Markets | Natural Gas Prices | NGI All News Access

Natural Gas Futures Trim Early Gains after EIA Reports Modest Pull from Storage

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

International

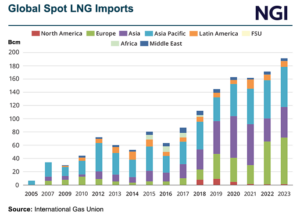

Natural gas buying at prices linked to dominant benchmarks like Henry Hub, the Japan-Korea Marker and the Title Transfer Facility last year again outpaced purchases linked to oil prices in a trend being driven largely by LNG trade growth, according to the International Gas Union (IGU). Between 2005 and 2023, the share of global gas-on-gas…

April 30, 2024Markets

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.