NGI Data | Markets | NGI All News Access

NatGas Futures Slump Following On-Target Storage

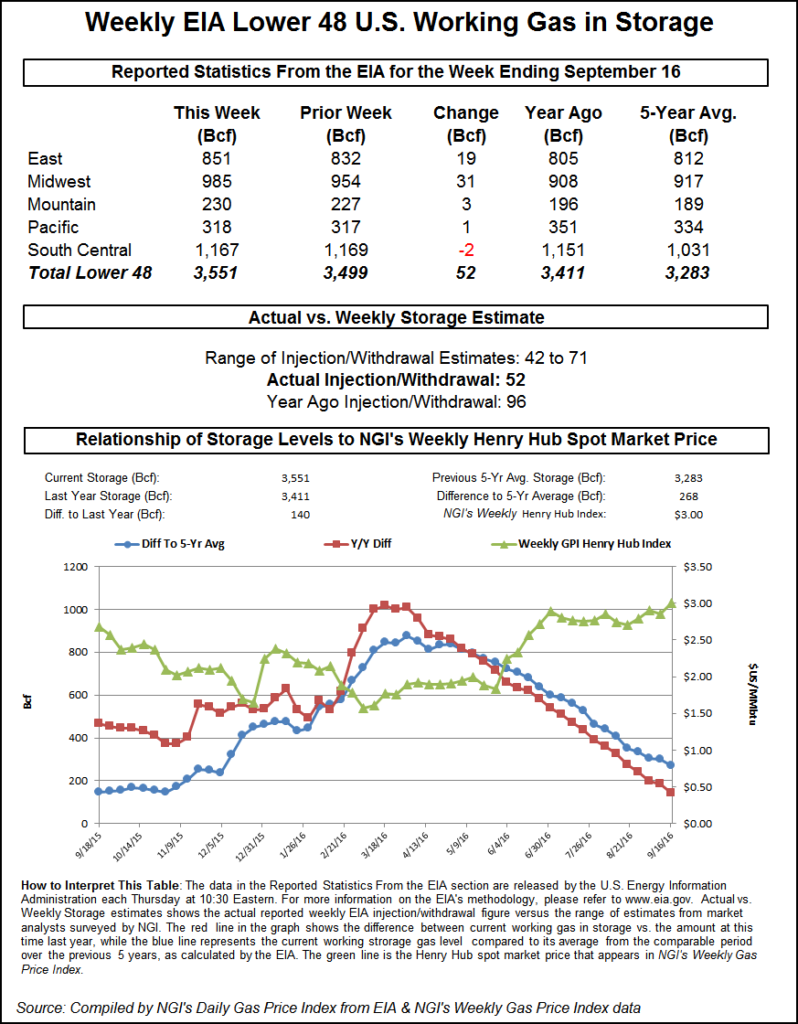

Natural gas futures traded lower Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was about in line with what the market was expecting.

EIA reported a 52 Bcf storage injection in its 10:30 a.m. EDT release, about what surveys and estimates by traders and analysts showed. October futures reached a low of $3.012 immediately after the figures were released, but by 10:45 a.m. EDT October was trading at $3.026, down 3.1 cents from Wednesday’s settlement.

“We were hearing a 45 Bcf build,” said Alan Harry, director of trading at McNamara Options in New York. “I think we are very overbought [and] $3.10-3.12 should be the next stop and then lower.”

“After two weeks of bullish misses, we saw it as unlikely that a third would follow, and though this number comes in far below the five-year average and even the 2012 print for the same week, it may not support prices above the $3 level for long,” said Harrison, NY-based Bespoke Weather Services.

Inventories now stand at 3,551 Bcf and are 140 Bcf greater than last year and 268 Bcf more than the five-year average. In the East Region 19 Bcf was injected, and the Midwest Region saw inventories increase by 31 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was up by 1 Bcf. The South Central Region decreased 2 Bcf.

Salt cavern storage was down 7 Bcf at 278 Bcf, while the non-salt cavern figure was higher by 5 Bcf at 889 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |