Bakken Shale | NGI All News Access

North Dakota Regains Mojo with Record Production

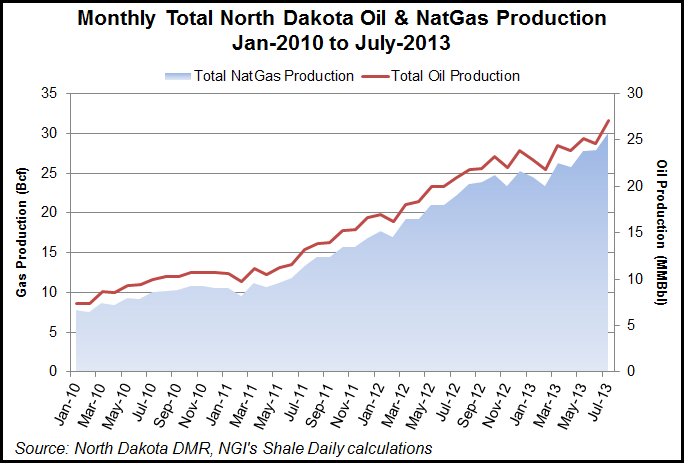

After a small slump in past monthly statistics reports, North Dakota regained its record-setting production, setting new highs for natural gas/oil production, wells and permitting in its most recent monthly totals for July. Gas production increased by 4% and oil jumped 6.4% month over month.

The state’s chief oil/gas regulator, Lynn Helms, director of the Department of Mineral Resources (DMR), called the ramp-up of production “startling,” predicting the next full month’s figures (for August) will be even bigger. He noted that the latest numbers are preliminary.

The July statistics underscore what some analysts are now saying that rig counts are becoming unimportant as hydraulic fracturing and horizontal drilling technologies keep improving the efficiencies and productivity in state-of-the-art oil/gas drilling.

One dark spot in the otherwise bright report for July was that the percentage of associated gas being flared jumped 2% to 30%, said Helms, who attributed “almost all of the increase” to processing plant outages for mechanical repairs and electrical failures. The all-time monthly flaring high was reached two years ago at 36%.

Helms said that with North Dakota’s frenetic oil/gas production activity, the state power transmission grid remains stretched to its maximum capacity as are a lot of other essential infrastructure being drawn on by the energy industry.

Helms attended a “summit” last Wednesday addressing flaring that included the governor and various other state officials, midstream operators, and the largest producers in the Bakken Shale play. The session resulted in a smaller working group being created with representatives from each of these sectors to meet weekly to address the issue, Helms said.

Natural gas production in July hit 30 Bcf, or 970 MMcf/d, compared to 28 Bcf, or 933 MMcf/d, in June. Oil production was 47.1 million bbl, or 874,460 b/d, in July, compared to 24.6 million bbl, or 821,598 b/d, in June.

While the rig count dropped slightly from 187 in June to 183 in August, Helms said the number of well completions jumped by 102. “Well completions really jumped to 251 in July, and the time for getting a well completed dropped from 94 days, which has been a long-term average, to 79 days,” he said.

Nevertheless, Helms said North Dakota still has “a large inventory” of uncompleted wells; 460 wells still waiting to be completed, which he said is the fourth highest monthly total on record and higher than totals in any month prior to March.

“So there still is a large inventory of supply of wells waiting on completion,” he said. “We anticipate a big production increase in the August statistics.”

For natural gas, there was a surge in the number of new wells with lower gas-oil rations, Helms said, adding that North Dakota’s shallow gas exploration remains uneconomic at the current near-term gas prices.

For July, gas delivered to the Northern Border Pipeline at Watford City was up 30 cents/Mcf to $3.09/Mcf, resulting in what Helms calculated as a current oil-gas price ratio of 30-to-1.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |