Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Appalachian NGL Growth Tops Range Resources 3Q Performance

Range Resources Corp.’s renewed focus on the Appalachian Basin continued to pay off during the third quarter, when natural gas liquids (NGL) production and commodity prices again improved.

Third quarter liquids production increased to 111,469 b/d from 96,661 b/d in the year-ago period and 104,219 b/d in 2Q2018. Management continued to plug those gains, saying the company is one of the three largest NGL producers nationwide.

In the second quarter, Range increased its full year guide for NGL price realizations after they hit a level not seen in years on higher oil prices. Pre-hedge prices during the third quarter reached $27.16/bbl or 39% of the average West Texas Intermediate (WTI) oil price. Fourth quarter NGL price guidance was again increased to 40% of WTI. Improving prices have incentivized more liquids-directed drilling across Appalachia.

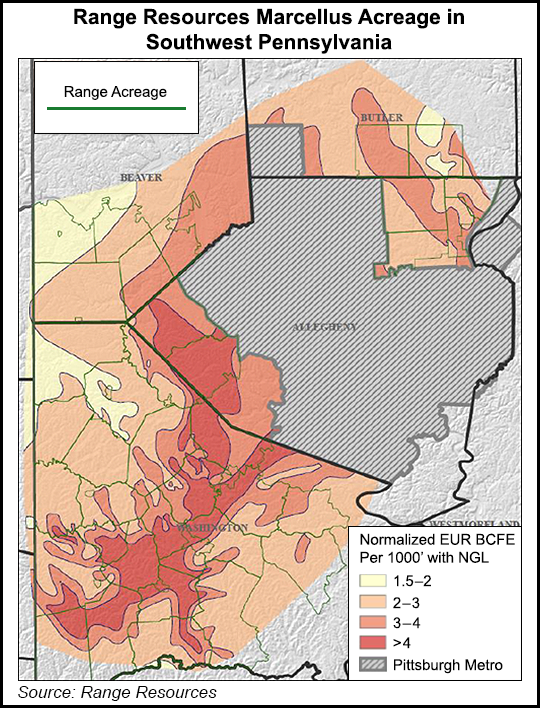

Range has doubled down in a way on Appalachia, which has long been its primary focus. It recently drilled its longest Marcellus Shale lateral to date in southwest Pennsylvania of 18,566 feet and completed two others this year at 18,000 feet. But the company has backed off on its $4.4 billion bet on North Louisiana’s Cotton Valley Sands Terryville Complex, assets acquired two years ago when it bought Memorial Resource Development Corp.

Underperforming assets there have the company intently focused on Appalachia. The North Louisiana assets, which management has not ruled out selling, barely registered a mention during the company’s third quarter earnings call. Production from the division was 278 MMcfe/d, down from 360 MMcfe/d in the year-ago period and 313 MMcfe/d in 2Q2018. Senior Vice President of Operations Dennis Degner said during the call that the company would continue to run one rig in the Terryville during the fourth quarter as appraisal efforts continue.

Overall, Range produced 2.267 Bcfe/d during the third quarter, up from 1.99 Bcfe/d at the same time last year and 2.2 Bcfe/d in 2Q2018. The company’s Appalachian division accounted for the bulk of production at 1.988 Bcfe/d, a 24% increase for the division over the prior-year quarter.

CEO Jeffrey Ventura said the company also remains on track to significantly reduce its leverage two years ahead of schedule when 2018 comes to a close. Range sold a 1% overriding royalty interest this month in its leases for core properties in southwest Pennsylvania for $300 million. Total debt declined by $46.2 million between the second and third quarters and now stands at about $4 billion.

With more takeaway online in Appalachia, Range said its 3Q2018 price realizations, including hedges, increased 17% year/year to $3.36/Mcfe. Revenue also increased 68% to $811 million over the same time.

Range reported net income of $48.5 million (19 cents/share) in the third quarter, compared to a net loss of $127.7 million (minus 52 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |