Infrastructure | E&P | NGI All News Access

U.S. Rig Count Pulls Back as Oil Leads Decline, Says BHI

The United States saw eight rigs, most of them oil-directed, exit the patch for the week ended Friday, including declines in Texas and Louisiana, according to data from Baker Hughes Inc. (BHI).

Five oil-directed, two natural gas-directed and one miscellaneous rig were pulled, leaving BHI’s domestic tally at 1,046, up from 950 rigs running at this time last year. The declines included one directional unit and eight horizontal units, offsetting the return of one vertical unit.

U.S. land rigs fell by six, while the Gulf of Mexico saw two rigs exit to end the week at 17, lagging its year-ago tally of 23. Canada netted 14 rigs on the week, including 11 gas-directed and three oil-directed, growing its tally to 211, versus 206 a year ago.

The combined North American rig count finished the week at 1,257, versus 1,156 active rigs in the year-ago period.

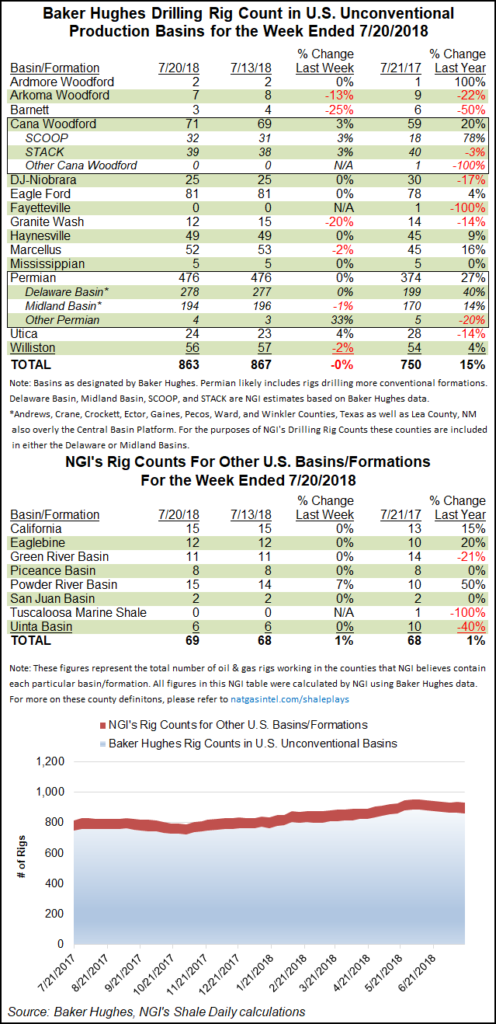

Among basins, the Cana Woodford gained the most, adding two rigs to end at 71, outpacing the 59 rigs active in the play at this time last year. A more detailed breakdown of BHI data by NGI’s Shale Daily shows the weekly gains split between the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties). The STACK finished at 39 active units, just below its year-ago tally, while the SCOOP has seen a 78% increase year/year with 32 rigs running as of Friday.

The Utica Shale was the only other major play tracked by BHI to grow its tally for the week, adding one rig to finish at 24 from 28 a year ago.

The Granite Wash saw three rigs depart, the largest decline among plays for the week. The Arkoma Woodford, Barnett and Marcellus shales and the Williston Basin each dropped one rig from their respective totals.

Among states, total active rigs in Texas fell by five for the week, but New Mexico countered with a net gain of four units. The U.S. onshore’s most active play, the Permian Basin, underlies West Texas and Southeast New Mexico.

Also among states, Oklahoma saw three net rigs depart, while two rigs packed up in Louisiana. Alaska and West Virginia each dropped a rig, while Wyoming and Ohio each added a rig.

The week’s drilling declines come as the industry is kicking off the 2Q2018 earnings season and as oil prices have shown started to show some weakness. Prompt-month West Texas Intermediate futures had just climbed back above $70/bbl Friday after trading above $75/bbl in early July.

Natural gas futures, meanwhile, have struggled under the pressure of expectations that supply growth will outpace the demand. The January Henry Hub contract was trading on the wrong side of $3/MMBtu from the bulls’ perspective Friday.

Kinder Morgan Inc. (KMI) management said late Wednesday it would pump $2.4 billion into growth projects this year, up $200 million from the previous forecast, as it lays the groundwork to debottleneck the juggernaut that is the Permian, where oil and associated natural gas production is booming.

“There continue to be bottlenecks, and the infrastructure is trying to catch up to that now,” said CEO Steven Kean. “There’s a long-term projection for a continued strong basis between the Permian and Houston Ship Channel, and that’s a consequence of expected continued growth in oil and associated gas production. We’re trying to help our customers by debottlenecking those constraints a bit, but the growth in production continues to make those constraints and those differentials fairly persistent, which is a good thing for a company in the business of moving this stuff from place to place.”

The world’s largest oilfield services operator Schlumberger Ltd. reported improvements almost across the board during the second quarter for its land and offshore operations.

In anticipation of a shortage in capacity, Schlumberger has begun to engage in “pricing discussions” with many customers to allow it to invest in more equipment. In the North America land business, for example, even as more fracturing fleets were deployed during the second quarter, pricing remained flat.

The company is paying particular attention to projected oil and gas takeaway constraints in the Permian. “The rate of permitting and the overall activity levels remain high,” but the constraints “could hamper activity growth over the coming quarters, which is something we will monitor closely going forward,” said CEO Paal Kibsgaard during a conference call Friday from London.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |