EIA Delivers Another Shocker, Reports 35 Bcf Storage Build; Natural Gas Markets Unfazed

The Energy Information Administration (EIA) reported a 35 Bcf build into natural gas storage inventories for the week ending July 27, well below market expectations that clustered around a build in the low 40 Bcf range.

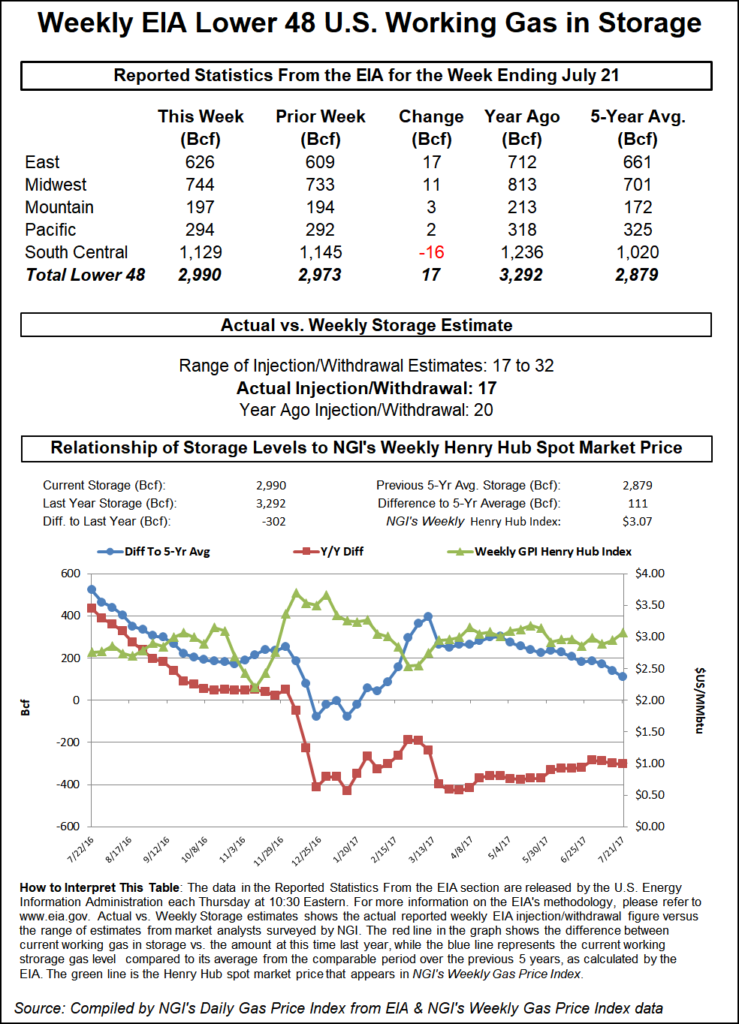

Last year, some 18 Bcf was injected into storage inventories for the similar week, and the five-year average stands at 42 Bcf. Working gas in storage stood at 2,307 Bcf as of July 27, 688 Bcf below year-ago levels and 565 Bcf below the five-year average.

By region, the East injected 25 Bcf into inventories, the Midwest injected 28 Bcf and the South Central withdrew 12 Bcf. The Pacific also posted a withdrawal of 7 Bcf.

Market action immediately following the report was swift as the Nymex September futures contract climbed as high as $2.795 within minutes of EIA’s 10:30 a.m. ET release, and continued to trade near that level at 10:55 a.m. September opened at $2.745, and fell as low as $2.74 before the EIA storage data was released.

Prior to the report, consensus had settled around a build in the low 40 Bcf range, in line with the five-year average. Kyle Cooper of IAF Advisors had projected a 40 Bcf build, while Genscape Inc. expected a 45 Bcf injection. A Bloomberg survey had a range between 25 Bcf and 58 Bcf, with the median response of survey participants coming in at 43 Bcf. Intercontinental Exchange settled at 43 Bcf.

The EIA’s reported 35 Bcf build was 5 Bcf below projections by Bespoke Weather Services, which said “today’s print continues to demonstrate a tight market (albeit one that has loosened slightly from last week’s print).

“Prices are accordingly bouncing off this print, and we do see it as supportive for the market,” Bespoke Chief Meteorologist Jacob Meisel said.

Still, Bespoke indicated it would be surprised to see prices break above the $2.80-$2.82 resistance level unless the market can get more winter contract participation in this rally.

“The market has shaken off other tighter EIA data recently, and while this certainly firms up the floor from $2.70-$2.72, medium-term cool makes resistance tests shorts,” Meisel said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |