Shale Daily | E&P | NGI All News Access

Despite Independence Refrain, Petroleum Imports Still Major Component of U.S. Energy Mix

The narrative of U.S. energy independence pushed by President Trump and some industry groups aside, petroleum imports remain a sizable component of the domestic energy mix, the Energy Information Administration (EIA) highlighted in a recent report. this week.

To be sure, the United States exported 772,000 b/d more petroleum (crude and products) than it imported in November, EIA said, making it the third consecutive month as a net exporter.

However, the country remains a net importer of crude oil, EIA said, with imports averaging 5.8 million b/d in November, compared to exports of 3.0 million b/d.

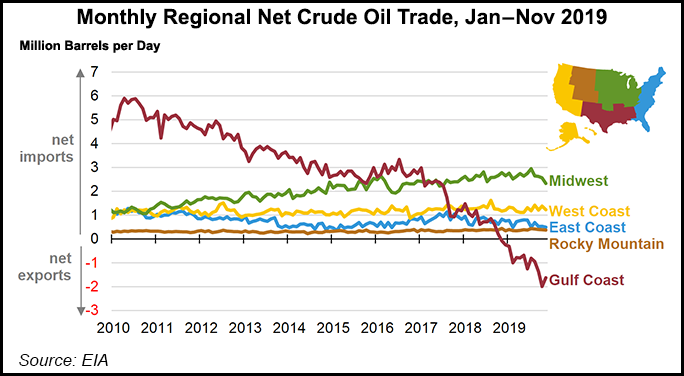

Moreover, “Although the United States is a net petroleum exporter as a whole, most regions other than the U.S. Gulf Coast…remain net petroleum importers,” the report said.

“Regional petroleum trade patterns are still determined by geographical factors, existing infrastructure, regional balances of supply and demand, and other constraints — factors that often change slowly,” EIA said. “In recent years, significant growth in crude oil output and infrastructure changes to refineries, pipelines, and terminals in the U.S. Gulf Coast region have led to most of the changes in U.S. petroleum trade patterns.

To track regional movements of petroleum supply, EIA breaks the country into five regions, known officially as the Petroleum Administration for Defense Districts (PADD): East Coast, Midwest, Gulf Coast, Rocky Mountain and West Coast. Of these, “only the U.S. Gulf Coast currently exports more crude oil than it imports: 2.9 million b/d of exports compared with 1.2 million b/d of imports in November.”

The Gulf Coast region mainly imports heavy, high-sulfur crude oil, EIA said, with Mexico and Canada nearly tied as the largest suppliers.

“Canada is also the largest source of crude oil imports for the Midwest, which is now the largest crude oil importing region,” EIA said. Crude oil net imports to the Midwest totaled 2.5 million b/d as of November, up by around 1.5 million b/d since 2010.

Over the same span, net crude imports to the West Coast, East Coast and Rocky Mountain regions have remained relatively static, EIA data show.

The EIA’s Short-Term Energy Outlook issued in January forecast that U.S. petroleum net exports will average 0.8 million b/d in 2020 and 1.4 million b/d in 2021. However, “EIA expects that the United States will remain a net importer of crude oil in both years, importing a net 3.9 million b/d of crude oil in 2020 and 2.9 million b/d in 2021.”

Opinions vary on the expected pace of near-term growth in Lower 48 production amid low commodity prices, geopolitical uncertainty, and increasingly scarce capital for exploration and production companies.

The coronavirus has only exacerbated the energy sector’s general unease and put further downward pressure on 2020 oil and natural gas price forecasts.

Rystad Energy researchers said in November they expected the United States to attain full energy independence by March, while IHS Markit analysts said they saw Lower 48 crude output growth slowing to a standstill by 2021 as the upstream segment shifts focus to growing capital returns instead of production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |