Markets | NGI All News Access | NGI Data

Traders Wary Of NatGas Price Rise As Storage Stats Come In On Target

October futures inched higher Thursday following a report by the Energy Information Administration (EIA) showing a natural gas storage injection that was less than what traders were expecting.

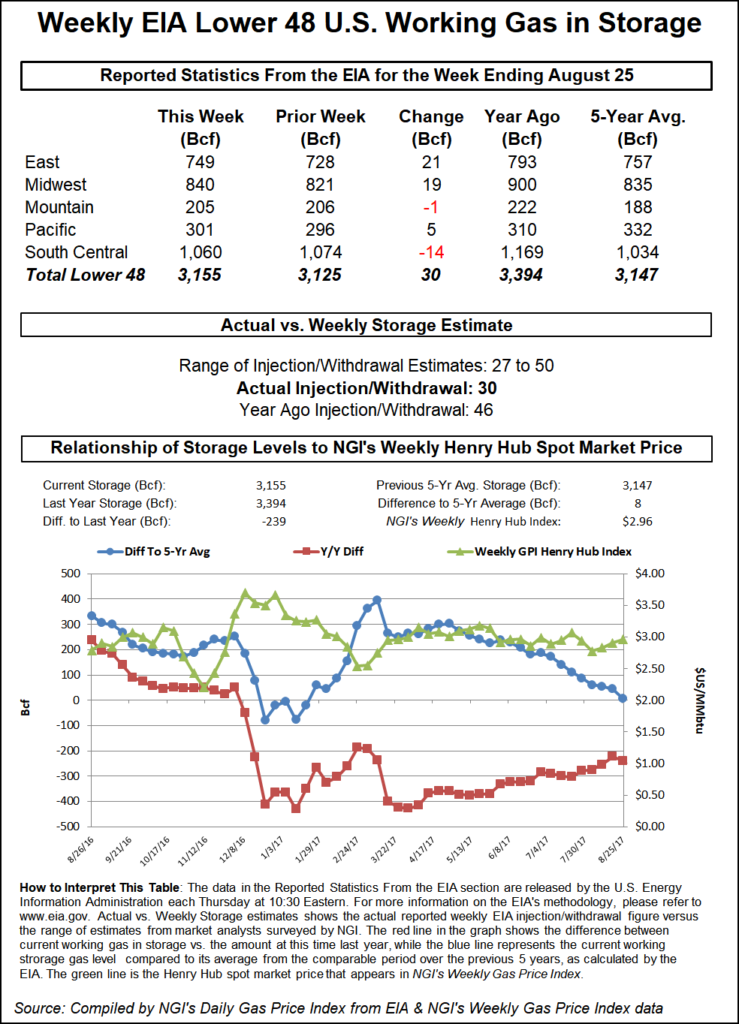

The EIA reported a storage injection of 30 Bcf, about 2 Bcf less than consensus estimates. When the number was released October futures rose to $2.950 and by 10:45 a.m. October was holding $2.948, up nine-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a storage build on either side of the actual figures. Last year 46 Bcf was injected and the five-year average stands at 67 Bcf. Citi Futures calculated a 35 Bcf injection and Ritterbusch and Associates estimated a 29 Bcf build. A Reuters survey of 19 traders and analysts showed an average 32 Bcf with a range of plus 27 Bcf to plus 50 Bcf.

Traders were unimpressed by the figure. “I wouldn’t consider a 4-cent range off a [storage] number as significant,” a New York floor trader opined to NGI. “The market sneezed higher,” he said.

“I didn’t think it meant much,” said Mike DeVooght, president of DEVO Capital. “Fundamentally natural gas is a mixed bag here, but the potential of getting a 25 cent to 30 cent rally is very, very possible right here.”

Inventories now stand at 3,155 Bcf and are 239 Bcf less than last year and 8 Bcf greater than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories rise by 19 Bcf. Stocks in the Mountain Region were down 1 Bcf and the Pacific Region was up 5 Bcf. The South Central Region fell 14 Bcf.

Salt storage fell 12 Bcf to 262 and non-salt storage decreased 3 Bcf to 797 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |