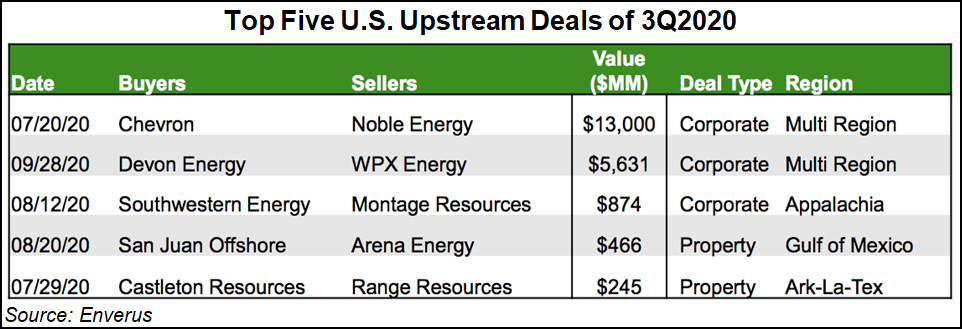

Chevron Corp.’s $13 billion takeover of Noble Energy Inc., completed on Monday, was the largest US. upstream deal during a sluggish third quarter, according to Enverus.

The oil and gas analytics company in its summary of 3Q2020 merger and acquisition (M&A) activity outlined the highs and lows for what was another volatile three-month period.

“While the third quarter’s tempo of 28 deals with a disclosed value is tied with 1Q2020 for the worst showing in 10 years, a couple of big corporate acquisitions pushed total transaction value to $21 billion,” analysts said. “That is a strong quarterly deal total by historical standards.”

Through the rest of 2020, “there is the potential for additional corporate deals,” but the “market for asset deals is likely to...