Storage Data Suggesting Weakening Supply-Demand Balance, Analysts Say

Natural gas futures lost ground Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was somewhat less than what traders were expecting.

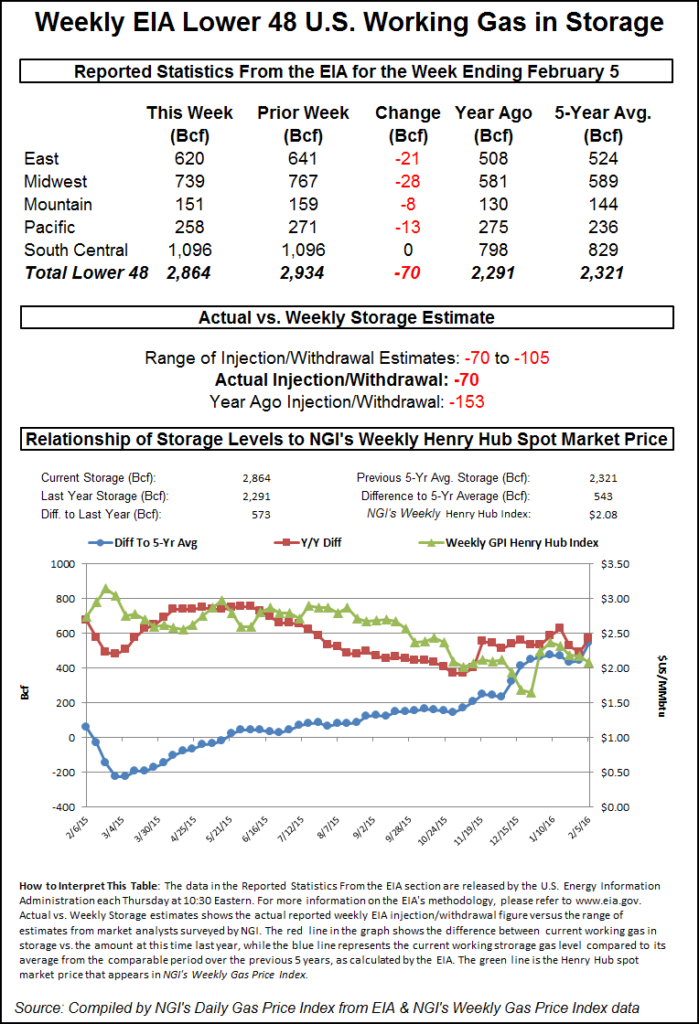

EIA reported a 70 Bcf withdrawal in its 10:30 a.m. EST release, and the withdrawal put inventories at 2,864 Bcf. March futures fell to a low of $2.002 following the release of the storage data, and by 10:45 a.m., March was trading at $2.005, down 4.1 cents from Wednesday’s settlement.

Prior to the release of the data, analyst estimates were in the upper-70 Bcf area. ICAP Energy was looking for a pull of 77 Bcf, and a Reuters survey of 23 traders and analysts showed a range from -70 to -105 Bcf with an average -82 Bcf. Citi Futures Perspective calculated a 98 Bcf withdrawal.

“Nothing has really changed. It’s $2 on the downside and $2.25 on the upside,” said a New York floor trader. “We were trading about $2.02 before the number came out, so the report pushed the market lower by a couple of pennies.”

“The net withdrawal of 70 Bcf was bearish relative to market expectations,” said Tim Evans of Citi Futures Perspective. “This was a second consecutive bearish miss, suggesting that the background supply-demand balance has weakened. There may have also been a greater sensitivity to last week’s warm temperatures than forecast. Either way, it’s a bearish result.”

Inventories now stand at 2,864 Bcf and are a whopping 573 Bcf greater than last year and 543 Bcf more than the five-year average. In the East Region 21 Bcf was pulled, and the Midwest Region saw inventories fall by 28 Bcf. Stocks in the Mountain Region were down by 8 Bcf, and the Pacific Region was lower by 13 Bcf.

The South Central Region was net unchanged as the salt cavern storage portion added 9 Bcf to 312 Bcf, while the non-salt cavern figure fell 9 Bcf to 784 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |