Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Gulf Coast Express Sees First Natural Gas Flows; First Spot Transactions Recorded

The commissioning process has begun for Kinder Morgan Inc.’s highly anticipated 2 Bcf/d Gulf Coast Express (GCX) pipeline, and NGI has recorded the first spot price transactions on the new pipe as it progresses toward full-service next month.

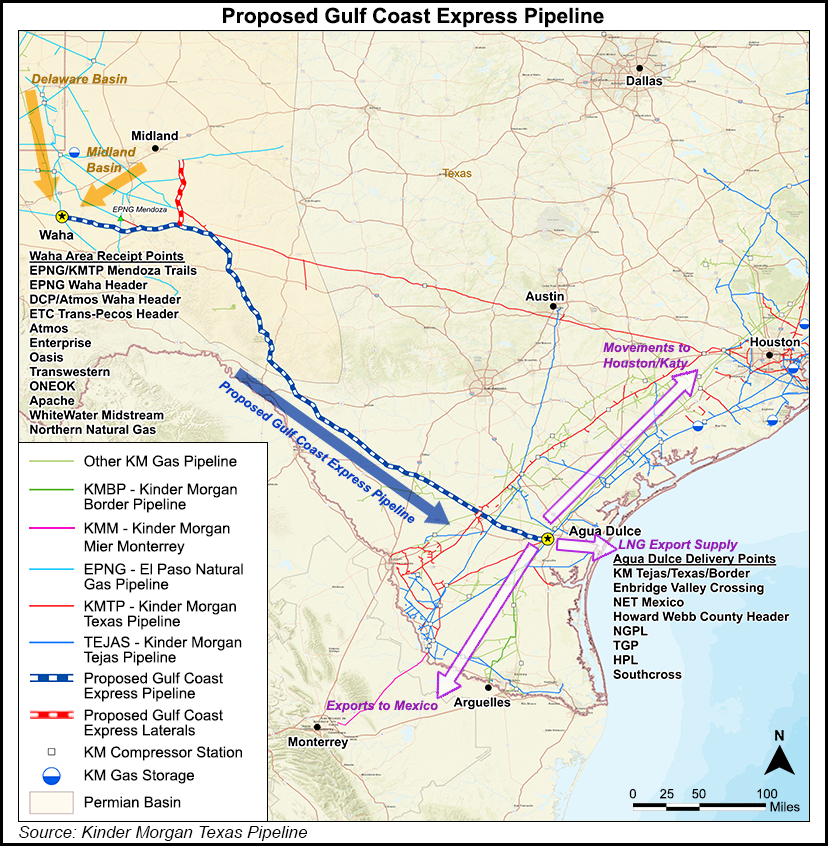

The fully subscribed $1.75 billion pipeline is designed to connect the Permian Basin to the Agua Dulce hub near Corpus Christi in South Texas. Given the Permian’s robust production growth and well documented constraints, GCX is expected to provide a major step up in natural gas flows out of the play.

Last month, Kinder management said it expected GCX to start up by late September, earlier than the previous target start date in October. With commissioning underway, GCX remains on track to start commercial operations on Sept. 20, the company confirmed to NGI on Thursday.

As part of the GCX construction, “we have flowed some commissioning gas to purge and pack the pipeline, and are undergoing equipment testing to ensure all aspects of the GCX construction efforts are working as designed,” spokesperson Katherine Hill said. “We will continue this process as we plan commissioning of the compressor stations for the pipeline in the next few weeks.”

According to RBN Energy LLC analyst Jason Ferguson, El Paso Natural Gas began delivering into GCX late last week, with volumes up to around 250 MMcf/d as of Thursday.

The start of flows on GCX also coincides with the first reported transactions recorded in the Daily GPI spot market survey, said NGI’s Patrick Rau, director of strategy and research.

“NGI began receiving GCX transactions as part of its daily natural gas spot market pricing survey earlier this week, and while the number of reported transactions remains low, it does show that the line packing process has begun,” Rau said. “Since last Friday, the September and October Waha basis differentials have improved by 10% and 7%, respectively, but no doubt that is being driven to a large extent by the oppressive heat that is currently gripping Texas.

“But the GCX line packing strongly suggests the pipeline will be in service before Oct. 1, as Kinder has indicated, which is good news for gas and oil production alike.”

Indeed, this year Permian producers have had to suffer through the lowest natural gas spot prices NGI has ever recorded. The growth in associated gas output from the liquids-focused region has outpaced the available takeaway capacity, flipping the West Texas natural gas market on its head.

This past spring the constraints were severe enough to force “sellers” at Waha to pay as much as $9/MMBtu to find a taker for their molecules, temporarily turning West Texas gas from a commodity into essentially an expensive waste product.

While producers will benefit from the new GCX capacity, the news might not be as positive for gas bulls, as delivering more Permian gas into an already well supplied market could send prices lower.

Analysts at EBW Analytics Group said in a recent note that they expect GCX to “unleash bottlenecked Permian output” once it comes online.

“A combination of capturing currently flared gas and rising Permian oil — and associated gas — production with new oil pipelines may quickly increase supplies headed to the Gulf Coast by over 1.0 Bcf/d, further increasing downward pressure on natural gas prices,” EBW said.

Given that “official dates from Kinder Morgan have been conservative,” it’s possible “the taps may open even sooner” than Sept. 20, according to EBW.

Kinder is constructing GCX through an affiliate, which would hold a 34% interest in the project. Atlus Midstream, DCP Midstream and an affiliate of Targa Resources round out the other equity holders.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |