Markets | NGI All News Access | NGI Data

Heat Not Enough to Lift Weekly Natural Gas Spot Market as Futures Plummet

Despite peak summer heat over much of the Lower 48, the promise of more comfortable conditions ahead helped take the edge off to keep natural gas spot prices in check during the trading week ended July 19; the NGI Weekly Spot Gas National Avg. slid 4.5 cents to $2.155/MMBtu.

Weekly spot prices at benchmark Henry Hub mirrored the bearish trends in the futures market, as forecasts showed the recent intense heat wave fading after the weekend. Prices there fell 6.0 cents to $2.365.

Midwest prices saw little uplift despite some well above-normal temperatures late in the week. Chicago Citygate slid 2.5 cents to $2.230. Along the East Coast, the heat did help to lift prices at a number of locations, including Transco Zone 6 NY, which gained 5.0 cents to $2.365.

Elsewhere, SoCal Citygate prices mostly held steady on the week as Southern California Gas was preparing to return a critical import line to service, one idled since 2017. Weekly SoCal Citygate prices added 2.5 cents to $2.615.

Natural gas futures prices sold off again Friday to cap off a decidedly bearish week, with the latest forecasts not promising enough summer cooling demand to appease a well-supplied market. The August Nymex futures contract dropped 3.6 cents to settle at $2.251, trading in a range from $2.242 up to $2.300. Week/week the front month plummeted 20.2 cents after settling at $2.453 the previous Friday.

The midday Global Forecast System (GFS) data Friday came in slightly cooler trending for the upcoming week but slightly hotter for the start of August, according to NatGasWeather. A comfortable pattern advertised for the northern portions of the country from late July into early August kept the pattern from looking bullish Friday.

“We do expect national daily” cooling degree day (CDD) totals “are likely to be above normal to start August, but they need to be much above normal to intimidate, and that would require hotter trends,” NatGasWeather said. This is “possible over the weekend, as we view the risk biased toward hotter trends versus cooler trends. But will it really be hot enough to induce a weather-driven rally? Not likely unless there were significantly hotter trends.”

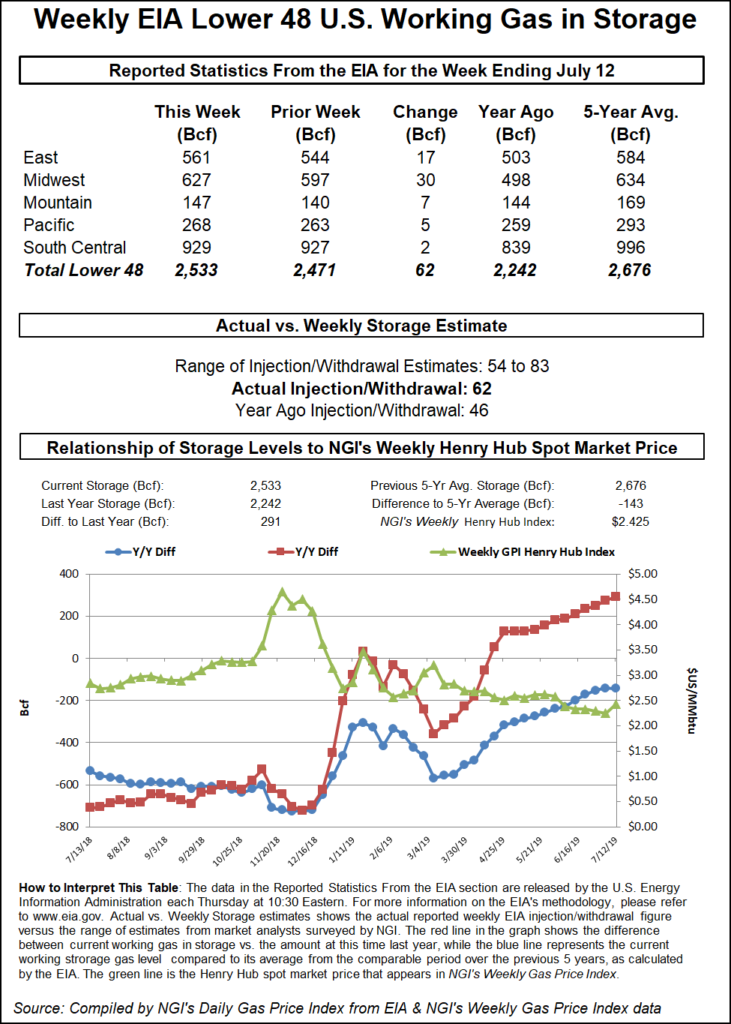

Meanwhile, the Energy Information Administration (EIA) reported a slightly below-average 62 Bcf build into U.S. natural gas stocks Thursday, on the low side of expectations, but it wasn’t enough to frighten the bears prowling the futures market.

The 62 Bcf injection, recorded for the week ended July 12, comes in higher than the 46 Bcf build for the year-ago period but slightly below the five-year average of 63 Bcf. The report marks the first below-average build since injections began in March, EIA historical data show.

Estimates had been pointing to a near-average injection close to the actual figure. A Bloomberg survey showed a median 69 Bcf, while a Reuters survey called for a 65 Bcf build. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 61 Bcf, while NGI’s model predicted a 65 Bcf injection.

Total Lower 48 working gas in underground storage stood at 2,533 Bcf as of July 12, 291 Bcf (13.0%) above year-ago levels but 143 Bcf (minus 5.3%) below the five-year average, according to EIA.

By region, the Midwest recorded the largest build of the week at 30 Bcf, followed by the East at 17 Bcf. The Mountain region refilled 7 Bcf, while the Pacific injected 5 Bcf. In the South Central region, a 14 Bcf injection into nonsalt stocks was partially offset by an 11 Bcf withdrawal from salt, according to EIA.

“Like Joe DiMaggio’s 56-game hit streak, eventually all streaks come to an end, and this week we ended the above-normal build streak (barely),” said analysts with Tudor, Pickering, Holt & Co. (TPH). “Barry impacts continue to be felt as Gulf of Mexico outputs are the primary driver behind dry gas volumes down around 2.3 Bcf/d from peaks achieved a week prior.

The upcoming EIA report “looks to be another bullish number, as power gen pushes 40 Bcf/d” and liquefied natural gas feed gas demand “continues its strength, averaging 4.9 Bcf/d for the week,” the TPH team said. “However, what this means for pricing is hard to say, as the market is in a three-way tug-of-war with bullish near-term fundamentals pulling against a bearish 2020 outlook, with a third force being applied from falling oil prices, which could drastically alter associated gas growth” should West Texas Intermediate prices drop below $50/bbl.

Genscape Inc. analysts viewed the 62 Bcf injection as indicating the market is about 2.0 Bcf/d loose versus the five-year average when compared to degree days and normal seasonality.

At current gas prices, average power burns for summer 2019 could finish ahead of the record levels set last summer, even with a “significant decline” year/year in CDDs, Genscape analyst Eric Fell said.

“This dynamic has already been in play this summer as seen with June power demand up approximately 1.5 Bcf/d despite 42 fewer CDDs for the month,” Fell said. “All else being equal, the decline in CDDs versus last June should have led to a decline in power demand of approximately 2 Bcf/d, but instead we saw an increase in gas demand of more than 1 Bcf/d. This means that, compared to last June, gas burn per CDD was up more than 3 Bcf/d.”

The increase in power burns per CDD this year has been driven by price, with June 2019 gas prices averaging nearly 60 cents lower compared to the year-ago period, according to Fell.

“Gas prices have actually been a stronger driver of gas demand than summer weather over the past 10 years,” he said. “Structural shifts have also been important, as we have retired coal plants and brought online new combined cycle gas plants. In 2018 we saw a particularly large shift in gas demand versus coal due to large changes in the power stack.”

Despite some of the hottest conditions of the summer to-date spread across the eastern two thirds of the Lower 48, the price reaction from the spot market had been muted heading into Friday’s session. With the sweltering conditions expected to dissipate early in the upcoming work week, deals for weekend and Monday delivery saw hefty discounts for most regions. Benchmark Henry Hub tumbled 8.5 cents to $2.275.

Over the weekend, NatGasWeather called for “hot high pressure” to strengthen across much of the country, increasing highs into the mid-90s from the Midwest to the East Coast. Highs were also expected to reach the 90s across the southern and central portions of the Lower 48, resulting in “very strong national demand, aided by very humid conditions.”

By the start of the upcoming work week, the forecaster called for showers and cooling to sweep across the Great Lakes and East.

“This will ease highs back into the 80s over these critical regions for lighter demand needs,” NatGasWeather said. “Cooling will also spread down the Plains into Texas and the South, dropping highs several degrees into the upper 80s to lower 90s.” In total, the pattern for the week ahead should result in “much lighter national demand.”

With cooler conditions expected after the weekend, prices headed lower throughout the Midwest, where Joliet shed 13.5 cents to $2.080. In the Midcontinent, Southern Star dipped 15.0 cents to $1.700.

Starting Monday (July 22) and continuing for another week, planned maintenance on the Southern Star system at the Welda compressor station is expected to limit 115 MMcf/d of gas bound for the pipeline’s Market Zone, according to Genscape analyst Dominic Eggerman.

During the maintenance “operational capacity through the Blackwell compressor station in Kay County, OK, will be limited to 417 MMcf/d. Blackwell is the primary compressor station delivering gas to Southern Star’s Market Zone in Kansas and Missouri, and has flowed an average of 532 MMcf/d over the past 30 days,” Eggerman said.

Elsewhere, East Coast locations also saw discounts. Transco Zone 6 NY slid 17.5 cents to $2.265. On the West Coast, meanwhile, PG&E Citygate shed 14.5 cents to $2.520. Further south, SoCal Citygate plunged 41.5 cents to $2.175.

A critical Southern California Gas (SoCalGas) import line was scheduled to return to service over the weekend, but that wasn’t expected to result in a change to overall import capacity, Genscape analyst Joe Bernardi said Friday.

“The L235 line, which brings gas west on SoCalGas from interconnects with El Paso Natural Gas and Transwestern, has been out of service since an explosion on Oct. 1, 2017,” Bernardi said. “SoCalGas has been working to restore it to normal operating pressure over the last several months but has been discovering new leaks on the line during testing.”

The latest maintenance schedule as of Friday showed L235 returning to service Sunday (July 21), but “there is some risk that this date gets pushed back again, in the event that further testing and remediation is needed.”

Assuming L235 returns to service as scheduled, it won’t result in an immediate increase in firm operating capacity, since once SoCalGas brings L235 back online it “plans to take the adjacent L4000 down for its own round of testing,” according to Bernardi.

The first increase in capacity through this area isn’t expected until the end of August, the analyst said.

Crude oil prices ended the July 15-19 week about $4 lower at around $56/bbl amid a weakening global demand picture. With a further downturn in demand expected due primarily to a weaker-than-expected global macro backdrop, Barclays Commodities Research lowered its Brent and West Texas Intermediate price forecasts by $2/bbl for 2H2019 and $6/bbl for 2020.

Supply glut concerns are genuine, but overdone, according to the firm. The trade truce between the United States and China at the G-20 meeting signaled de-escalation by kicking the can down the road, but a clear path to a deal remains elusive.

“Therefore, we do not expect oil demand growth headwinds from a continued slowdown in global trade and manufacturing activity to subside anytime soon,” Barclays said.

Meanwhile, core petroleum inventory trends in the United States and globally remain supportive, according to the firm.

“The call on U.S. shale oil has increased significantly, and several underlying trends lead us to believe that the shale growth engine is slowing,” Barclays researchers said.

The firm therefore remains bullish with respect to the curve and the consensus, “as we think that the market is underestimating demand and overestimating supply growth at current price levels.”

Meanwhile, amid heightened tensions between the United States, United Kingdom (UK) and Iran, a British-flagged oil tanker was reportedly seized in the Gulf by the Iranian Revolutionary Guard, Iran media said. The owners of the Stena Impero, which was bound for Saudi Arabia, say they have been unable to contact the vessel and it is “heading north towards Iran.”

A second tanker with UK links also reportedly made a sharp turn towards Iran. The Ministry of Defence said it was aware of reports about a second vessel — the Liberian MV Mesdar is British owned.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |