Cash NatGas Nearly Flat; Futures Rattle Higher on EIA Data

Most physical traders on Thursday made a point of getting their deals done prior to the release of weekly natural gas storage data from the Energy Information Administration (EIA). Overall, the market for Friday gas gained a penny to $2.36.

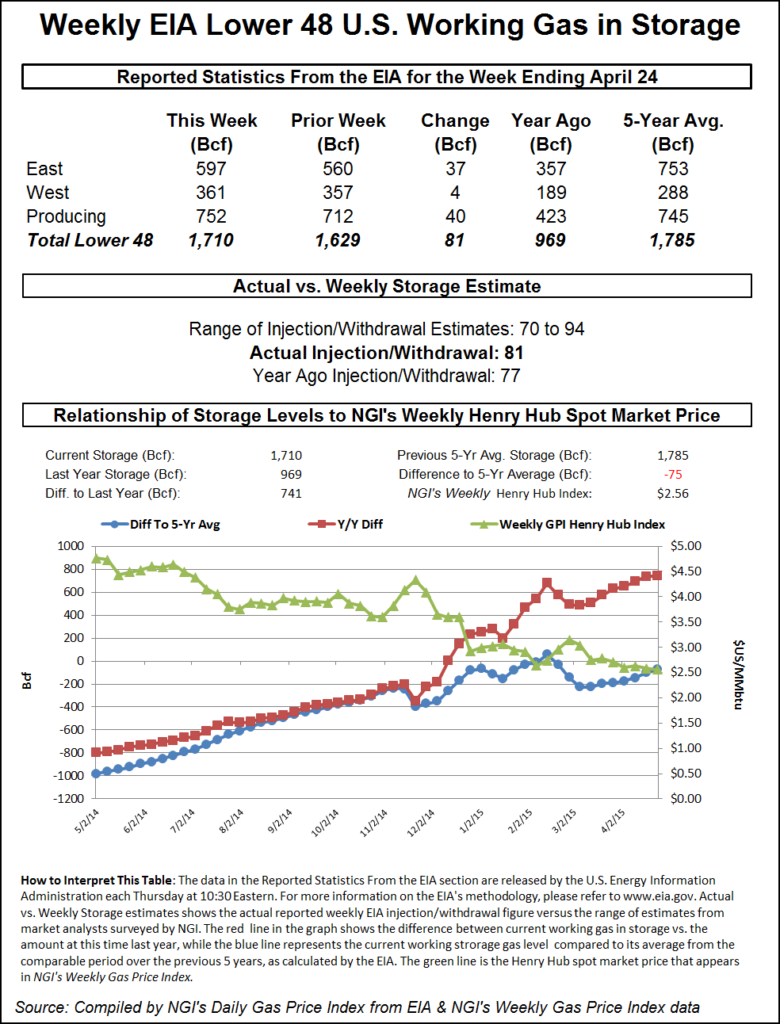

Futures trading rebounded from a 3-cent deficit prior to the release of inventory data to a stout double-digit gain as the EIA reported a leaner-than-expected 81 Bcf addition to inventories. The June contract settled up 14.5 cents to $2.751, and July added 14.3 cents to $2.802. June crude oil continued its upward path, gaining $1.05 to $59.63/bbl.

The 10:30 a.m. EDT EIA report caught a number of traders by surprise. Natgasweather.com calculated a 92 Bcf injection, and ICAP Energy was looking for an 89 Bcf build. A Reuters survey of 24 traders and analysts revealed an average 85 Bcf with a range of 70 Bcf to 94 Bcf.

Some suspected even higher. Energy Metro Desk (EMD) said, “We see our Survey Index this week came in at 87 Bcf, and we have a sense that the EIA will come in higher than that number by 5 or more. The range is way too wide, and the spread between the three categories we track came in above the 3 Bcf watermark. So something is amiss.” John Sodergreen, EMD editor, estimated a 90 Bcf build.

Prices lost no time reacting to the lower than expected figure. June futures rose to a high of $2.713 after the number was released and by 10:45 a.m. June was trading at $2.692, up 8.6 cents from Wednesday’s settlement.

“We had heard a number anywhere from 85 Bcf to 90 Bcf and we were trading 3 cents lower when the number came out,” said a New York floor trader. “Volume-wise, we are above average at almost 80,000 [June] contracts, and usually we are at 55,000 when the number comes out.

“We’ve only settled below $2.50 one day, so I think we may have seen the lows for a while, but we are still within the $2.50 to $3 range. There is no weather to speak of.”

Tim Evans of Citi Futures Perspective said the report should “provide at least a short-term boost to market sentiment. While still more than the 56 Bcf five-year average, the report should at least count as less bearish than anticipated in our view.”

Inventories now stand at 1,710 Bcf and are 741 Bcf greater than last year and 75 Bcf less than the five-year average. In the East Region 37 Bcf was injected, and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 40 Bcf.

Risk managers haven’t been very active in the market as of late. “We are just hoping for some kind of short-covering rally to give us a chance to enter into some short hedges,” said Mike DeVooght, president of DEVO Capital Management, a Colorado-based trading and risk management firm.

He added that he thought a lot of the emphasis on large supplies expected out of the Marcellus and Utica shales and those volumes trying to make their way to more western points had been “discounted in the market and that’s one of the reasons the funds have been carrying record short positions, end-users are not motivated to buy on a forward basis, and that [trade] has basically gone away. The hedge side of the business has definitely slowed down.

“If we could get some kind of rally where the back months were $3.50, then there are probably some things to do. With the winter at $3.50 or $3.60 then you can put on some collars or something like that. It’s really hard to be a bull in this environment.”

In the physical market next-day gas at New England points slumped as weaker next-day power prices gave buyers for gas-fired electrical generation little incentive to make incremental purchases. Intercontinental Exchange reported that on-peak power at the ISO New England’s Massachusetts Hub for Friday delivery fell $2.55 to $23.45/MWh and peak power at the New York ISO’s Zone G (eastern New York) delivery point fell $3.75 to $28.00/MWh. At the PJM West Hub next-day peak power retreated $2.72 to $30.33/MWh.

Gas for delivery Friday to the Algonquin Citygates fell 58 cents to $1.94, and parcels on Iroquois Waddington shed 8 cents to $2.65. Gas on Tennessee Zone 6 200 L changed hands 60 cents lower at $1.92.

Weather forecasts called for moderate New England temperatures going into the weekend. Forecaster Wunderground.com predicted that the Thursday high in Boston of 56 would slide to 49 Friday before rising to 59 on Saturday. The seasonal high in Boston is 61. New Haven, CT’s 59 high Thursday was seen reaching 60 on Friday and 65 Saturday, 4 degrees above normal.

In the Midwest, next-day quotes were mostly steady to higher. On Alliance, gas for Friday was seen at $2.55, down 3 cents, but packages at the Chicago Citygates came in unchanged at $2.57. Gas at Demarcation was quoted at $2.51, up 4 cents, and gas on Northern Natural Ventura rose a couple of pennies to $2.50.

Western Market Hubs were mostly higher. Gas on El Paso Permian fell a penny to $2.37, but deliveries to Kern River added 3 cents to $2.39. At the SoCal Citygates Friday gas added 4 cents to $2.70, and parcels at PG&E Citygates added 2 cents to $2.93.

In late NGI bidweek trading El Paso Permian was seen at $2.21 to $2.31 and Kern River was changing hands between $2.29 and $2.31. Bidweek gas at SoCal Citygates was seen at $2.54 to $2.61, and gas at PG&E Citygates was quoted between $2.81 to $2.91.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |