Markets | NGI All News Access | NGI Data

Natural Gas Futures Higher as Structural Tightness Seen; EIA Storage Meets Expectations

Natural gas futures ratcheted higher Thursday as afternoon model guidance came in more supportive, while government storage data came in near expectations. In the spot market, most regions fell within a nickel of even, though there were bigger changes in the Northeast and California. The NGI National Spot Gas Average added 4 cents to $2.43/MMBtu.

The April contract settled at $2.698 Thursday, up 3.1 cents on the day after trading as high as $2.731 and as low as $2.642. May settled at $2.729, up 3.3 cents.

A futures market that has been range-bound “saw a bit of volatility following an Energy Information Administration print that hit expectations,” Bespoke Weather Services said. “Prices initially ran up off the 9 a.m. pit open, which they have been doing the last few days, and bounced around first higher then lower” after the storage number came out.

“Through the afternoon we saw prices creep higher on some more supportive afternoon model guidance, and though prices dipped into the settle it was again the summer strip that remained firmest,” Bespoke said. “This continues to confirm that it is structural tightness, not weather or production, that is the primary price driver, and that tightness could very well put the $2.75 level in play either Friday or early next week,” though a potentially warm back half of March limits upside.

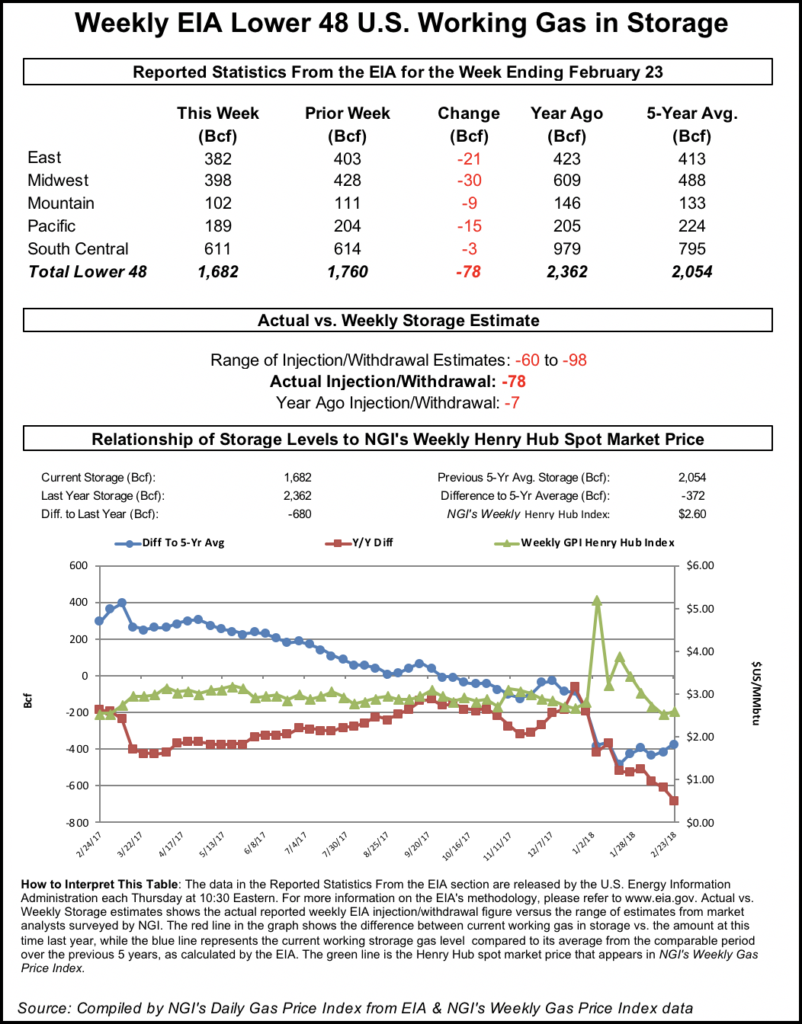

The Energy Information Administration (EIA) reported a 78 Bcf withdrawal for the week ending Feb. 23, which was tighter versus the 7 Bcf withdrawn a year ago, but looser than the five-year average pull of 118 Bcf.

Total working gas in underground storage stood at 1,682 Bcf as of Feb. 23, according to EIA. That’s versus 2,362 Bcf in the year-ago period and five-year average inventories of 2,054 Bcf. The year-on-year storage deficit increased week/week from -609 Bcf to -680 Bcf, while the year-on-five-year deficit shrank from -412 Bcf to -372 Bcf, EIA data show.

Prior to the 10:30 a.m. EDT release of the storage figure, the April contract on Thursday had been trading around $2.695. As the number crossed trading desks, April briefly shot up to as high as $2.731 before pulling back to around $2.670-2.680. By 11 a.m. EDT, April was trading right around $2.70, up about 3 cents from Wednesday’s settle.

Before the report, the market had on average been looking for a withdrawal close to the actual number, though surveys showed a fairly wide range of expectations among respondents.

A Reuters survey of traders and analysts on average had predicted a 77 Bcf withdrawal, with responses ranging from -60 Bcf to -98 Bcf. Kyle Cooper of ION Energy had called for an 82 Bcf withdrawal, while PointLogic Energy on Tuesday had predicted a withdrawal of 72 Bcf.

Stephen Smith Energy Associates had predicted a 74 Bcf withdrawal, and Intercontinental Exchange futures for this week’s report had settled at -80 Bcf Wednesday. The Desk’s Early View survey, released last week, showed participants expecting on average a 70.9 Bcf withdrawal, with responses ranging from -60 Bcf to -86 Bcf.

“This number perfectly confirms our balance expectations, with the market balance being tight enough to keep support around the $2.62 level rather firm but weather not cooperating enough for any move above resistance from $2.70-2.75,” Bespoke said.

By region, the largest weekly withdrawal occurred in the Midwest at 30 Bcf, followed by a 21 Bcf withdrawal in the East. The Pacific Region saw a 15 Bcf withdrawal for the week, while 9 Bcf was withdrawn in the Mountain region. The South Central region recorded a net 3 Bcf withdrawal, with an 11 Bcf pull from nonsalt offsetting an 8 Bcf injection into salt.

Societe Generale analyst Breanne Dougherty said in a recent note that the firm’s natural gas price outlook for the balance of 2018 is $3.03/MMBtu, higher than a recent average of around $2.77/MMBtu.

“In 2018, year/year supply growth has to outpace demand growth this injection season to accommodate structural demand growth and bring storage to a comfortable position for winter 2018/19; current prices don’t reflect that concept,” she said. “Spring contracts are more reasonably priced at the moment given the downside price risk of shoulder seasons, but core summer contracts look undervalued in particular. Conviction is soft given potential for production outperformance.”

Dougherty said the firm is considering raising its 2018 production outlook and consequently lowering the price outlook, “but even a higher production scenario leaves first half 2018 open to periods of bullish sentiment.”

Meanwhile, analysts with Jefferies LLC said Thursday that production growth showed signs of stalling in late February.

“Production averaged 77.4 Bcf/d in February, up about 1.3 Bcf/d from January (a month impacted by freeze-offs early on) and up about 0.4 Bcf/d from the prior monthly high in December 2017,” the analysts said. “Production growth has slowed, as the second half of February averaged 77.3 Bcf/d, slightly below the first half of the month (77.4 Bcf/d). In the Northeast, production has yet to recover to December highs,” averaging 27.0 Bcf/d versus 27.2 Bcf/d in December.

In its latest outlook Thursday, NatGasWeather.com was calling for rain and snow to reach the East heading into the weekend before “stronger cold blasts tracking out of the central U.S. and into the East during the middle of next week and lasting through the following weekend. This will result in a period of stronger than normal national demand as much of the country experiences colder than normal conditions.

“However, the pattern March 12-16 continues to favor a mild ridge gaining ground over the central and southern U.S., eventually shifting into the eastern U.S.,” the firm said. As of Thursday’s midday data, this shift was “slower in its development…thereby allowing cool air to linger along the East Coast a day or two longer to add several heating degree days.”

In the spot market Thursday, points across most regions saw day/day moves of less than a nickel, while points in California and the Northeast saw larger price adjustments.

SoCal Citygate added back 14 cents following Wednesday’s 66-cent slide, ending the day at $2.70.

Southern California Gas Co. on Thursday was forecasting system demand to remain above 3 Bcf/d through the end of the week, totaling around 3.3 Bcf/d Friday and Saturday before increasing to around 3.5 Bcf/d on Sunday. Receipts were forecast to total around 2.6 Bcf/d during that time, requiring hefty storage withdrawals.

Further upstream in West Texas, El Paso Permian added 5 cents to $2.10, while Waha gained 5 cents to average $2.17.

A force majeure event declared on the El Paso Natural Gas (EPNG) Pipeline’s Tom Mix compressor station in Arizona was only expected to impact about 25 MMcf/d of volumes, according to Genscape Inc.

“The operational capacity limit of 489 MMcf/d” during the event, in place until further notice, “is 28 MMcf/d below the previous 30-day average flow,” Genscape said. “This is the third force majeure declared by EPNG in the last week, although all have had relatively small impacts.”

In the Northeast, Algonquin Citygate shot up 50 cents to $2.82, while Iroquois Zone 2 climbed 16 cents to $2.63.

Temperatures into the 60s in Boston Thursday were expected to give way to more seasonal conditions starting Friday, with temperatures forecast to hover in the 30s and 40s, according to AccuWeather.

Points in Appalachia also saw a small bump, including Tetco M3 Delivery, which added 9 cents to $2.30.

In the Midwest, prices finished near even as Genscape was calling for regional demand to hover around 13-14 Bcf/d over the next few days, in line with demand from earlier in the week. Chicago Citygate finished up a penny at $2.41, while Dawn also added a penny to average $2.46.

Inventories for Dawn Hub area storage have reflected the bearish weather patterns during the month of February, according to Genscape.

“The Dawn Area Storage Hub will end February with around 91 Bcf working in gas in storage, well below” the comparable 2017 level of 117 Bcf and “almost exactly the five-year average of 92 Bcf,” Genscape said. “From Feb. 1-28, the average withdrawal was about 1.4 Bcf/d. However, the average withdrawal from the first half of the month, 2.21 Bcf/d, was in stark contrast to second half withdrawals that averaged just 0.62 Bcf/d, in addition to two days of injections.”

Storage patterns mirrored population-weighted heating demand in Toronto during the month, the firm said.

“Small injections were recorded on Feb. 20 and Feb. 27 when heating degree days (HDD) fell at or below 20,” Genscape said. “Temperatures are expected to cool off slightly for the rest of this week and into the weekend, indicating withdrawals could pick back up.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |