Weekly NatGas Grinds Higher As Futures Post Highest Spot Settlement Of The Year

Those on the long side of the natural gas market enjoyed healthy gains in weekly trading as the NGI National Weekly Spot Gas Average tacked on 5 cents to take it to $2.97.

Those gains, however, are beginning to show market stresses in the form of futures prices a stout 30 cents ahead of the weekly Henry Hub reported at $3.12. Typically a differential of that magnitude is not long-lived, and the June futures contract expires in a little over 2 weeks.

The market point showing the week’s greatest gain was a tie between Transco Zone 6 New York and Transco Zone 6 non New York North with gains of 15 cents to average $2.95 and $2.96, respectively. Northwest Sumas was the weakest performer and was one of the few points in the red with a loss of 19 cents to average $2.38.

All regions of the country posted gains and the Northeast led the pack with a rise of 10 cents to average $3.13 and South Texas and East Texas proved to be the week’s laggards adding just 3 cents apiece to both average $3.06.

South Louisiana rose 4 cents to average $3.07 and the Rockies, Midcontinent and Midwest all gained a nickel to $2.72, $2.87, and $3.02, respectively.

The Southeast and California both added 7 cents to $3.11 and $3.04, respectively and Appalachia rose 9 cents to average $2.86.

Perhaps auguring still further advances was the weeks move in the June futures, up a healthy 15.8 cents to $3.424, the highest spot futures settlement of the year.

The markets got a double dose of adrenaline during the week, first on Wednesday when the Federal Energy Regulatory Commission ordered Energy Transfer Partners to suspend all horizontal directional drilling (HDD) work — except where drilling activity has already begun — on the Rover pipeline project pending a third-party review of a recent spill in Ohio.

Last month, Rover filed incident reports with FERC disclosing drilling fluids spills, including a 2 million gallon spill near the Tuscarawas River in Stark County, OH, a state-designated category 3 wetland.

“It’s a huge impact. The market was expecting all this new gas this winter around that project. If it gets delayed, end-of-season storage under 3.7 Tcf doesn’t look so hot,” a Northeast trader said.

Given the surge in prices since news of the FERC order hit the market, the trader said that prices could go even higher, into the $3.60 range, as production continues to hover around 70-71 Bcf/d.

The second boost came Thursday when market bulls got a pleasant surprise as the EIA reported a storage build of just 45 Bcf for the week ending May 5, about 8 Bcf less than expected. Futures prices romped higher. The NGI National Spot Gas Average gained a nickel to $3.04 and at the close June had added 8.4 cents to $3.376 and July was up 8.1 cents to $3.461.

Once the 45 Bcf had rumbled across trading desks on Thursday, June futures rose to $3.387, and at 10:45 a.m. EDT June was trading at $3.372, up 8.0 cents from Wednesday’s settlement.

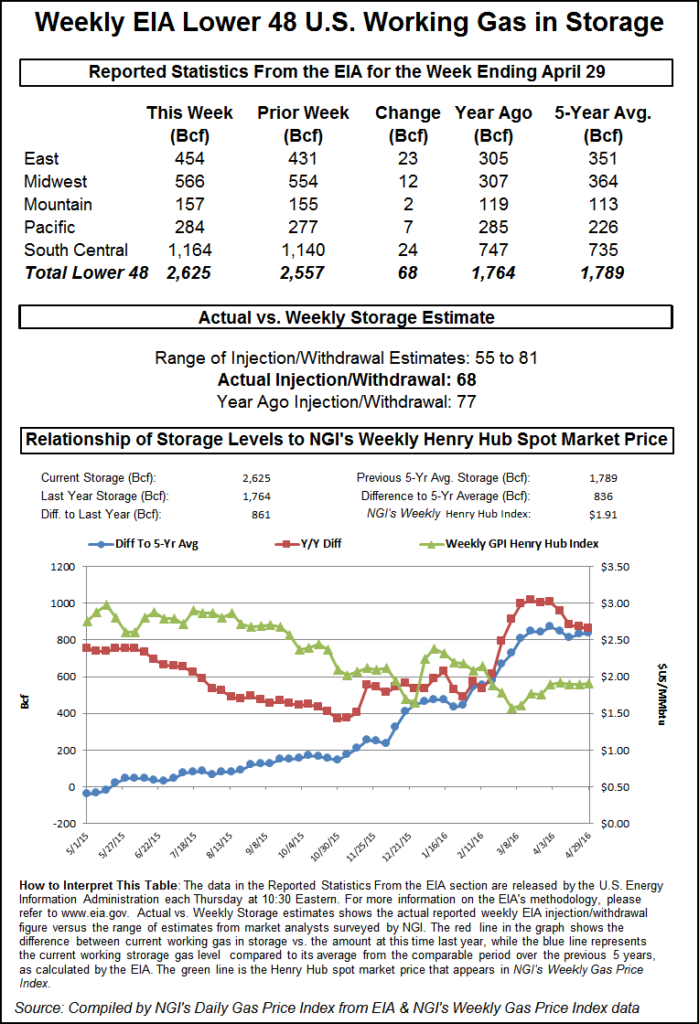

Prior to the report, traders were looking for a storage build well below historical norms, but the 45 Bcf figure was beyond expectations. Last year 58 Bcf was injected and the five-year average stands at a stout 73 Bcf.

Tradition Energy was looking for a 55 Bcf increase, and Stephen Smith Energy had calculated a build of 50 Bcf. A Reuters survey of 23 traders and analysts showed a sample mean of 53 Bcf with a range of +49 to +65 Bcf.

“We were looking for a number in the mid-50 Bcf range,” said a New York floor trader. “Initial technical resistance was $3.35 so it broke through that, and if it settles above $3.35, that would be a good indication.

“The 45 Bcf build for last week was below the consensus expectation for 53-54 Bcf and also below the 73 Bcf five-year average for the date, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “The data implies some tightening of the market and the end of a mini-run of bearish surprises.”

Some see not only tightening but an undersupplied market. “This week marked the first data point since the start of shoulder season where temperatures were comparable to both the 5-yr average and last year, and the clear read-through from this week is that the natural gas market is meaningfully undersupplied,” said the Wells Fargo Securities analytical team in Denver.

“The 45 Bcf injection was 22 Bcf below the 5-yr average, 11 Bcf below last year and 10 Bcf below consensus estimates. Heating degree days [HDD] for the week came in at 56, in-line the 5-yr average and below last year’s 68. The week ended 5/12/17 has seen cooler than normal temperatures thus far and the NOAA’s forecast next week calls for above average temperatures across the eastern U.S. Therefore our forecasted cumulative injection for the next 2 weeks is just 120 Bcf, 57 Bcf below the 5-yr average of 177 Bcf and 24 Bcf below last year’s 144 Bcf.”

Inventories now stand at 2,301 Bcf and are 372 Bcf less than last year and 275 Bcf greater than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories rise by 5 Bcf. Stocks in the Mountain Region were increased by 2 Bcf and the Pacific Region was up 5 Bcf. The South Central Region increased by 8 Bcf.

Next week’s storage figures may be on the lean side as well. The National Weather Service (NWS) forecasts above normal heating loads for Midwest and eastern energy markets. For the week ended May 13 NWS sees New England at 86 HDD, or 13 above normal. The Mid-Atlantic is expected to see 86 HDDs also, or 26 above normal. The greater Midwest from Ohio to Wisconsin is predicted to experience 79 HDDs, 14 more than its normal seasonal tally.

In Friday’s trading physical natural gas for weekend and Monday delivery moved little as temperature outlooks across major markets were benign and traders saw little incentive to commit to three-day deals. Strength in Louisiana and the Southeast was able to offset weaker pricing in California and the Northeast, and the NGI National Spot Gas Average rose two cents to $3.06.

Futures continued to work higher but are well above cash quotes and seen as being overbought. At the close June was up 4.8 cents to $3.424; July had added 3.7 cents to $3.498.

Weekend and Monday temperature forecasts are mixed with eastern points below normal and the Midwest above. Forecaster Wunderground.com said Boston’s high of 52 Friday would reach 53 Saturday before making it to 59 by Monday, 6 degrees below normal. Philadelphia’s 59 high Friday was expected to drop to 52 Saturday before rising to 69 by Monday, 4 degrees below normal. The Windy City’s high of 66 Friday was seen climbing to 75 Saturday and Monday, six degrees above normal.

Gas at the Algonquin Citygate fell 2 cents to $3.16 and packages on Dominion South shed a penny to $2.87. Deliveries to New York City via Transco Zone 6 fell 7 cents to $2.93 and gas at the Chicago Citygate was quoted 2 cents lower at $3.10.

Packages at the Henry Hub rose a nickel to $3.25 and deliveries to El Paso Permian lost a penny to $2.83. Gas at Opal was unchanged at $2.89 and gas priced at the SoCal Citygate slipped a penny to $3.28.

Deliveries to Tetco M-3 fell six cents to $2.90, but pricing next week is likely to get more volatile. Tetco M-3 Zone compressor capacity is set to go to zero starting next week through May 30, according to industry consultant Genscape. Tuesday, May 16, Tetco will reduce its York County, PA compressor to 0 MMcf of flow.

“During this outage a handful of citygates, power plants, and interconnects will be limited to a total of 350 MMcf/d of deliveries, and the affected locations have averaged 451 MMcf/d over the last seven days, with a single day maximum of 531 MMcf/d. TETCO listed 34 locations to be affected by this maintenance,” Genscape said.

Genscape data shows that “next week is forecasted to be warm nationwide. Cooling demand is expected to pick up mid next week, with the northeast having 7 CDDs, up from 12.4 HDDs this weekend. The warm temps are forecasted to last through the 25th.”

Futures traders see the market as overextended with forecasts for the second half of May looking supportive. “Although the price trend and below-average storage injections both keep the upside open, we also note that the market is arguably somewhat overvalued, with nearby futures trading at a 22¢ (6.9%) premium to the five-year average price for this time of year at a time when storage is still 275 Bcf (13.6%) above its corresponding five-year average,” said Tim Evans of Citi Futures Perspective. “By this measure, natural gas is not cheap.”

Gas buyers responsible for incremental supplies for power generation across the PJM power pool will have challenging weather and not much in the way of renewables to offset purchases. “Unsettled weather and cool conditions are expected into the weekend before a big warm-up early next week,” said forecaster WSI in a morning report to clients. “A frontal boundary will remain the focal point for clouds along with areas of light rain and drizzle today.

“Wet weather and a northeast breeze will knock temps down into the 50s and 60s, and a storm system will develop and track up the East Coast tonight through Saturday, with even more rain, gusty winds and cool conditions across the Mid-Atlantic. A variable north-northwest wind will support modest wind gen through the weekend. After a brief decline, a developing southerly wind will boost wind gen by Tuesday. Output will generally range 2-3 GW.”

Traders suggest holding on to, but not adding to, current short positions. “This market is currently prioritizing the dynamic of surplus contraction over the static factor of an approximate 275 Bcf storage overhang,” said Jim Ritterbusch of Ritterbusch and Associates in a morning note to clients. “[Thursday’s] much smaller than expected injection furthered the mid-week price up spike with some chart related buying adding to the bullish momentum.

“Although we suggest holding short June positions established above the $3.31 level, we are also advising against fresh shorts at current levels given the chart improvement seen yesterday off of a bullish EIA storage report. The money managers have been gravitating toward the long side of the market for several weeks and currently have little reason to accept profits. Various non-weather factors remain aligned to reduce weekly storage injections to significantly lower levels that might be implied by heavy emphasis on HDD or CDD accumulation.

“Holding a short position currently is being challenged by the dynamic of surplus contraction and this week’s price strengthening appears to be discounting some additional significant reductions in the supply overhang for a couple more weeks. Although the spot trade is having difficulty keeping pace with the futures rally with the weak cash basis restricting curve strength, this doesn’t appear to be a sufficient consideration to prompt much sell hedging required to force a significant price decline.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |