NGI Mexico GPI | E&P | NGI All News Access

Latin American Rig Count in May Plummets to Lowest Level Since 1982, but Mexico Still Active

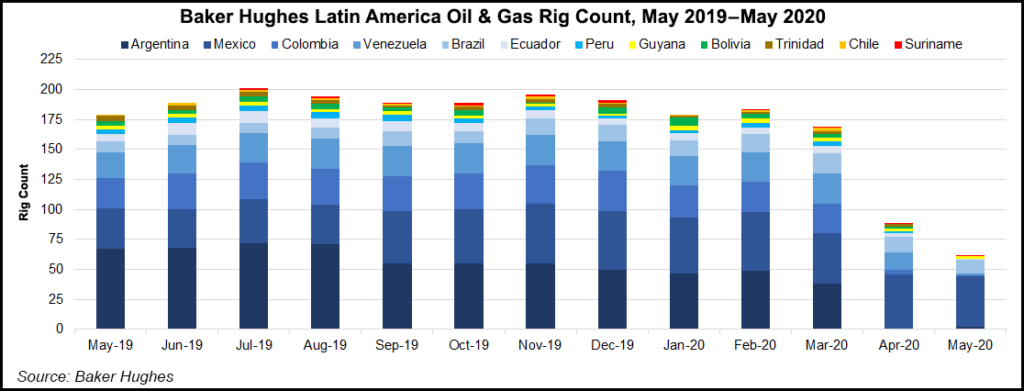

Driven by plummeting oil prices and the shutdown of local economies from the coronavirus pandemic, Latin America’s rig count fell a further 27 rigs month/month to 62 in May, according to the latest figures from Baker Hughes Co.

The rig count is down 107 from March, when the first cases of coronavirus were reported in Latin America, to 169. Last May, there were 179 rigs running in the region.

The May total of 62 rigs was the lowest on record, according to Baker Hughes, which has monthly global rig count information dating back to January 1982.

Land rigs slumped to 32 in May, compared to 135 in March. Offshore rigs have shown more resiliency, and were at 30 in May from 34 in March.

There were only three natural gas directed wells operating in Latin America in May, compared to 13 in March, and 24 a year ago.

The drop in rig count in Latin America mirrors what has happened in the United States, where recent cuts have been even more marked. As of last Friday (June 5), the U.S. rig count dropped another 17 units to 284 and is down more than 500 rigs since March 13.

Almost all oil and gas producing countries in the region scaled back drastically in April and May, except for Mexico. Taking Mexico out of the equation, there would have been only 20 active rigs combined in May in Latin America, which includes the producing states Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Peru, Suriname and Venezuela.

Mexico reported 42 active rigs in May, flat from March, and up eight rigs compared with May 2019.

Mexico’s government has vowed to continue to ramp up oil and gas production in its attempt to halt a decade of oil and gas production declines, even as oil prices have plummeted this year.

As much of its economy went into lockdown in April, Mexico’s energy industry was deemed essential and kept running.

Overall, Mexico has been able to stabilize production over the past six months. Production in April, the latest month for which official information is available, fell by 20,000 b/d month/month, to 1.727 million b/d. On a yearly comparison, April production was up by 56,000 b/d, according to data from the Comisión Nacional de Hidrocarburos (CNH).

April natural gas production rose to 3.935 Bcf/d from 3.897 Bcf/d in March and 3.739 Bcf/d in the year-ago period.

Mexico has also said that it will not further aid the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, in any new supply cuts after agreeing to scale back by 100,000 b/d in May and June.

“We already informed the members of OPEC of our posture,” President Andrés Manuel López Obrador said last Friday ahead of a weekend meeting of OPEC-plus members, explaining that Mexico is complying with its allotted supply cut of 100,000 b/d. What’s more, he said, there are countries “that, according to OPEC’s own report, have not fully complied with these adjustments.” Energy Minister Rocío Nahle declined to attend Saturday’s virtual meeting, sending a subordinate instead.

One of the consequences of work charging ahead in Mexico’s oil and gas sector has been a worrisome coronavirus outbreak at state oil company Petróleos Mexicanos (Pemex). On Monday, Pemex reported that 108 employees had died from complications due to the coronavirus.

Elsewhere in Latin America, the picture was decidedly different in May.

Venezuela, which has the largest oil reserves on earth, ran two rigs in May, compared to 25 in March. Argentina, after reporting zero active rigs in April, also ran two rigs in May.

Only Brazil was able to maintain a degree of continuity, reporting 11 rigs in May, compared to 17 in March.

Analysts at Welligence Energy Analytics suggested that recent price gains, along with the new OPEC-plus agreement, Mexico notwithstanding, mean that in Latin America the “bottom is already behind us.” They expect a gradual recovery in Latin American upstream operations through the second half of 2020.

After falling into negative territory for the first time ever in April, the New York Mercantile Exchange West Texas Intermediate contract for July delivery settled at $38.94/bbl on Tuesday, up 75 cents from Monday’s close.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |