E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oxy Sitting on Thoroughbred Permian Production, Execs Say

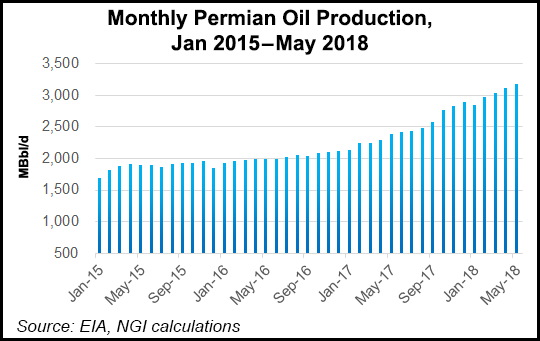

Signaling it will reach Permian Basin growth and efficiency goals six months ahead of schedule later this year, Occidental Petroleum Corp.’s (Oxy) senior executives on Wednesday reported sharp increases in 1Q2018 earnings, and a 12% bump in Permian boe daily production.

CEO Vicki Hollub said during a conference call to discuss results that all of the business units delivered in the quarter by implementing an exploration and production (E&P) “value-based” development approach to its domestic assets centered in the Permian and the southern Delaware sub-basin. Executive Vice President Jody Elliott, who heads domestic E&P, drilled down to continuing efficiency improvements pushing the production gains.

Overall, Hollub made it clear to analysts during a conference call that she sees Oxy as having growth opportunities not only in the Permian, but internationally, and future capital spending plans could be pushed upward depending on the outlook for global oil prices near the end of this year.

Permian production increased by 11% year/year or by 18,000 boe/d, to 177,000 boe/d in 1Q2018, propelled by “better-than-expected” results, particularly in the Greater Sand Dunes play in southeastern New Mexico’s Permian, Hollub said.

Globally, total production was 609,000 boe/d, with 336,000 boe/d from U.S. operations and 273,000 boe/d overseas.

During the conference call, Elliott was bullish about the new maintenance and logistics hub, Aventine, built to support the full-court press in the Permian, noting it was the primary driver for 19% efficiency gains in the southern Delaware. He expects even greater efficiency gains when Aventine is fully developed as a supply source for sand and pipe later this year.

Since Aventine began partial operations early this year, Oxy’s drilling operations have received sand from 14 separate unit trains and supplied sand on 31 well completions across its wellsites in Texas and New Mexico, he said. Since March, another part of the facility has received about 1,400 tons of pipe, with more than 1,000 delivered via rail. A new “sandstorm system” also has reduced the number of trucks needed for wellsite deliveries.

“As activity has ramped up we have been able to avoid logistics and supply problems by servicing our wells from Aventine, which I expect to be fully operational by the end of the third quarter,” Elliott said.

He reiterated during the question-and-answer session that Oxy’s proprietary “drilling dynamics” system for improving well design and wellsite operations, along with detailed subsurface geologic planning and design, are driving success on the ground.

“Our success really starts with subsurface characterization, geomechanics, geochemistry, integrating seismic work, and advancing petrochemical physical modeling to better understand what we call ”flow units’. We need to understand how those flow units will react to the stimulation, and that leads to a better stimulation design that is customized for each well completion.”

Analysts probed Oxy’s plans for increasing its future capital expenditure (capex) plans if the growth in its Permian operations continues as planned, but Hollub was not ready to make any commitments beyond the current $3.3 billion annual budget now in place.

“When we laid out our program we intentionally designed it so at the end of [this] year we would have the flexibility to ramp down, and that’s built into the capital program,” she said. “What we wanted to be able to do is ramp down to our $3.3 billion capex for 2019 if we were seeing a $50 environment” for crude oil prices. The company is unsure of oil prices in 2019 “and we want to stay within cash flow,” so future capital has not been set.

“What you’re seeing is an up front loaded 2018 capex,” she said. Pressed about international spending, she noted that Oxy hasn’t made any additional decisions. “What I will assure you is that we have flexibility with a vast inventory of things to do, not only in the Permian, but internationally. Our opportunities are pretty much unlimited at this point, but for the program this year, we haven’t made any decision yet to increase our capital.”

Oxy earned $708 million (92 cents/share) in 1Q2018, compared with $117 million (15 cents) for the same period last year. In 4Q2017 Oxy earned $497 million (65 cents/share).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |