NGI Mexico GPI | Markets | NGI All News Access

Higher Mexico Natural Gas Prices Likely as U.S. Gas Seen Surpassing $3; Covid-19 Seen Impacting 0.5 Bcf/d of Mexico Demand

U.S. natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, with Mexico prices poised to follow suit, according to analysts and historical price data.

Tudor, Pickering, Holt & Co. (TPH) and Goldman Sachs Commodities Research each weighed in with somewhat optimistic — but cautious — notes about the outlook for U.S. natural gas, driven by reduced oil supply.

Sustained $3-plus prices are likely “in our view, as the oil price collapse is set to drive 5.5 Bcf/d of supply declines” from the end of 2019 to the end of 2020, “putting the market 4-5 Bcf/d undersupplied heading into 2021,” the TPH analysts said in a note Monday.

This would likely translate to an increase in prices south of the border, as “most prices in Mexico are really just U.S. prices with a cost element added to move gas from the U.S. to wherever it lands in Mexico,” said NGI’s Patrick Rau, director of strategy and research.

One caveat, Rau said, is that most gas priced into Mexico is typically done via the Houston Ship Channel (HSC) and Waha indexes, which both trade at a discount to Henry Hub.

“But generally speaking, as U.S. prices rise, so too they rise in Mexico.”

The monthly Henry Hub spot price and Mexico’s IPGN monthly natural gas price index each fell 29% year/year in February, to $1.91/MMBtu and $2.71/MMBtu, respectively.

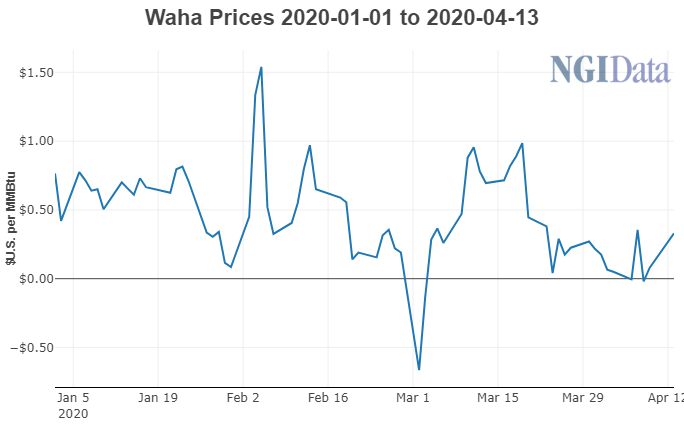

Rau highlighted that HSC prices typically track more closely to Henry Hub, while “Waha prices have had a mind of their own in recent years” due to the rapid growth of Permian Basin oil and associated gas output, which has outpaced the growth of takeaway capacity from the area.

“However, the accelerating reduction in the Permian rig count in response to extremely low oil prices means gas prices in the Permian will likely rise in the weeks ahead,” Rau said. “Not necessarily to the level of HSC prices, but closer.”

The TPH team said that “At $3/Mcf, we expect gas producers to continue to show restraint, with just 1 Bcf/d of gas-directed growth expected, meaning demand destruction may ultimately be the required path to a balanced market.”

Coal-to-gas (C2G) switching could erode 2 Bcf/d of demand, while pricing above $3 would begin to erode U.S. liquefied natural gas (LNG) utilization rates, based on the current strip for 2021. And obviously, the key variable is the price of oil, which determines how much associated gas is produced.

“Assuming crude prices stay depressed through year-end, the 5.5 Bcf/d of expected declines set the stage for sustained $3.00-plus gas pricing,” the TPH analysts said.

In a note to clients last week, analysts at Energy Aspects said that cross-border gas flows from the United States to Mexico had been capped at around 5 Bcf/d in recent days, likely a result of maintenance on the intrastate Net Mexico Pipeline in Texas, and that total volumes had dropped despite Enbridge Inc.’s Valley Crossing Pipeline, LLC delivering a record high 1.4 Bcf/d into the Sur de Texas-Tuxpan subsea pipeline.

“However, flows are not likely to revert to pre-maintenance levels of 5.5-5.6 Bcf/d once maintenance is over, due to Covd-19 quarantine measures,” analysts said.

While the ultimate impacts of social distancing on Mexico gas demand remain unknown, the Energy Aspects base case scenario entails a disruption of around 0.5 Bcf/d, similar to a weekend effect, while stricter measures could lead to an impact of up to 1.5 Bcf/d on baseline levels.

If West Texas Intermediate oil prices were to be $50/bbl or higher, associated gas could be expected to increase by 1.5 Bcf/d.

“But we see this being necessary to dig the market out of material undersupply and don’t see it being a threat to our $3 thesis,” said the TPH analysts. “After multiple years of associated gas being the scourge of the gas market, gas producers are positioned to regain control, and it likely means a prolonged period of very attractive pricing, provided the lessons of capital discipline are lasting.”

The gas pricing recovery then would accelerate because of associated gas shut-ins, with up to 7 Bcf/d possibly offline in the near term.

Even with the agreement by the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, it may not be enough to balance global crude markets in the near term, and U.S. oil output could be shut-in to restore balances.

A 3 million bbl reduction would equal the 25% decline in refinery utilization, with an impact to gas supply of around 7 Bcf/d, according to TPH.

“We expect this drives pricing north of $2/Mcf in the near-term but see further appreciation capped through the summer by global LNG pricing,” the analysts said.

A rally in Henry Hub prices “into the low-to-mid $2s would price even the committed cargoes out of the money on a variable cost basis, and we see the reduction in utilization rates being the primary balancing mechanism for the U.S. market.” The balance could be achieved in the low $2/Mcf price, next winter could lead to higher demand, delivering the potential return to $3.00 gas.

The Waha hub in West Texas, the gateway for Permian Basin gas, has been hit by negative pricing because infrastructure has been unable to keep up with associated gas growth. There’s been an estimated 3 Bcf/d on average wellhead growth over the past three years.

“We now see line of sight for a material recovery in price as production is set to decline in 2020,” the TPH analysts said. Even with estimated 1Q2020 flared gas volumes of 700 MMcf/d, wellhead volumes should decline over the next three quarters by 1.2 Bcf/d before oil well shut-ins.

Goldman analysts led by Samantha Dart recently talked about how U.S. oil well shut-ins during 2Q20020 offer an upside to this summer’s New York Mercantile Exchange (Nymex) gas price forecasts because more oil shut-ins mean less associated gas.

“This would open up room in storage, requiring lower C2G substitution to manage inventory levels, implying higher natural gas prices relative to our forecast,” the Goldman analysts said.

The deal by OPEC-plus may be insufficient to avoid hitting capacity in oil storage. That means “at least 4 million b/d of additional shut-ins are necessary globally in the near term,” according to Goldman analyst Damien Courvalin.

Goldman’s base case is for 1.5 million b/d of U.S. shut-ins during April and May, in addition to the 1 million b/d in domestic production declines between 1Q2020 and 4Q2020 reflected in the gas balances resulting from low oil prices.

“This results in an estimated 4.6 Bcf/d impact to U.S. natural gas production in that period, and a 2.1 Bcf impact to our previous 92.5 Bcf/d summer 2020 level expectations,” the Goldman analysts said.

The firm has revised expected U.S. LNG export cancellations this summer to 2 Bcf/d from 0.9 Bcf/d and slightly lowered assumptions for gas exports to Mexico by another 200 MMcf/d for the summer.

The lower supply should be enough to make room in storage for lower C2G substitutions and consequently, higher domestic gas prices. Lower expected end-of-October storage using current forward gas prices was reduced to 4.2 Tcf from 4.3 Tcf.

“Accordingly, we raise our 2Q2020 and 3Q2020 gas price forecasts to $1.75/MMBtu and

$1.90/MMBtu from $1.60/MMBtu and $1.75/MMBtu to reflect a need for lower C2G substitution than what we expected previously.”

Gas markets should be able to accommodate a high storage level this summer without a collapse in prices because high inventory levels should be needed in the face of tighter forward gas balances, the Goldman analysts said.

The firm is maintaining 2020/21 winter and 2021 summer Nymex forecasts at $3.50/MMBtu and $3.25/MMBtu, which is above current forwards at $2.74/MMBtu and $2.50/MMBtu.

Still, the firm said there is a high degree of uncertainty around expected changes to supply and demand in the coming months.

“Specifically, if oil shut-ins are 0.5 million b/d lower than our expected 1.5 million b/d or if U.S. LNG cancellations are 1 Bcf/d higher than our base case, storage levels would be unsustainably high, above 4.4 Tcf.”

Under that scenario, summer gas prices would need 40 cents/MMBtu below current prices to incentivize enough C2G substitution and bring the end-of-summer storage closer to its 4.26 Tcf capacity.

In late March Raymond James & Associates Inc. analysts said they expect 2020 gas prices to average $1.90/MMBtu, down from a previous forecast of $2.30. However, Henry Hub could average $3.50 in 2021 and reach “the $4 threshold in 4Q2021,” with 10-15 cents of upside potential if analysts are “too optimistic on oil prices.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |