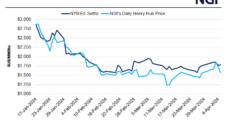

Prompt-month natural gas futures on the New York Mercantile Exchange (Nymex) tested key resistance but failed to push beyond the $1.906/MMBtu high early last week. The front-month contract was taking another stab at the upside on Monday, gaining 5.5 cents by midday to $1.840 from a $1.785 settlement ahead of the weekend. “May has done…

Markets

Articles from Markets

Geopolitical Tensions Push TTF Higher, but Cargoes Flow to Asia Amid Unchanged Fundamentals – LNG Recap

LNG cargoes continue to flow to Asia as injections get underway in Europe, where the market is well stocked and demand is low. Asia has imported 93.8 million tons (Mt) of liquefied natural gas year-to-date, up 8% over the same time last year, according to Kpler data. Meanwhile, European imports of the super-chilled fuel are…

Natural Gas Futures Rally; Maintenance Puts More Pressure on Waha — MidDay Market Snapshot

Bullish optimism, driven in part by lighter production, eclipsed concerns around mild April weather to send natural gas futures higher through midday trading Monday. Meanwhile, spot market sellers in West Texas can expect more pipeline congestion to deal with starting this week. Here’s the latest: May Nymex futures up 5.1 cents to $1.836/MMBtu as of…

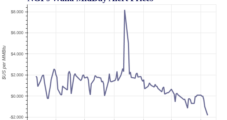

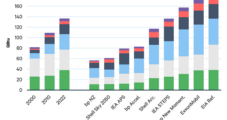

What Will Natural Gas Demand Look Like in 2050? It Depends

Global natural gas demand has boomed in the past 25 years and, unlike coal and oil, growth could continue through 2050, according to Washington, DC, nonprofit Resources for the Future (RFF). RFF’s “Global Energy Outlook 2024: Peaks or Plateaus?” report compared 16 scenarios across eight outlooks published in 2023 by major energy agencies and companies.…

Natural Gas Futures Slightly Higher, but Some Downside Risks Seen Near-Term

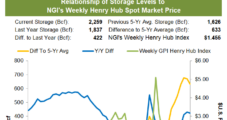

Amid mild springtime weather-driven demand and steady readings for production and exports, natural gas futures hovered close to even in early trading Monday. The May Nymex contract was up 0.7 cents to $1.792/MMBtu as of 8:30 a.m. ET. June was trading at $2.013, up 0.3 cents. EBW Analytics Group analyst Eli Rubin told clients early…

Weekly Natural Gas Spot Prices, Futures Uneven Amid Mixed Fundamentals

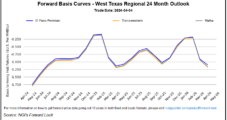

Weekly natural gas cash prices gained ground overall amid a rash of chilly northern temperatures, but pockets of weakness, particularly in West Texas, tempered the advance. NGI’s Weekly Spot Gas National Avg. for the April 1-5 period rose 16.0 cents to $1.460/MMBtu. As the trading week culminated, leading gainers included Michigan Consolidated, up 25.0 cents…

Natural Gas Futures Finish Trading Week on Positive Note, Bolstered by Supply Cuts; Cash Prices Cascade

Natural gas futures found fresh footing on Friday, supported by expectations for an ongoing production pullback as well as economic vigor that continues to support industrial energy demand. At A Glance: Output holds under 100 Bcf/d Inventory surplus narrows Weather forecast favors bears The May Nymex gas futures contract gained 1.1 cents day/day and settled…

Natural Gas Futures Traders Weighing Mixed Outlook; Steep Spot Discounts — MidDay Market Snapshot

Natural gas futures clawed back some of their recent losses through midday trading Friday as the market continued to mull a mix of fundamental factors, including restrained production, mild weather and plump inventories. Meanwhile, little buying interest for weekend and Monday delivery had cash prices falling hard. Here’s the latest: May Nymex futures at $1.804/MMBtu…

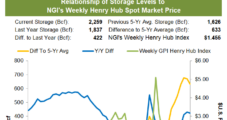

Natural Gas Futures Flat to Lower Early as Market Mulls Mild Weather, Storage Outlook

Natural gas futures held steady at the front of the curve in early trading Friday as mild shoulder season weather and a somewhat looser-than-expected close to withdrawal season kept the pressure on prices. At around 8:45 a.m. ET, the May Nymex contract was close to unchanged at $1.773/MMBtu. The front month sold off 6.7 cents…

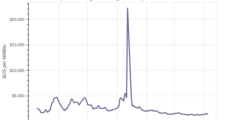

Natural Gas Futures Falter After Storage Print Affirms Lofty Supplies; Spot Prices Slide

Natural gas futures fell for a second straight session on Thursday, dragged lower by forecasts for benign weather and government inventory data that showed stout supplies in storage. At A Glance: EIA prints 37 Bcf withdrawal Outlook shifts to injections Weather demand softens Coming off a 2.1-cent loss the prior day, the May Nymex gas…