Shale Daily | E&P | NGI All News Access

Callon Slashes Production, Capex in Permian, Eagle Ford to Survive Oil Demand Destruction

If there are any exploration and production companies that are stepping up activity in the Lower 48 today, they’ve yet to step forward, as operators have pulled back, shut in and cut off funding to some of the most prized assets.

Houston’s Callon Petroleum Co.,which had been eyeing big plans in the Permian Basin and Eagle Ford Shale this year after completing its takeover of fellow Texas operator Carrizo Oil & Gas Inc., has made some sharp changes to its 2020 plans as the energy world has been upended.

The Houston-based independent in its first quarter results noted that the Covid-19 pandemic has required a makeover in how it spends money and where. CEO Joe Gatto provided the update in a first quarter call.

“Our updated activity scenarios, which are dependent on an improving outlook for oil prices in the second half of 2020 and into 2021, reflect a minimum reduction of 40% compared to our initial budget and imply a maximum capital spend of $150-225 million in the second half of the year,” Gatto said. “We have positioned the company to quickly resume efficient development across all three of our areas when economically justified, albeit at reduced levels relative to where we began 2020.”

As exploration and production companies saw prices tumble in March, Callon was quick to the draw, by cutting capital spending in early March to $700-725 million and indicating it would drop four of its nine rigs in operation by mid-year.

With the outlook for energy since disintegrating further, capital for 2020 now is set at $250-325 million, assuming completion activities can resume in the second half. In addition, only one rig is slated for operation.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Callon shut in 1,500 b/d (gross) in April and expects to have curtailed more than 3,000 b/d in May. June volumes now are being scrutinized. In addition, flowback of a recently completed project in the WildHorse area of the Permian has been deferred until expected netbacks improve.

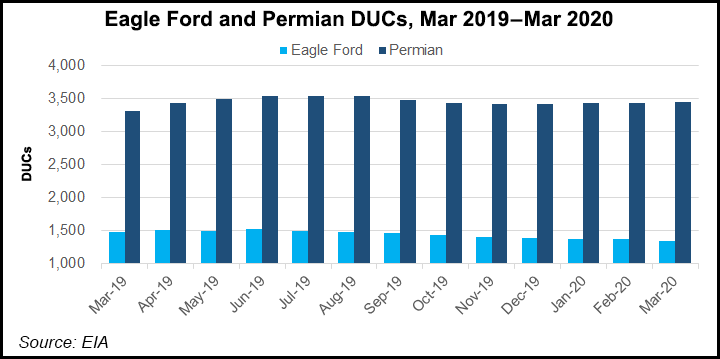

The drilled but uncompleted (DUC) well backlog that’s waiting to be turned to sales is expected to be at around 70 heading into the third quarter. Callon also has nine recently deferred completions, which should provide “capital-efficient sources of production once activity resumes,” Gatto said.

Callon had 1,268 net horizontal wells producing in the Permian and Eagle Ford at the end of March with output averating 101,000 boe/d, up 150% year/year. In the first quarter, 39.4 net wells were drilled with 30.8 turned to sales. Most of the wells are in the Eagle Ford (61%), with the Permian accounting for the rest.

Callon fetched an average price of $31.56/boe in 1Q2020, versus a year-ago average of $49.37. For natural gas, prices fell sharply to 62 cents/Mcf from $2.59, while the realized price for oil was nearly flat at $48.90/bbl from $48.83.

Net income, lifted by hedges, increased to $216.6 million (55 cents/share) in 1Q2020 from a year-ago loss of $19.5 million (minus 9 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |