Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Seneca Resources Cuts Production Guidance as Utica Tests Taking Time

National Fuel Gas Co. (NFG) exploration and production subsidiary Seneca Resources Corp. was forced to cut full-year guidance over operational issues in the fiscal second quarter that are likely to persist.

Seneca reduced its fiscal 2019 forecast by 10 Bcfe, or 5% from the midpoint of its previous range to 205-215 Bcfe in what NFG CEO Ronald Tanski said was a “slight disappointment” after turning in solid second quarter results. “We were expecting more,” of Seneca, he said.

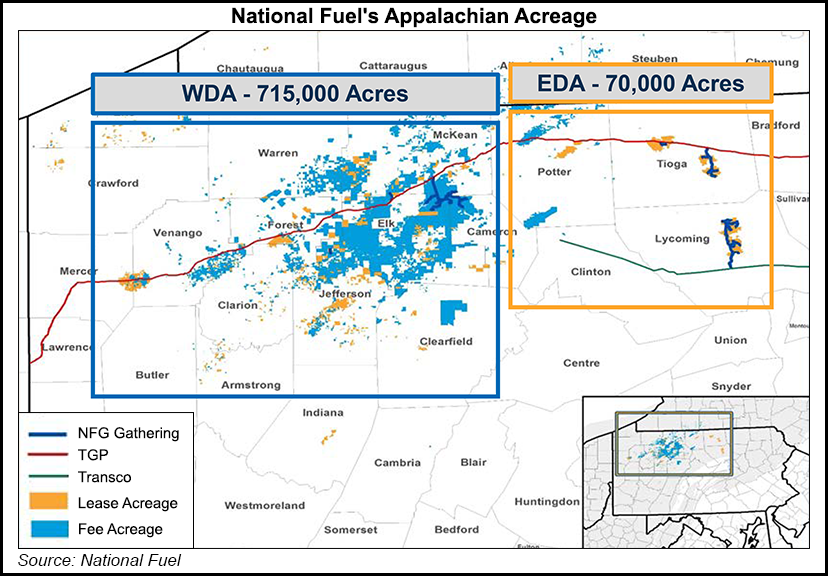

The cut came primarily in relation to drilling and completion delays on state-owned land in northeastern Pennsylvania in Seneca’s Eastern Development Area (EDA); the impact of ongoing Utica Shale testing efforts in the company’s Western Development Area (WDA) of northwestern Pennsylvania; and the drilling of longer laterals, which are taking more time.

“We’ve experienced longer drilling and completion times on Utica wells, which will shift production that we had planned for this year into fiscal 2020,” Tanski said. However, “the delay in well turn on dates is not expected to materially change the economics of our Utica drilling program.”

Despite the guidance change, Seneca still expects its three-rig drilling program to deliver annual production growth of 15-20% over the next three years. Seneca’s 2019 budget of $460-495 million also remains unchanged.

Seneca has been focused on optimizing Utica drilling and completion designs in the WDA as it continues to fold more of the formation into its development program. The company has tested landing targets and completion design variations, including stage spacing, proppant loading and production fluid blends, said Seneca President John McGinnis.

“Due to this ongoing testing, we expect to see some variability within our program as we fine tune our well design,” he added.

The company has brought on 21 Utica wells in the WDA in recent years since transitioning to a full development program there. It plans to turn another six Utica wells to sales this year along with six more Marcellus Shale wells. The company also turned to sales four other Utica development wells in the EDA on state-owned land for the first time since 2016.

Seneca produced 48.8 Bcfe in the latest quarter, up 6% from the year-ago period, but down sequentially from 49.2 Bcfe. Production in Appalachia, which accounts for the bulk of volumes, increased 8% year/year and 1% sequentially, but oil production from the California properties has declined, mainly as the result of a recent sale of assets.

NFG continued making progress on the takeaway front during the latest period. The Empire North project, which would move 205 MMcf/d of Appalachian volumes to New York and into Canada, is still on target to enter service in the second half of fiscal 2020, which begins in October. The company filed a notice to proceed with construction at FERC on Thursday.

NFG’s embattled Northern Access expansion project, which has been stalled since 2017, also recently scored major victories before the Federal Energy Regulatory Commission and the U.S. Court of Appeals for the Second Circuit. Despite the wins, Tanski said construction is still likely a “few years off,” as the company works through other legal and regulatory challenges.

Tanski is set to retire in July. He’ll be replaced by CFO David Bauer. Tanski will still serve on the board.

NFG reported second quarter consolidated earnings, which includes its upstream, midstream and downstream business segments, of $90.6 million ($1.04/share), compared with $91.8 million ($1.06) in the year-ago period. Revenue was up to $552.5 million from $540.9 million over the same time.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |