Markets | Infrastructure | NGI All News Access

NatGas Cash, Futures Both Inch Higher; Hefty Storage Build on Tap

Physical natural gas traded Wednesday for Thursday delivery added to Tuesday’s gains as healthy increases in the Gulf and Texas lifted soft pricing seen in the Midwest and Midcontinent. Only a few points slipped into the loss column, and most locations added either side of a nickel. The NGI National Spot Gas Average rose 6 cents to $1.96.

Futures continued moving up. June added 5.5 cents to $2.141, and July was higher by 4.2 cents to $2.296. June crude oil added 13 cents to $43.78/bbl.

“Utilization at a few of the major REX Zone 3 delivery points dropped Wednesday,” NGI markets analyst Nate Harrison said. “Flows into ANR at Shelby dropped 135 MMcf to 742 MMcf, bringing utilization at the point down from 70% to just 59%. Similarly at REX’s interconnect with Panhandle Eastern at Putnam, deliveries fell from 252 MMcf to 209 MMcf. The drop in flows caused utilization to fall from 85% to 70%, [but] the reduction was not due to a decline in receipts, which remain at almost 100% utilization.”

According to Genscape Inc.’s markets analyst Erik Fabry, the shortfall in deliveries to ANR from REX Zone 3 was made up by flows from Dominion via the Lebanon Lateral, which connects with ANR north of the REX Zone 3 point. It wasn’t immediately clear how the shortfall on Panhandle was offset.

Points downstream of the Tetco rupture and fire (see related story) continued to gain. Gas on Texas Eastern M-3, Delivery rose 11 cents to $1.85,and gas headed for New York City on Transco Zone 6 was quoted 12 cents higher at $1.99.

Deliveries to the Algonquin Citygate posted an 11 cent rise to $2.83, and packages on Tenn Zone 6 200L added 4 cents to $2.77.

Just when it seemed the North American gas market was on the verge of rebalancing from the onslaught of shale gas out of the Marcellus and Utica, think again. In a first quarter conference call Tuesday, Encana Corp. CFO Sherri Brillon extolled the prolific possibilities of the Montney Shale in Canada.

The Montney carpets a 130,000-square kilometer (52,000 square-mile) region that straddles the border between northern Alberta and British Columbia (BC). Although a remote frontier by standards of the urban population in Canada and the Lower 48 states, the area is the most accessible tight gas, liquids and oil zone on the northwestern fringe of the industry.

“Ultimately, we believe that the combination of cost and well performance, condensate yields and royalties sets the Montney up to compete head-to-head with the Marcellus,” Brillon said. “The collaborative approach of both producers and infrastructure owners has historically aligned market access with the pace of development in the Montney, and in our view, this dynamic will continue.”

Brillon also pointed out that Montney development is less likely to be constrained by lack of infrastructure as has been the case with the Marcellus/Utica.

“It is important to note that unlike Appalachia, Western Canada is not physically short of transportation capacity. Although we do not disclose the specifics of our regional hedge programs, Encana uses both forward financial in term physical markets to hedge price exposure across the portfolio.”

A leading consulting firm said the weak settlement of the May contract was evidence the market may have gotten ahead of itself.

“Despite growing bullish sentiment, the market deemed it too soon for $2/MMBtu-plus gas as per the final settlement price for the May futures contract,” said PIRA Energy researchers. “The related tepid May contract termination underscores concerns regarding the timing of supply rebalancing.

“With the June contract now in the ‘pole position,’ traders will be more focused on weather and related demand prospects this summer. Yet, Henry Hub cash will still remain susceptible to renewed weakness due to building storage congestion — at least for the next few weeks. Such a backdrop would require supply to be pushed (or kept) out of the region, thus requiring [Midwest] basis premiums.

“Meanwhile, the more acute price weakness in Western Canada is being ”exported’ into the West — especially when demand is weak — as highlighted by the depths prices at Northwest Sumas reached this month.”

Weather forecasters see a slight increase in heating and cooling load this week, but going forward, requirements are expected to lag longer-term averages.

“For each day this week so far, we have recorded slight increases in national demand forecasts (single-digit total degree day advances), but we continue to track next week and the week after below the 10-year normal and last year’s levels,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report.

“This current week is managing to edge out higher than both benchmarks, though. Indeed, we see additional cooler short-range changes for the East Coast that are adding some last-minute heating degree days to the forecast,” said Rogers.

In the near term, the National Weather Service (NWS) forecasts below-normal heating and cooling demand in major population centers. For the week ending Saturday (May 7), NWS predicted that New England would see combined heating and cooling degree-days (DD) of 84, or seven fewer than normal. The Mid-Atlantic should enjoy 68 DD, or five fewer than normal, and the greater Midwest from Ohio to Wisconsin is anticipated to experience 69 DD, or 11 below it seasonal tally.

Tom Saal, vice president at FCStone Latin America LLC in Miami, in his work with Market Profile expects the market to test Tuesday’s value area at $2.092 to $2.072. At that point he recommends following the course of prices should they break outside the initial balance, higher than $2.119, and lower than $2.033. “Eventually” he expects the market to test $2.281 to $2.225.

“One of the best features of Market Profile is the display of both the vertical and horizontal price dimensions,” he said Wednesday. “Note last four days of horizontal trading [and] look for change away from the horizontal — untested value area at $2.225.”

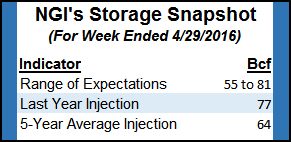

Thursday’s Energy Information Administration storage report should give traders an idea of what the summer injection season may bring. IAF Advisors expects a fill of 67 Bcf and ICAP Energy calculates at 69 Bcf build. A Reuters survey of 21 traders revealed an average 64 Bcf with a range of 55 Bcf to 72 Bcf. Last year 77 Bcf was injected and the five-year average stands at 64 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |