In the article titled “NatGas Price Spikes Possible as Demand Returns, Production Cuts Linger Post-Harvey,” it states that in 2005, hurricanes Katrina/Rita temporarily shut-in 8 Bcf/d of demand and permanently destroyed 1.7 Bcf/d of demand. Hurricanes Gustav/Ike in 2008 temporarily shut-in more than 7 Bcf/d of demand and around 1 Bcf/d was permanently destroyed. This statement was based on a report from Genscape Inc. which has indicated the report contained a typo and that it was actually supply(not demand)that was shut-in and permanently destroyed during all of those storms.

Markets

Articles from Markets

NatGas Cash Drops as Harvey Pummels Pipelines; October Futures Drop 4 Cents

Physical natural gas for Thursday delivery weakened in Wednesday’s trading; weakness in California along with soft pricing in Louisiana, the Midcontinent and Midwest offset gains in the Northeast. Pipelines reported Harvey-driven damage, and the NGI National Spot Gas Average fell 3 cents to $2.67.

Harvey Still Swamping Gulf Coast Infrastructure, While Offshore Limping Back

Anadarko Petroleum Corp. has resumed production from its deepwater Lucius facility, one small step in returning to business in the wake of Hurricane Harvey.

Energy Sector Directing Millions to Gulf Coast Hurricane Relief Efforts

The devastation from Hurricane Harvey will be difficult to overcome, but the energy industry is making an effort to ease the pain by donating money and time to relief efforts along the Gulf Coast.

FERC Waiver to Help Facilitate NJR’s Purchase of Talen Energy’s Natgas Trading Portfolio

FERC has agreed to waive capacity release regulations and related tariff provisions to help facilitate the sale of Talen Energy Marketing LLC’s retail and wholesale natural gas trading business to an affiliate of NJR Energy Services Co.

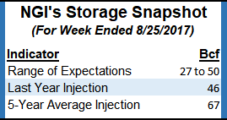

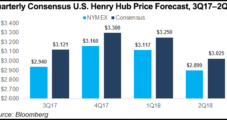

Industry Continuing To Assess Harvey’s Impact; Bidweek Prices Modestly Lower

Hurricane Harvey’s demand-killing impact on the natural gas market has been apparent since the Category 4 storm made landfall across the Texas coast late Friday, but things could turn decidedly more bullish — albeit temporarily — in the days to come as demand begins to creep higher while production remains offline, some analysts say.

CA Heat Lifts NatGas Cash; Harvey Impact Mixed as September Expires Firm

Physical natural gas for delivery Wednesday on average gained, but the next-day market was highly skewed. Most points were down a few cents and Texas, Louisiana, the Midcontinent and Midwest on average all posted losses. The NGI National Spot Gas Average, however, rose 1 cent to $2.70, primarily on the backs of outsized gains in southern California prompted by an ongoing heat wave.

Future Gulf Coast Storms ‘Increasingly Bearish’ for U.S. Natural Gas Markets, Says Barclays

Because the Gulf Coast increasingly is the hub for natural gas exports and industrial demand, Hurricane Harvey may foretell what could occur in future natural disasters, according to Barclays Capital.

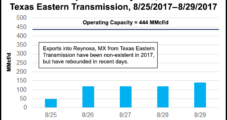

Harvey Saps Estimated 1 Bcf/d from U.S. Exports to Mexico

Tropical Storm Harvey as of Monday had curtailed about 1 Bcf/d from U.S. natural gas exports to Mexico, according to Genscape Inc.

Expiring September NatGas Seen 2 Cents Higher as Supply Destruction in Crosshairs

The expiring September natural gas futures are expected to open 2 cents higher Tuesday morning at $2.94 as traders turn their attention more to Harvey-driven supply disruption than falling demand. Overnight oil markets gained.