The issues that linger between federal regulators and oil/rail industry representatives over crude oil rail transportation are going to be resolved, but changes in the Obama administration’s cabinet could slow the process, the American Petroleum Institute’s (API) chief economist told NGI Wednesday.

E&P

Articles from E&P

Oxy Mum on Williston Sale Rumors, Cites Ongoing Strategic Review

Exactly a year after it said parts of its 2.5 million acres in the Midcontinent could be up for sale, a Houston-based Occidental Petroleum Corp. (Oxy) spokesperson refused to comment Thursday on rumors in North Dakota that Oxy was selling all of its more than 330,000 acres in the Williston Basin for an asking price of $3 billion.

California Issues More Changes to Fracking Rules

California oil/natural gas regulators on Thursday issued yet another set of draft well stimulation rules, including for hydraulic fracturing (fracking), making further refinements based on nearly 200,000 comments that have been accumulated in the past 10 months. One change has raised the proposed threshold level for seismic activity tied to well stimulation to 2.7 from a previously proposed level of 2.0.

Weather, Completions Gave SM Energy 3Q Production Pains

Implementation of its enhanced completion program in the Eagle Ford Shale and weather-related delays in the Williston Basin caused SM Energy Co. to turn in disappointing third quarter production results.

Magnum Hunter Steadily Selling Off Bakken Assets

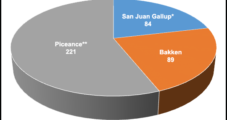

Magnum Hunter Resources Corp. keeps whittling away at its North Dakota portfolio, announcing late Thursday another deal to sell more of its nonoperated Bakken Shale assets, this time divesting 12,500 net acres for $84.7 million to a large undisclosed independent.

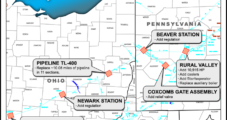

Texas Gas Planning Two-Way Street Ohio to/from Louisiana; DTI Proposes Upstream Marcellus Link

Boardwalk Pipeline Partners’ Texas Gas Transmission LLC is proposing to move more Marcellus/Utica shale gas to market via the Ohio-Louisiana Access Project, which would create capacity from Lebanon, OH, to Midwestern and southern markets on the pipeline’s system through the addition of north-to-south capability.”The project adds north-to-south transportation capacity by relying primarily on Texas Gas’ existing facilities, which avoids the need to build substantial greenfield pipeline facilities to meet transportation demand,” the company told FERC in its application [CP14-553]. “By modifying Texas Gas’ existing pipeline system, the project will allow Texas Gas to flow gas bidirectionally and provide access to markets located in the Midwestern and southern regions of the United States.”Like other traditionally northbound pipelines, Texas Gas is working to provide southbound capacity for the abundance of Appalachian gas that is looking for a market. In the case of the Ohio-Louisiana project, the market in the south would be predominantly gas-fired power generators.Ohio-Louisiana Access also would enhance supply flexibility on the Texas Gas system by making additional supplies available, the pipeline said. Talks have been under way with customers desiring south-bound capacity since fall 2013. The pipeline gave notice that some of its unsubscribed capacity would be reserved for the project beginning as early as June 1, 2016. Texas gas reserved 162,000 MMBtu/d on its mainline from Lebanon to the Bastrop Compressor Station in Morehouse Parish, LA. It also reserved 126,800 MMBtu/d on the mainline from Bastrop to the Eunice Compressor Station in Acadia Parish, LA.Sabine Pass Liquefaction LLC is the project’s foundation customer with 300,000 MMBtu/d of capacity. A binding open season, which ended Jan. 13, resulted in additional agreements for firm capacity of 326,000 MMBtu/d, for a total of 626,000 MMBtu/d.Besides Sabine, there are six other shippers on the project: R.E. Gas Development LLC, Jay-Bee Production Co., Louisville Gas and Electric Co., Gulfport Energy Corp., DTE Energy Trading Inc., and Public Energy Authority of Kentucky.The pipeline would construct the 10,915 hp Bosco Compressor Station in Ouachita Parish, LA; modify the existing Gulf South-Bosco receipt meter station to allow bi-directional gas flow; and make certain yard and station piping modifications at the Dillsboro, Columbia, Pineville and Eunice compressor stations to add north-to-south capability, while retaining the ability to flow south to north.Texas Gas is seeking a determination that it may roll project costs into rates in a future rate case. The incremental cost-based transportation rates for the project calculated on a standalone basis are less than Texas Gas’ existing approved maximum transportation rate for service from Zone 4 to Zone SL under Rate Schedule FT.7, the pipeline said.The current maximum FT reservation charge for deliveries from Zone 4 to Zone SL is $0.0794/MMBtu, whereas the calculated standalone monthly FT reservation charge for the proposed expansion facilities (which includes service from Zone 4 to Zone SL) is $0.0433/MMBtu.”Because Texas Gas’ existing system-wide rates will fully recover the costs of the project, existing customers will not subsidize any of the project’s costs. Texas Gas will also be at risk for costs related to any unused capacity between rate cases.”In its application, Texas Gas discussed some other projects it is planning. Southern Indiana Market Lateral would be 29 miles of 20-inch diameter pipeline from an existing lateral on Texas Gas in Henderson County, KY, to a termination point in Posey County, IN. It would serve two new industrial customers in Indiana. The pipeline told FERC it would have no objection to the Commission processing the environmental review of Southern Indiana Market Lateral concurrently with Ohio-Louisiana Access.Another project, the Western Kentucky Market Lateral, would consist of about 19 miles of 24-inch diameter pipeline from an existing Texas Gas lateral to a gas-fired power plant currently under construction.Additionally, the pipeline’s Northern Supply Access Project is still being considered to provide new north-to-south transportation capacity. Scope and timing are currently unknown, Texas Gas said. “Although the Northern Supply Access Project would have some overlap with the [Ohio-Louisiana Access Project] on the mainline capacity, the Northern Supply Access Project would be incremental to [Ohio-Louisiana Access], and the construction schedule and in-service dates would be offset from [Ohio-Louisiana] by more than one year,” Texas Gas said.Separately, in support of a contract with Ohio-Louisiana Access Project shipper R.E. Gas Development, Dominion Transmission Inc. (DTI) has applied at FERC for a project upstream of Ohio-Louisiana Access, its Lebanon West II Project, which would carry gas from Pennsylvania to Lebanon.”DTI’s natural gas pipeline system is uniquely positioned to transport new gas production in Pennsylvania, Ohio and West Virginia as its pipelines traverse the areas of significant supply growth,” the company told FERC [CP14-555]. “DTI is proposing the project in response to customer requests for incremental pipeline capacity which will promote supply diversity as well as meet the growing market demand for natural gas. The additional firm transportation capacity for the new gas supplies will also alleviate the possibility of shortages by providing more gas to market and firm capacity to get this gas to market.”The project would provide 130,000 Dth/d of firm service. Lebanon West II facilities would be in the Pennsylvania counties of Armstrong, Allegheny and Beaver and in the Ohio counties of Licking, Fayette, Coshocton, Tuscarawas, Harrison, Carroll and Columbiana.DTI said it would receive gas on behalf of R.E. Gas Development at its existing interconnect in Butler County, PA, known as the MarkWest Liberty Bluestone Interconnect, and deliver gas to Warren County, OH, at the interconnect with Texas Gas Transmission, known as the Lebanon-Texas Gas Interconnect. The new firm transportation capacity is fully subscribed pursuant to a precedent agreement with RE Gas, DTI said.DTI proposes to commence construction of the project in September 2015 in order to meet an in-service date of Nov. 1, 2016.

West Virginia Regulators Coping With Growing Oil, Gas Permit Applications

With more than 1,000 horizontal shale well permits issued to date in West Virginia, and with only about 5% of unconventional oil and gas reserves under development there, state regulators are confronting a pile of paperwork that has created a backlog of pending permit applications and slowed production in some instances.

WPX Still Appealing PA Orders to Replace Families’ Water Supplies

WPX Energy Inc. has appealed all three of the Pennsylvania Department of Environmental Protection’s (DEP) orders to permanently replace the water supplies of families that were impacted by problems at the company’s impoundment in Westmoreland County in 2012.

Seismic Operators Dawson, TGC Propose Merger to Expand North American Reach

Seismic operators Dawson Geophysical Co. and TGC Industries Inc. are shaking up the market after attempting once again a strategic combination to expand their onshore reach in North America.

WPX Cowboys Up, With Western Portfolio Now Sole Focus

WPX Energy Inc. is hauling its rigs and equipment out West and will keep the drillbit going in only three states — North Dakota, New Mexico and Colorado — with the balance of the portfolio, including Appalachia, on the sales block, the Tulsa-based operator said.