Mexico Regulator Gives Green Light to Deepwater, Burgos Exploration Projects

Mexico’s upstream oil and gas regulator, Comisión Nacional de Hidrocarburos (CNH), last Thursday approved drilling the Xakpún-1EXP deepwater exploration well by a subsidiary of China National Offshore Oil Corp., aka CNOOC.

The J-shaped well plans to target light oil resources in the Gulf of Mexico’s Wilcox formation to a total depth of 6,346 meters (20,820 feet) at an expected total cost of $96.2 million. Drilling is planned for August.

The well is included in the exploration plan approved by CNH in 2018 for offshore Area 4, awarded to CNOOC through the Round 1.4 bidding process conducted in 2016. The prospective resource to be evaluated totals 992.7 million boe, with a 42% probability of success, CNH said.

Area 4 is off the coast of Tamaulipas state, within the Salina del Bravo and Perdido Fold Belt geological provinces.

Last week also saw the approval by CNH of a deepwater appraisal plan for offshore Area 5 operated by a subsidiary of Murphy Oil Corp. CNH awarded the block, in the Salina del Istmo basin off the coast of Tabasco state, to a Murphy-led consortium through Round 1.4.

Through the appraisal program, Murphy and its partners plan to evaluate the discovery associated with the Cholula-1EXP exploration well, which was announced in March 2019.

The appraisal plan to drill up to three wells is expected to cost around $11.53 million under the base scenario and up to $275.6 million in the incremental scenario.

CNH also approved the appraisal plan by Mexican firm Pantera Exploración y Producción to drill two wells in the Burgos Basin south of the Texas border. One well is the Patriota-106DEL in Tamaulipas state, part of a modification to the evaluation program approved in early March. Investment is expected to hit $6.37 million, with $3.9 million for drilling and $2.47 million to complete the well.

The second approval was for the Teenek-1 well, targeting natural gas. Drilling is to begin in mid-September with costs projected at $4.93 million.

Last month Mexico’s Jaguar Exploración y Producción CEO Warren Levy said natural gas in the Burgos is a promising investment opportunity in Mexico, even given current demand and regulatory uncertainty. Jaguar has acreage in the basin. Last week Levy said the new Burgos approvals by CNH “will allow Jaguar to continue moving forward with our exploration and development plans.”

The energy reform of 2013-2014 in Mexico opened the upstream segment, formerly monopolized by national oil company Petróleos Mexicanos (Pemex), to private sector participation. All new upstream rounds have been canceled by the current government, but as a result of the reform, 22 companies including Jaguar are now producing oil and natural gas in Mexico, with another two expected to join the list this year, according to local oil and gas association Amexhi.

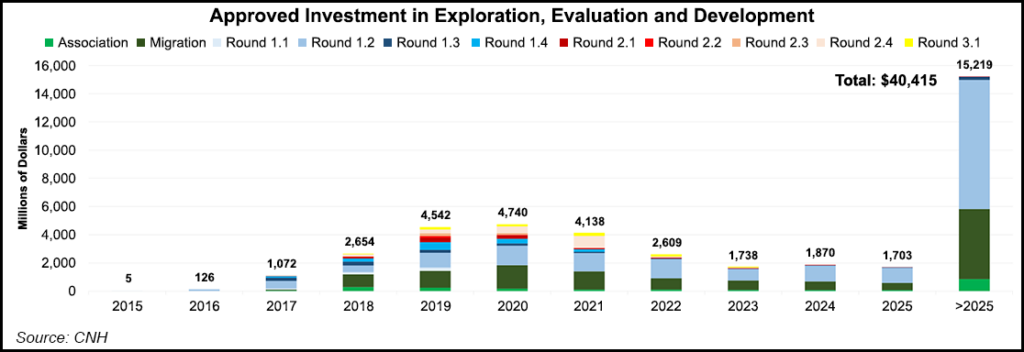

CNH Commissioner Sergio Pimentel said during an online event organized by Amexhi that a total of 73 energy companies were operating in Mexico, of which 38 are based in Mexico. As of May, investments of $40.5 billion had been approved for exploration and extraction activities.

Of the 111 contracts awarded in bid rounds during the previous administration, 56 are in the exploratory stage, 31 in the extractive stage, and 24 in the exploration stage at fields where appraisal work has already been undertaken by Pemex.

Private sector operators produced 196.2 MMcf/d of natural gas in 2019, up 35.2% from the 127.1 MMcf/d averaged in 2018. Amexhi expects the figure to increase to 450 MMcf/d by 2024.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |