may be willing to stomach lower prices for longer in order to maintain momentum for the future demand jump.

Tudor, Pickering, Holt & Co. analyst Matt Portillo provided a similar assessment Monday, saying production could continue to outstrip demand through this year and into next.

“Overall, good to see the data starting to align with industry plans to drop drilling activity, but the market remains fundamentally oversupplied in our view through 2024, continuing to bias the strip lower until LNG demand really begins to surge into 2025,” Portillo said.

Weaker Weather

Meanwhile, weather-driven demand in the near-term remains elusive, production is steady and supplies in storage are stout.

“Bulls likely aren’t feeling fully confident they’re in full control when considering production remains very strong” and “weather patterns through the end of May are not nearly hot enough to intimidate,” NatGasWeather said.

The combination is expected to result in triple-digit storage injections through the remainder of May and into early next month, the firm said.

There is “the potential the streak extends to five or six weeks without hotter trends in early June,” NatGasWeather added. “Clearly, weather patterns are to the bearish side, and it doesn’t help that the background state remains quite bearish with surpluses at plus-332 Bcf, while forecast to increase to plus-375 Bcf by the end of May.”

The U.S. Energy Information Administration (EIA) most recently printed an injection of 78 Bcf natural gas into storage for the week ended May 5. That lifted inventories to 2,141 Bcf and kept stocks well above the five-year average of 1,809 Bcf.

Early storage estimates submitted to Reuters for the week ended May 12 ranged from injections of 76 Bcf to 122 Bcf, with an average increase of 106 Bcf. NGI modeled a 110 Bcf injection. That compares with a build of 87 Bcf during the same week last year and a five-year average of 91 Bcf.

Against the supply backdrop, analyst Brian LaRose of ICAP Technical Analysis asked, “can the bulls keep the rally going?” He thinks the prompt month needs to top $2.500 to show genuine momentum – or futures may revert back to the stagnant or lower trading that defined much of the spring. “And if the bulls are not up to the task? The door will remain open for the sideways to lower drift to continue.”

Cash Climbs Back

After a rough ride last week, spot gas prices bounced back Monday on the anticipated easing of production and the culmination of maintenance work in West Texas.

Chicago Citygate jumped 32.5 cents to average $2.195, while Houston Ship Channel gained 35.0 cents to $2.100 and SoCal Citygate spiked 95.0 cents to $2.755.

Analysts at East Daley Analytics noted that spot prices in the Permian Basin plunged into negative territory last week as maintenance on Permian Highway Pipeline (PHP) “bottled some production in the basin.”

PHP began scheduled work on Tuesday (May 9), reducing throughput by up to 1 Bcf/d to the Texas Gulf Coast, the analysts said. This left a glut of supply and forced producers without takeaway capacity to “effectively pay other shippers to take the gas in order to keep crude oil pumping,” the East Daley analysts said.

PHP, however, scheduled a return to full capacity of 2.1 Bcf/d over the weekend, and prices in West Texas rebounded with vigor on Monday. El Paso Permian gained 50.5 cents to $1.460, while Waha rose 49.0 cents to $1.440.

Looking ahead, cash markets are not likely to get much help from the weather this week or next.

NatGasWeather said an active pattern would continue through much of this week as weather systems track across the country with heavy showers and thunderstorms. However, the forecaster expects mostly comfortable high temperatures from the 60s to 80s for light national demand.

The West Coast could prove an exception, with highs in the 90s developing alongside strong high pressure, the firm said.

For the last week of May, NatGasWeather expects continued mild conditions across the northern half of the country. This could overshadow early summer heat in the Southwest and humidity in Texas and swaths of the Southeast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |