E&P | Eagle Ford Shale | NGI All News Access

Texas Upstream Industry Producing More Oil, Natural Gas with Fewer People, Rigs

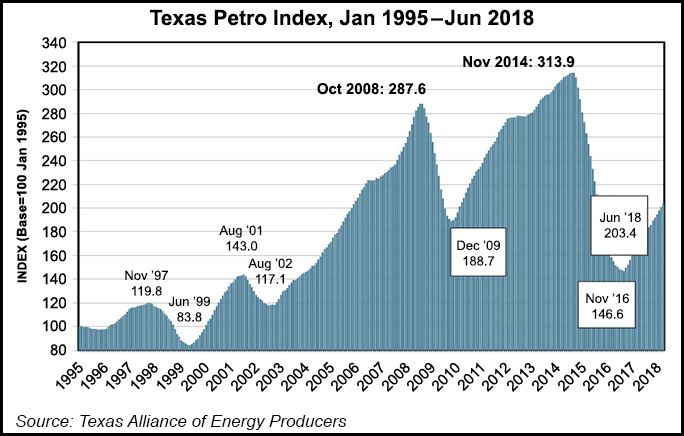

The Texas upstream oil and gas economy continued to expand through the first half of 2018, with the Texas Petro Index (TPI) increasing in June for the 19th straight month to 203.4 from 200.7 in May and up 19.4% from the year-ago score of 170.3.

The TPI, developed for the Texas Alliance of Energy Producers by petroleum economist Karr Ingham, tracks growth rates and business cycles in the state’s exploration and production economy. The TPI is based at 100.0 in January 1995.

“We’ve seen extraordinary expansions in Texas oil and gas activity over the 23-year history of the Texas Petro Index,” Ingham said. “What makes this one unique is the sheer amount of crude oil and natural gas produced in the state — and the growth rates in production — at lower levels of activity compared to the peak levels from the previous growth cycle.”

Oil and gas prices, the statewide rig count, drilling permits, well completions and employment all are rising, but they continue to lag behind the pinnacles established in 2014, said Ingham.

However, crude oil production has moved into all-time record territory in 2018, surpassing 4 million b/d. Crude oil and natural gas production are expected to “easily” set new annual production records this year.

Texas oil production eclipsed 4 million b/d in February and reached an estimated 4.3 million b/d in June, an increase of 27%-plus from a year earlier. Through June, Texas operators have produced an estimated 745.2 million bbl of oil, up by 25% from the first half of 2017.

The June monthly average oil price, while up by more than 50% from year-ago levels at $63.75 West Texas Intermediate (WTI), “remains significantly lower than price levels in 2014 in advance of the collapse in prices.” The posted WTI price averaged $101.68/bbl in June 2014.

Natural gas production has grown more slowly in the state as producers mostly are targeting oil.

“About 92% of the active rigs in Texas are drilling for crude oil,” said Ingham. “Natural gas production growth is largely accidental at this point, produced from wells that are drilled to produce crude oil.”

More than one-third (35%) of the state’s gas production is classified by the Railroad Commission of Texas as casinghead gas, i.e. associated gas from crude oil production.

“Natural gas production growth is not the current goal of Texas oil and gas producers, and continued production expansion is pushing prices lower, especially in the Permian Basin, where the takeaway capacity for that gas is increasingly insufficient.”

The rising shortage in Permian gas takeaway capacity has widened the negative differential between Waha hub in West Texas gas pricing by as much as a $1.00/Mcf or more compared to the Henry Hub and the Houston Ship Channel, said Ingham.

The statewide monthly average rig count has improved to 534 in June from a cyclical low point of 182 (and a weekly low point of 173) in May 2016, according to the report.

However, the June 2018 monthly average is 370 rigs lower compared to the peak monthly average of 904 in November 2014.

“It simply takes fewer rigs and fewer people to produce ever higher amounts of crude oil and natural gas,” said Ingham. “The efficiencies achieved by Texas oil and gas producers, service companies and drilling companies are nothing short of stunning, and in part were borne of necessity during the deep contraction of 2015 and 2016.

“But this is what all industries strive to do — produce more with less and at lower costs. The Texas oil and gas industry has been enormously successful at accomplishing these productivity gains to the great benefit of the American consuming public.”

The number of direct upstream oil and gas jobs from extraction, service and drilling companies, stood at an estimated 228,600 jobs in June. As of midyear, about 47,000 jobs have been added back to upstream payrolls following the loss of 115,000-plus jobs over the course of the downturn.

“Jobs have certainly been added back in the current expansion, and job growth continues moving into the second half of 2018,” Ingham said. “But again, estimated upstream oil and gas employment as of June 2018 is down by over 68,000 jobs compared to peak industry employment levels in late-2014, and still crude oil production is at record levels and continues to climb.”

The number of drilling permits issued in Texas through June was up by more than 10% from year-ago levels, but it also remains well below the number of permits issued midway through each year 2011-2014.

Texas continues to dominate the upstream landscape in 2018. At the midpoint of 2018, the state contributed fully 40% of U.S. oil production and 30% of domestic gas output. More than half of the working rigs in the country were in Texas, and nearly 54% of all U.S. direct upstream jobs were in the state.

As Texas oil and gas employment relative to total production has shrunk, the share of total state payroll employment comprised by upstream employment has diminished as well. June estimated direct upstream oil and gas employment makes up about 1.7% of total employment, from 2.5-3%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |