Markets | NGI All News Access | NGI Data

Sneak Peak of Autumn Leads to Widespread Losses for Weekly Natural Gas Prices

With crisp temperatures hovering over the Pacific Northwest and Canadian air moving down into the Midwest and East, weekly natural gas prices across the country posted losses for the Aug. 5-9 week. Led by steep declines in the Rockies and California, the NGI Weekly National Avg. dropped 6.5 cents to $1.89.

Despite the overall weakness in the Rockies, one of the most volatile pricing locations week was Kingsgate, which traded in a wide 55-cent range and hit a high of $1.80 following word that imports from Canada would remain restricted due to an ongoing outage at the McMahon gas processing plant in British Columbia (BC).

The McMahon plant had been expected to return to service on Wednesday, but a notice posted Tuesday indicated the new expected date for flows to return is Aug. 13. Receipts onto Westcoast Transmission averaged 387 MMcf/d through most of July, but then dropped to zero on July 30, according to Genscape Inc.

“Since the McMahon outage started, and with other area processing plants posting lower output, BC production has been running about 1.49 Bcf/d lower than the prior 30-day average,” Genscape analysts Rick Margolin and Joseph Bernardi said.

Kingsgate weekly prices ultimately dropped a quarter to $1.66.

With milder conditions moving into the West Coast after several days of scorching temperatures, prices in California slid. SoCal Citygate fell 16 cents for the week to $2.82.

Smaller losses were seen in most other areas of the country. Houston Ship Channel lost a dime to average $2.04 despite intense heat in the region. Local forecasts showed actual highs reaching the triple-digits through at least Monday, with real-feel temperatures reaching above 110 degrees.

In the Permian Basin, Waha fell 8 cents on the week to average 9 cents, with prices ranging wide from minus 58 cents to $1.05.

Prices throughout the Midcontinent and Midwest were down mostly less than a dime, as were those in Louisiana and across the Southeast.

The big mover in the Northeast was Maritimes & Northeast, which plunged 45 cents amid ongoing pipeline maintenance. Most other pricing hubs in the region fell in line with the rest of the country.

With long-range weather models trending hotter for much of the week, natural gas futures traders took notice and sent Nymex futures up several cents during the first full week of August. September prices rose about a nickel from Aug. 5-9 to reach $2.119, as did October, which landed at $2.133, even as production hit a new record and the year/year storage surplus grew.

Although the latest weather models finally eased a bit on the amount of projected demand in the coming week, particularly for the Aug. 16-18 period, the pattern as a whole remains locked into its overall hotter state, with 15-day gas-weighted degree day (GWDD) totals well above normal, and now even higher than GWDD totals for the same 15-day period last year, according to Bespoke Weather Services.

The South, especially Texas, continues to be where the strongest heat is forecast for the next several days before above-normal heat expands into the Midwest and East after the middle of the month. There has been a subtle move cooler at the end of the 11- to 15-day outlook in the central United States, with heat easing off in Texas, Bespoke said. The West, however, is due to see the return of above-normal temperatures. Overall, the forecast maintains above-normal heat on a national level, “just some variation regionally,” according to the forecaster.

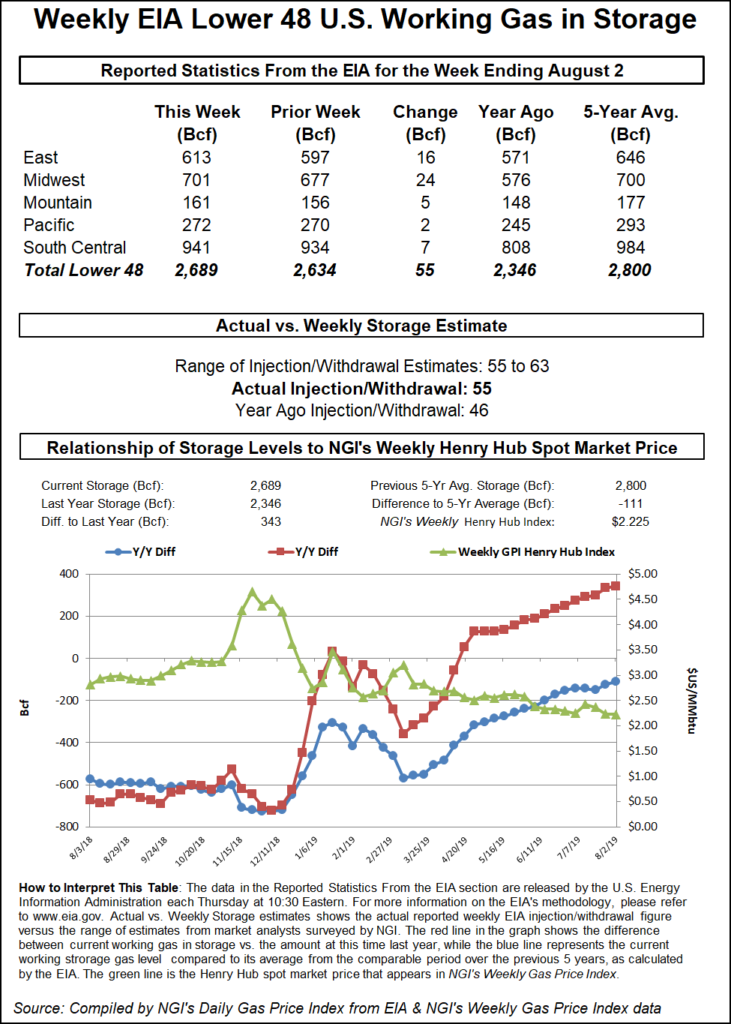

Bulls are banking on the projected heat stalling the string of above-average storage injections that have been seen for much of the summer. The Energy Information Administration (EIA) on Thursday reported yet another lofty build of 55 Bcf, which was well above last year’s 46 Bcf injection and the five-year average of 43 Bcf.

The reported build was slightly lower than expected, and by as much as 1.25/Bcf/d, according to Mobius Risk Group. It was also 10 Bcf lower than the previous week. More importantly, the salt storage withdrawal of 5 Bcf was not only 2 Bcf lower than the previous week, but also 2 Bcf lower than the same week last year.

Broken down by region, the South Central injected a net 7 Bcf, which took into account a 5 Bcf draw from salt facilities, according to EIA. The Midwest added 24 Bcf into stocks, while the East injected 16 Bcf. Inventories in the Mountain region rose by 5 Bcf, while the Pacific increased by 2 Bcf.

The 55 Bcf injection lifted working gas in storage as of Aug. 2 to 2,689 Bcf. The year/year surplus grew to 343 Bcf, while the deficit to the five-year average shrunk to 111 Bcf, EIA said.

“Although August and September are likely to see a continued trend of storage surplus expansion, the potential for sequential tightening helped hold the market up Thursday,” Mobius analyst Zane Curry said. “However, headwinds will remain intense as stockpile gains start climbing back towards the century mark in late September. Unless there is a substantially warmer shift to September weather forecasts and an abrupt transition to material cooling demand by mid-October, the market will likely continue to function in a ”sell the rally’ type manner through the early fall.”

Spot gas prices remained firmly in the red Friday as extremely mild weather set up over most of the United States aside from the South, especially Texas.

“Temperatures and humidity levels over much of the Upper Midwest and Northeast will be more typical of September, rather than the middle of August, this weekend,” AccuWeather senior meteorologist Alex Sosnowski said. Highs were forecast to range from the upper 70s to near 80 over the northern tier to the upper 80s around the Chesapeake Bay. The air expected over the weekend had its origins from northern and central Canada, which was expected to cool conditions at night.

“Low temperatures in the Northeast are forecast to range from the middle 40s over the mountains of northern New England to the upper 60s around the Chesapeake Bay,” Sosnowski said.

Meanwhile, at their lowest point, nighttime temperatures over the Midwest are expected to range from the lower 50s over the Upper Peninsula of Michigan and northern Minnesota to the middle 60s along the Ohio River in Illinois, Indiana and Ohio.

The breath of fresh air on tap for the Northeast sent prices plunging on Friday. Transco Zone 6 NY spot gas prices tumbled 16.5 cents to $1.685, while New England prices posted smaller losses due to the reshuffling of flows following unplanned maintenance on Algonquin Gas Transmission.

In Appalachia, Tennessee Zone 4 Marcellus cash tumbled 28 cents to $1.395, although most other pricing hubs fell less than 20 cents day/day.

Prices were mixed throughout the Southeast and in Louisiana, with changes limited to less than a nickel at most locations as flow nominations to U.S. LNG export terminals for Friday returned above the 4 Bcf/d mark for the first time since last Monday (Aug. 5).

However, Genscape Inc. proprietary monitoring indicates a new set of operational issues cropping up similar to those that recently suppressed numbers, suggesting Friday’s nominations may be subject to downward revisions.

Since Aug. 3, when feed gas deliveries to domestic LNG export terminals began dropping with a series of train outages, pipeline-reported deliveries had averaged 3.98 Bcf/d (including Friday’s potentially high value), according to Genscape. This represented a drop of nearly 1.8 Bcf/d compared to the 30-day average prior to the outages.

On the pipeline front, Gulf South Pipeline on Thursday began maintenance at the Hall Summit compressor station in Bienville Parish, LA. The work, set to continue through Sept. 26, is to restrict capacity at the Hall Summit/East Texas/Koran Area scheduling group by 146 MMcf/d for the duration of the event.

In the Midcontinent, cash prices were down as much as 10.5 cents at Northern Border Ventura. Similar decreases were seen in the Midwest.

Losses intensified farther west in the Rockies, where El Paso Bondad spot gas dropped 22.5 cents to average $1.49. In California, SoCal Citygate was down 79 cents to $1.96.

The only significant gains seen across the country were in West Texas, where strong local demand lift prices considerably. Waha jumped 28.5 cents to average 44 cents, with every trade pricing above zero and at least one hitting a high of $1.05.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |