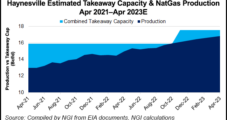

Lower 48 heavyweights EOG Resources Inc. and Coterra Energy Inc. are reducing activity in their natural gas plays to deal with slipping commodity prices. However, the pullback does not dim the long-term bullish outlook, EOG CEO Ezra Yacob said. During the first quarter conference call, Yacob said the Houston-based independent is still “constructive on future…

Topic / Natural Gas Prices

SubscribeNatural Gas Prices

Articles from Natural Gas Prices

Lower U.S. Natural Gas Activity, Fewer Fleets Predicted as Rigs Move to Oil

Activity in the Lower 48 natural gas basins softened during the first quarter, with hydraulic fracturing fleets pulled, and the slowdown may continue before the market balances, some of the largest oilfield services companies reported. Helmerich & Payne Inc. (H&P), NexTier Oilfield Solutions Inc., NOV Inc. and Patterson-UTI Corp. in delivering their first quarter results…

Natural Gas Futures Continue to Climb Early Amid Supply Disruptions

Natural gas futures added to recent gains in early trading Tuesday as the market continued to gauge the impact of cuts to Canadian supply amid wildfires in Alberta. Coming off a 10.1-cent rally in the previous session, the June Nymex contract was up 3.6 cents to $2.274/MMBtu at around 8:50 a.m. ET. Monday’s rally saw…

Natural Gas Futures Relief Rally Extends to Second Day Amid Production Threats; Spot Prices Rebound

Natural gas futures found further momentum on Monday, rallying a second consecutive session amid bargain buying, hints of a potential pullback in U.S. production and wildfires that interrupted output in Canada and boosted cash markets. At A Glance: Wildfires crimp Canadian output U.S. rig count hints at slowdown Cooling demand further softens The June Nymex…

Natural Gas Futures Climb Early as Weather Models Add Demand; Supply Down Amid Alberta Wildfires

Riding momentum from late last week, natural gas futures advanced in early trading Monday amid reports of declining production and modest weather-driven demand gains. The June Nymex contract was up 6.9 cents to $2.206/MMBtu at around 8:50 a.m. ET. On Friday, the front month rallied to finish in positive territory after probing as low as…

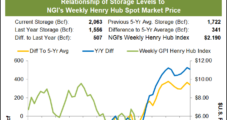

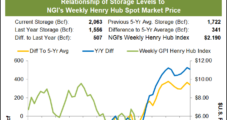

Weekly Natural Gas Spot Prices, Futures Fall as Demand Dips, Supplies Swell

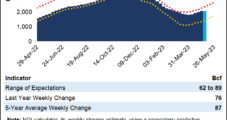

Weekly natural gas cash prices dropped amid mild temperatures and weakening demand across much of the Lower 48. NGI’s Weekly Spot Gas National Avg. for the May 1-5 period fell 30.0 cents to $1.865/MMBtu. Conditions during the week largely favored bears. Production held around 100 Bcf/d most days – well above year-earlier levels and within…

Bears in Control of Natural Gas Forward Prices for Now, but Key South Central Region Already Tightening

Natural gas forward markets continued to face fierce headwinds in early May, with prices selling off sharply through 2024, according to NGI’s Forward Look. Henry Hub paved the way as June forward prices fell 25.0 cents from April 27-May 3 to reach $2.172 and the balance of summer (June-October) slid 21.0 cents to $2.390, Forward…

Natural Gas Futures, Spot Prices Lose Again Amid Supply/Demand Imbalance

Momentum for natural gas futures proved further elusive on Thursday following an in-line government inventory report that kept supplies at a hefty surplus relative to historic averages. Strong production and weak weather-driven demand continued to command traders’ attention. The June Nymex gas futures contract fell 6.9 cents day/day and settled at $2.101/MMBtu. July lost 6.3…

Demand Weakness, Production Strength Continue to Weigh on Natural Gas Futures

Natural gas futures remained under pressure in early trading Friday as the market mulled evidence of loose shoulder season balances, including signs of weakening demand and robust domestic supply. Approaching the conclusion of a week that has seen the front month post four straight daily declines, including a 6.9-cent sell-off in the previous session, the…

Stout Supplies Leave Natural Gas Futures to Falter Fourth Consecutive Day; Cash Prices Plop

Momentum for natural gas futures proved further elusive on Thursday following an in-line government inventory report that kept supplies at a hefty surplus relative to historic averages. Strong production and weak weather-driven demand continued to command traders’ attention. The June Nymex gas futures contract fell 6.9 cents day/day and settled at $2.101/MMBtu. July lost 6.3…