Appalachian Pure-Play Arsenal Resources Files for Bankruptcy

Appalachian pure-play Arsenal Resources Development LLC (ARD) has filed for Chapter 11 bankruptcy protection to implement a prepackaged plan of reorganization already approved by lenders.

The announcement follows another earlier this year in which ARD holding company Arsenal Energy Holdings LLC entered a speedy Chapter 11 proceeding to wipe out more than $800 million of debt.

Those proceedings didn’t impact ARD, an exploration and production (E&P) company with about 208,000 net acres in Pennsylvania and West Virginia. But the producer made its own filing last week in the U.S. Bankruptcy Court for the District of Delaware.

ARD said the prepackaged plan has support from all of its existing lenders and most of its equity holders. Under the reorganization, the company would receive a $100 million equity investment from funds affiliated with Chambers Energy Capital and Mercuria Energy Co. in exchange for a majority ownership stake.

“Implementing the plan will provide the company with the needed capital to execute on its long-term business plan and pursue growth opportunities and allow it to continue to operate seamlessly for our customers, vendors, employees and stakeholders,” said ARD CEO Jonathan Farmer.

Management said the company’s employees, customers, vendors and operating subsidiaries would be paid during the court proceedings.

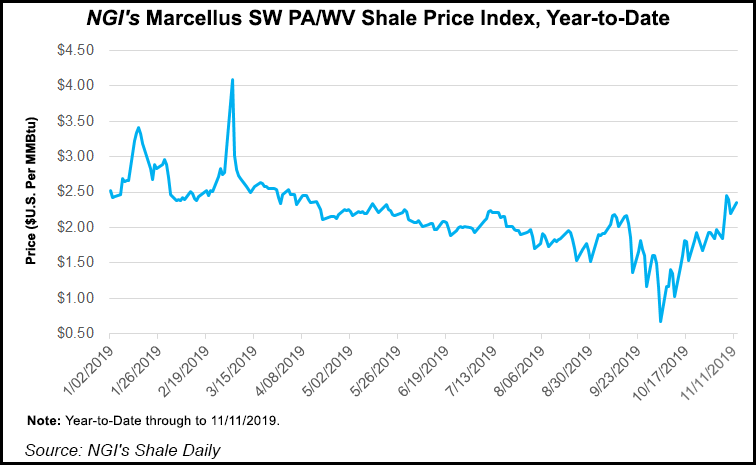

Oil and gas producers across the country are confronting weak commodity prices, but operators in Appalachia have been particularly hard hit as surging gas supplies have far outpaced demand, denting cash flow and making it hard for some to stay afloat as they grapple with heavy debt loads and an investment community that’s increasingly wary of the upstream sector.

While roughly in line with years past, dozens of North American E&Ps have filed for bankruptcy in 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |