Natural Gas Futures Extend Slump on Large Storage Build, Mild June Forecast

A less than impressive forecast for early June and expectations for another triple-digit storage injection created an opening for bears to extend a recent sell-off in the natural gas futures market Wednesday. In the spot market, sweltering conditions in the Southeast couldn’t stave off widespread discounts; the NGI Spot Gas National Avg. fell 1.0 cent to $2.080/MMBtu.

Coming off a 6.0-cent sell-off on Tuesday, the June Nymex futures contract plunged another 7.0 cents to settle at $2.543. Losses were steeper further along the summer strip. July shed 8.2 cents to $2.559, while August dropped 8.2 cents to $2.574.

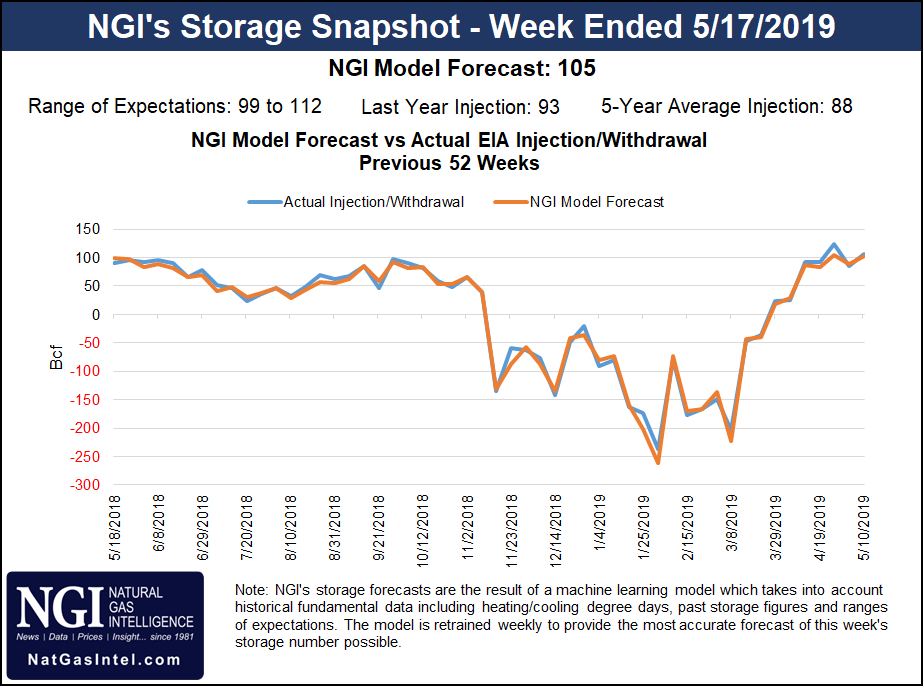

Estimates this week suggest the Energy Information Administration (EIA) will report yet another above-average shoulder season storage injection for the week ended May 17.

Surveys as of Wednesday showed a consensus prediction in the low triple digits for Thursday’s weekly data release. Respondents to a Bloomberg survey offered a median prediction of 104 Bcf, with a range of 99 Bcf to 112 Bcf. A Reuters survey also pointed to a 104 Bcf build, with responses from 100 Bcf to 112 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 102 Bcf, while NGI’s model predicted a 105 Bcf build.

A triple-digit build would top both the 93 Bcf injection EIA recorded for the year-ago period and the five-year average 88 Bcf. The reported weekly builds from EIA have topped the comparable five-year average every week since the season’s first net injection, which was recorded for the week ended March 29. If consensus is confirmed, this week’s report would mark the third build to top the 100 Bcf mark over that time frame.

According to NatGasWeather, the latest Global Forecast System ensemble data Wednesday continued to show national degree day totals easing into early June.

“While the nation experiences a little stronger demand through the middle of next week, the early June pattern still isn’t nearly hot enough to intimidate, and without hotter trends would likely lead to another 100 Bcf-plus build,” NatGasWeather said.

Looking at the technicals, Wednesday’s trading saw the June contract drop below the 50% weekly break down target at $2.564 pegged in INTL FCStone Financial Inc. Senior Vice President Tom Saal’s latest Market Profile. That’s based on a weekly initial balance between $2.609 and $2.700. According to Saal’s profile, after testing a value area from $2.538 to $2.552, prices could next test the $2.669 to $2.687 area.

Meanwhile, the commissioning phase at Kinder Morgan Inc.’s Elba Island liquefied natural gas (LNG) terminal in Georgia appears to be nearing an end, as the facility has been cycling its first liquefaction train on and off, according to power line monitoring conducted by Genscape Inc.

“Genscape power line monitors measure the electric and magnetic fields surrounding the power line that feeds the electrically-driven train engines at Elba Island LNG,” analyst Amir Rejvani said. “Current monitoring observations indicate continued testing as the first train can be seen turning on and off…Genscape expects Elba to exhibit activity that is similar to what other facilities have done leading up to a liquefaction commencement announcement from Kinder Morgan.”

Despite calls for some exceptionally hot temperatures in the southeastern United States this week and next, spot prices mostly posted discounts from Texas to the Mid-Atlantic Wednesday. In East Texas, Katy slid 1.5 cents to $2.535, while further east, Transco Zone 4 gave up 4.5 cents to $2.565.

NatGasWeather called for national demand to remain “relatively strong” Wednesday “due to unseasonably strong high pressure strengthening across the South and Southeast, with coverage of 90s gaining, hottest and most uncomfortable over Georgia and South Carolina.

“Demand is also being aided by cool conditions across the West and into the Plains as weather systems with rain and snow track through with chilly lows of 30s and 40s,” the forecaster said. “Demand for cooling will remain strong across the southeastern U.S. through the middle of next week.”

Still, demand totals would likely be more impressive if not for “mostly comfortable temperatures” expected across a corridor stretching from Chicago to New York City, including highs in the 60s to 80s in the coming days, NatGasWeather said.

Midwest locations sold off Wednesday, including at Joliet, which dropped 11.0 cents to $2.270. The Northeast saw generally minor day/day adjustments. Transco Zone 6 NY notched 1.5 cents to $2.265.

Elsewhere, with Northern Natural Gas (NNG) expected to finish maintenance work that had been impacting Permian Basin volumes this week, prices in West Texas rebounded Wednesday, albeit with a few trades still logged in the negatives. Waha’s day-ahead average nosed back above zero, gaining 56.5 cents to finish at 1.0 cent.

As of Wednesday’s early cycles, NNG’s production receipts remained more than 200 MMcf/d below the prior 30-day average, reflecting a second day of impacts from an ongoing two-day planned maintenance event, Genscape analyst Joe Bernardi said. The maintenance, expected to conclude Wednesday, impacted capacity through the pipeline’s Brownfield North and Mitchell to Gaines allocation groups.

“Overall Permian production was down just under 9.40 Bcf/d Tuesday, about 0.25 Bcf/d below the monthly rolling average and a drop of over 0.35 Bcf/d day/day,” the analyst said.

Further downstream in California and the Desert Southwest, prices were mixed. PG&E Citygate slipped 7.0 cents to $3.230, while Transwestern San Juan picked up 2.0 cents to $1.320.

A force majeure declared Tuesday on the Transwestern Pipeline was expected to have only a minor impact on flows into California from the Desert Southwest, according to Genscape’s Bernardi.

“Transwestern’s Topock Lateral capacity is cut by 165 MMcf/d by the force majeure, reducing it from 437 MMcf/d to 272 MMcf/d,” Bernardi said. “However, the previous month’s average flow was only 268 MMcf/d.”

Transwestern notified shippers that it expects the capacity to be restored by Thursday’s gas day. “Transwestern’s deliveries onto PG&E’s Redwood Path at Topock, AZ, have accounted for essentially all of this lateral’s volumes recently,” according to Bernardi.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |