NatGas Bears Ignoring Forecast Northern Tier Spring Cold; Weekly Quotes Ease

Right on cue the decline in the spot natural gas futures for the week ended Feb. 3 correctly predicted a decline in weekly natural gas cash prices for the week ended Feb. 10. A week ago spot natural gas futures tumbled 32.8 cents to $3.063, and for the week ended Feb. 10 the NGI Weekly National Gas Average fell 6 cents to $2.95.

Only a handful of points in the Northeast recorded gains and most points lost close to a dime. The location showing the week’s greatest gain was gas on Transco Zone 6 New York adding 22 cents to average $3.55, and the week’s loser was the Algonquin Citygate with a drop of 53 cents to $4.37. Regionally Appalachia lost the most falling 14 cents to $2.69 and the Northeast and East Texas had the softest landing with declines of a nickel to $3.66 and $2.90, respectively.

Four points lost 8 cents, the Midcontinent, Southeast, Rocky Mountains, and California to $2.81, $2.97, $2.74, and $3.00, respectively.

Three regions declined by an average of 6 cents, South Texas, the Midwest, and South Louisiana to $2.89, $2.96, and $2.91, respectively.

March natural gas futures fell 2.9 cents on the week to $3.034.

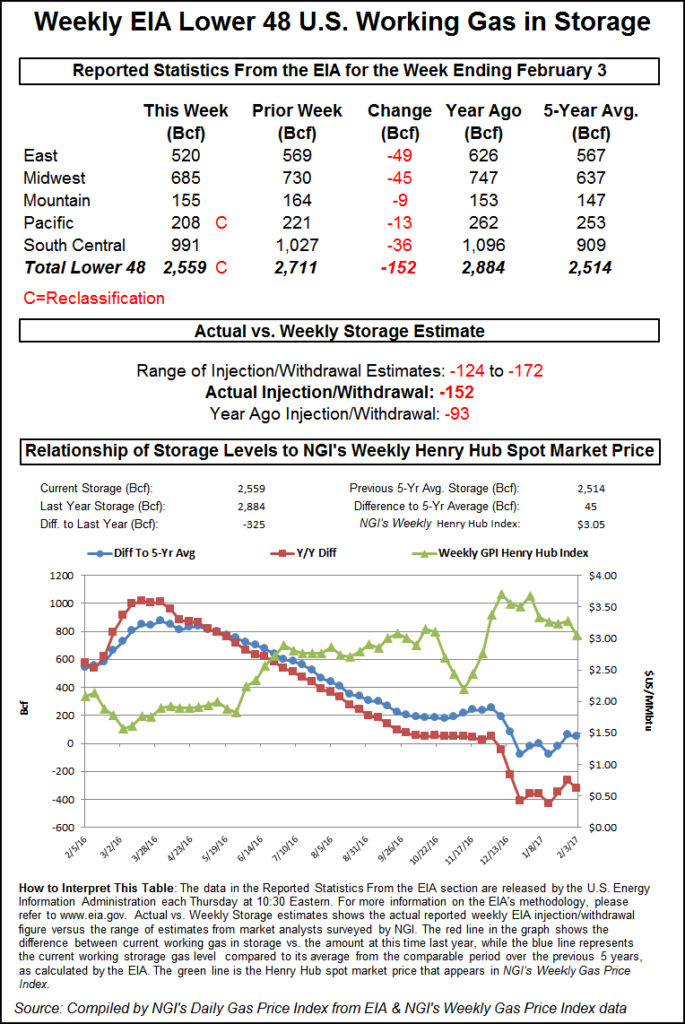

Volatility was not in the mix Thursday when the Energy Information Administration (EIA) announced a withdrawal of 152 Bcf in its weekly storage report, almost exactly what the market was expecting, and the total range on March futures was a miserly 7.9 cents. At the close Thursday, March had added 1.5 cents to $3.141 and April gained 1.3 cents to $3.209.

While the report was of a 152 Bcf storage withdrawal, 5 Bcf of that represented a reclassification of working gas to base gas, thereby reducing actual flows to 147 Bcf. Traders had been expecting a pull of about 153 Bcf. March futures were trading about 5 cents higher prior to the release of the figures, but after the number was reported, March fell to $3.130, and by 10:45 a.m. on Thursday March was trading at $3.146, up 2.0 cents from Wednesday’s settlement.

Last year 93 Bcf was withdrawn for the week, and the five-year pace stood at a 138 Bcf decline.

“I think the market is in kind of grey area,” said a New York floor trader. “The market has to hold here, but right now it looks like a weak hold. I think the market will work its way lower.”

“The 152 Bcf net withdrawal from storage for last week was right in line with market expectations and so neither a bullish nor bearish surprise,” said Tim Evans of Citi Futures Perspective. “However, we note that the report included a 5 Bcf reclassification of working gas as base gas, with the implied flow out of storage at a weaker 147 Bcf rate.

“While the data for last week looks moderately supportive compared with the 138 Bcf five-year average draw, we note that the market lacks a follow-up support, with the warming trend that followed last week’s cool temperatures likely to translate into weaker storage withdrawals and weaker comparisons over the next few reports.”

Inventories now stand at 2,559 Bcf and are 325 Bcf less than last year and 45 Bcf greater than the five-year average. In the East Region 49 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 45 Bcf. Stocks in the Mountain Region fell 9 Bcf, and the Pacific Region was down 13 Bcf. The South Central Region dropped 36 Bcf.

Bulls take heart. While the 2016-2017 winter to date has been largely the winter that wasn’t for much of the country, cold weather is expected to grab hold of the northern tier of the United States well into spring, according to AccuWeather forecasters.

Northeast population centers can expect rain and snow through mid-March, and that will keep a lid on temperatures, according to Paul Pastelok, AccuWeather lead long-range forecaster.

“As far as a significant warmup goes in the Northeast, I think you have to hold off until late April and May,” Pastelok said.

And chilly air will also stretch westward into the Midwest.

“It seems like all the cold and all the snow has been really piling up across that area and it’s going to be no different going into the early spring,” he said. “North and west [of Chicago] is going to be delayed because of the amount of snowpack. It will be running behind schedule, no doubt in my mind. I just don’t know how far behind at this point.”

Friday the bears had a weather forecast just for you whether you were a short-term natural gas trader looking to buy or sell weekend and Monday physical packages, or you were a longer-term futures trader anticipating that $3 technical support would hold.

Only a handful of market points followed by NGI even made it to unchanged on Friday, and the majority of market points dropped by double digits or more. The NGI National Spot Gas Average tumbled 31 cents to $2.82 on Friday for weekend and Monday delivery, and the Northeast led the parade lower with a series of $1-plus declines.

Futures opened about a dime lower on Friday as overnight weather models turned milder, and at the close March had skidded 10.7 cents to $3.034 and April was off 9.2 cents to $3.117.

Major market centers over the weekend were forecast to be at or above normal temperatures, and the Thursday storm that pummeled the Northeast was expected to be out over the weekend. AccuWeather.com forecast that Chicago’s Friday high of 42 degrees would reach 47 by Saturday before easing to 44 by Monday, 10 degrees above normal. New York City’s high on Friday of 32 was seen rising to 43 Saturday and dropping to 39 Monday, 2 degrees below normal.

Gas at the Algonquin Citygate plunged $1.65 to $4.14, and deliveries to Iroquois, Waddington skidded $1.15 to $3.47. Gas on Tennessee Zone 6 200 L fell $1.72 to $4.31.

Parcels on Tetco M-3 were quoted 45 cents lower at $2.66, and deliveries to New York City on Transco Zone 6 changed hands down $2.09 to $2.85.

More temperate conditions are expected to prevail in the Northeast following the stormy blast. “During the period from this afternoon into [Saturday] milder air will be advancing from the Midwest toward the Middle and North Atlantic states,” said AccuWeather.com meteorologist Elliot Abrams.

“From most of Illinois to southern Pennsylvania, this should be accomplished without precipitation. From the central Great Lakes to New England, the action of warm air climbing over cold air under a favorable jet stream configuration (right rear quadrant of the jet for meteorologists) precipitation will break out, and there could be something like a one- to three-inch snowfall from Buffalo to Boston.

Major market centers weakened as well for the weekend. Gas at the Chicago Citygate fell 14 cents to $2.86, and deliveries to the Henry Hub gave up 17 cents to $2.93. Gas on El Paso Permian shed 17 cents to $2.63, and parcels at the Cheyenne Hub fell 15 cents to $2.67. Gas delivered to the PG&E Citygate retreated 15 cents to $3.32.

Futures traders are zeroed in on $3 technical support. “We are saying on our website that $2.99 to $3 is major technical support and needs to hold,” said Steve Blair, vice president at Rafferty Technical Research.

Blair says what actions one takes depends on whether one is a speculator or a hedger. “From a hedge perspective, this is a good place to put on long hedges, and from a speculative position, it’s not a bad place to buy the market with a short leash. I don’t know if I would want to go short if it breaks $3 because we still have some winter left, although there isn’t a lot of cold weather in sight.

“Maybe we are seeing slightly lower production and more exports, so I am not convinced breaking the $3 area is going to prompt any big moves down.”

Longer-term weather forecasts turned still more moderate. “The already warm dominated [11-to 15-day] forecast trends additionally warmer today, featuring a coverage of much above normal temperatures across most of the eastern half,” said MDA Weather Services in its Friday morning report to clients. “This comes in a period influenced by the MJO [Madden Julian Oscillation] tracking through phase one, a phase which has produced similar pattern themes as is forecast in other cases seen this winter. The American model, however, remains a less-warm scenario, but this is likely a bias relating to the MJO and over-phasing of upper-level features.

“Low pressure is expected to track across the country; and despite weakened heights left in its wake, cold air is lacking with this system. Low pressure’s passage across the country could offer a brief cold risk, but a connection to a colder source region is lacking. Bias correcting European model data argues for an even warmer eastern half.”

Other traders see a market void of trading opportunities.

“The market appears more focused on forward EIA reports where [Thursday’s] surplus contraction is apt to be followed by a renewed expansion in the overhang next week that should be followed by additional stretch in the surplus,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday.

“This dynamic of an expanding overhang to being accompanied by a lack of significant cold weather in reliable forecasts that are now stretching out to about the 23rd of this month. This is why nearby futures were unable to test nearest chart resistance at the $3.20-3.22 region. Until one last hurrah of sustainable cold temps shows up within the short-term forecasts, this market could contain to about the $3.00-3.20 zone.

“We still see the $3 support as vulnerable as we leave open the possibility of an eventual price drop into the $2.80-2.90 zone. However, we are still not seeing enough of a rally to support a short position and, as a result, we will maintain a sideline stance for now.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |