Utica Shale | E&P | Infrastructure | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

MVP Again Delays Service, but Appalachian Pipeline Nearly Complete

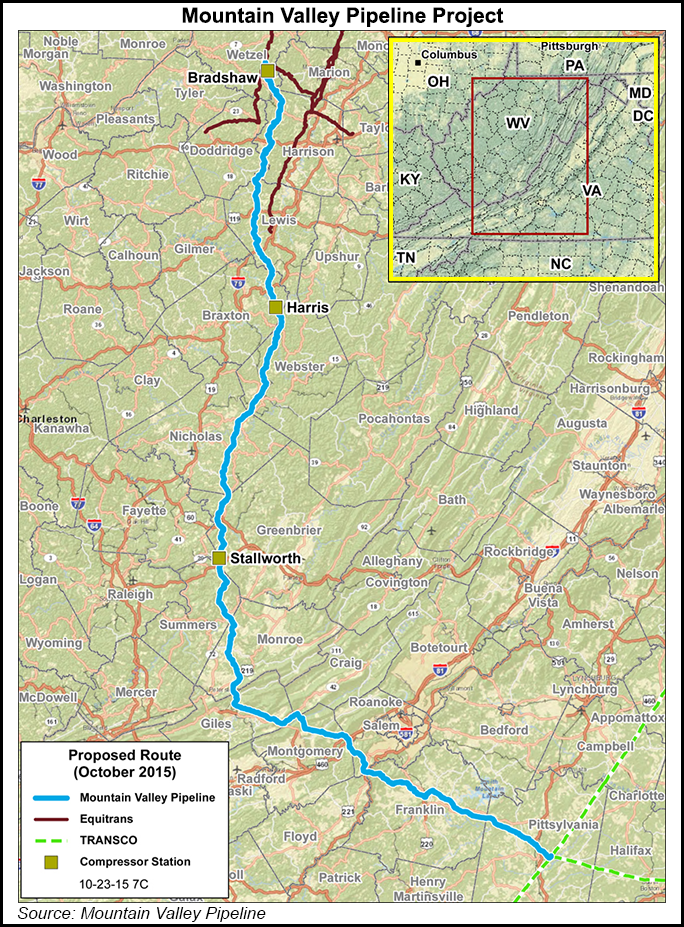

The beleaguered Mountain Valley Pipeline (MVP), one of the last major greenfield projects pending to move natural gas from the Marcellus and Utica shales, is almost at the finish line, but more delays and cost overruns are likely, according to the operator.

MVP is 92% complete, EQM Midstream Partners LP said late Thursday, but in-service is now expected early next year, slipping from the most recent target of late 2020. “We are confident in the ultimate completion of this important infrastructure project,” said COO Diana Charletta, noting that the project has battled “unprecedented regulatory and development challenges” for years.

The company also said total costs for the 303-mile pipeline, which would move gas from Appalachia to markets in the Mid-Atlantic and Southeast, could be about 5% above the current $5.4 billion estimate. The increases could be possible if the company needs to “adapt to complex judicial decisions and regulatory changes” that would require supplemental crews to safely maintain the route during winter months and if construction stops.

The project is currently under a stop work order, and crews have been focused on environmental stabilization, restoration work and erosion maintenance along the right-of-way. EQM said construction is expected to resume once MVP receives its Biological Opinion (BO) from the U.S. Fish and Wildlife Service (USFWS) and FERC lifts the stop work order.

Last year, the USFWS reopened its review of the project on the Federal Energy Regulatory Commission’s request. That move followed a legal challenge to MVP’s BO and Incidental Take Statement, necessary components of the pipeline’s FERC certificate that USFWS prepared under the Endangered Species Act.

The latest delays also reflect changes to the construction schedule as the project navigates uncertainty related to the timing of permits it needs to cross a small stretch of the Jefferson National Forest and Appalachian Trail.

MVP said its three compressor stations are complete, as well as the three originally certificated interconnects. A fourth interconnect has been approved for construction this year. Eighty percent of the pipeline work is finished and 50% of the right-of-way has been fully restored.

EQM’s marquee project has been plagued by legal issues and regulatory delays, prompting management to repeatedly reset cost expectations and in-service dates. It’s one of a few remaining Appalachian infrastructure projects that were expected to be completed years ago when another wave of pipelines were built to serve the basin’s prolific natural gas production.

The PennEast Pipeline and the Atlantic Coast Pipeline, which would move more than 2 Bcf of out of the Northeast, have faced similar challenges and have yet to be completed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |