Markets | Infrastructure | NGI All News Access

U.S. Gas Exports to Canada Climb While Southbound Flow Shrinks

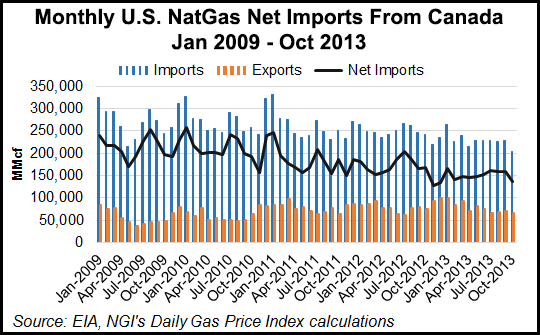

The new pattern of the North American natural gas trade is staying entrenched as northbound flows from the United States hold their gains, while southbound exports from Canada continue to shrink.

Pipeline deliveries of U.S. gas north into Canada grew by 1% to 708.1 Bcf in the first nine months of 2013 from 702.1 Bcf during January-September of 2012, according to U.S. Department of Energy (DOE) data.

Canadian exports south into the United States shrank by 8% to 2.14 Tcf in the first three quarters of 2013 from 2.3 Tcf in the same period of 2012, according to the record kept by the DOE Office of Fossil Energy.

The value of the gas trade improved sharply for all concerned last year as markets rebounded from severe lows brought on by supply gluts and weak demand in 2012.

U.S. exports north into Canada fetched an average US$4.08/MMBtu in the first nine months of 2013, up 44% from US$2.83/MMBtu over the same period of 2012.

Prices at the border for Canadian pipeline deliveries south into the United States averaged US$3.57/MMBtu during the first three-quarters of last year, up 43% from US$2.50/MMBtu in the comparable period of 2012.

Canadian exports go to an array of destinations for a wide range of prices in California, the U.S. Pacific Northwest, the Midwest and Northeast. Most U.S. exports go to Canada’s highest-value gas markets: 78% flowed through a border crossing between Michigan and Ontario under the St. Clair River in the first nine months of 2013.

The delivery and sales route then runs northeast to the Dawn, ON, storage and trading hub on TransCanada Corp.’s Mainline and the Union Gas (Spectra Energy) distribution network. From the hub, gas flows out via an array of transmission and distribution interconnections across Ontario and Quebec.

U.S. exports have also begun flowing north from New York State into Ontario through newly reversed pipeline facilities in the Niagara Falls region, according to DOE.

In the first three quarters of 2013 the Niagara Falls border crossing, previously a mainstay of southbound Canadian exports since the 1960s, accounted for six% of northbound U.S. deliveries under short sales contracts lasting two years or less and all of a small minority of shipments to fulfill longer commitments.

The rate of growth in northbound U.S. exports — which are chiefly shale production, primarily from the Marcellus formation — slowed down and even reversed last year after surging from one record to the next since 2008.

Between second and third-quarter 2013, U.S. pipeline deliveries into Canada slid by 10% to 204.5 Bcf from 228.3 Bcf. Demand softened in Ontario and Quebec, while TransCanada embarked on an effort to refill its eastbound Mainline into the region from Alberta with reduced tolls and overhauled services.

But any retreat by U.S. exporters is expected to be temporary because central Canadian importers continue to reach out for more Marcellus gas from supply sources much closer to Ontario and Quebec than old wells in Alberta or new shale fields in British Columbia.

Under an agreement filed for approval by the National Energy Board just before Christmas, TransCanada and the country’s three biggest distributors — Union, Enbridge Gas and Gaz Metro — plan C$391 million (US$352 million) in additions to northbound conduits for U.S. gas during the next three years alone. A contested regulatory review of the scheme is just beginning (see Daily GPI, Jan. 24).

Total U.S. gas exports, meanwhile, continue to increase regardless of pauses or setbacks in the Canadian traffic. In the smaller Mexican trade, U.S. southbound exports grew to 510.3 Bcf in the first three-quarters of 2013, up 11.5% from 457.6 Bcf in the same period of 2012. Overall U.S. exports to all destinations rose by 3.4% to 1.22 Tcf during January-September 2013 from 1.18 Tcf in the first nine months of 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |