Story of the day

TC Energy Advances Southeast Gateway Pipeline Offshore Mexico

Markets

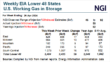

Natural Gas Futures, Spot Prices Find Fresh Footing Following Seasonally Light Storage Increase

Natural gas futures on Thursday snapped a two-day losing streak, bolstered by a bullish storage print, lower production and forecasts for strong summer heat. At A Glance: EIA prints 59 Bcf injection Hotter temperatures ahead Output hovers at 97.6 Bcf/d The June Nymex gas futures contract rallied 10.3 cents day/day and settled at $2.035/MMBtu. After…

May 2, 2024Mexico

Mexico Imports of U.S. Natural Gas Surge as Domestic Production Sputters – Spotlight

North American natural gas futures worked their way above $2.00/MMBtu this week amid tighter U.S. production and storage levels. Mexico imports, meanwhile, of U.S. natural gas have started to hit their stride in the lead-up to summer. Over the last 10 days, Mexico imported 7.38 Bcf/d of natural gas via pipeline from the United States,…

May 2, 2024Natural Gas Prices

June Natural Gas Futures Rally Above $2 Following Bullish Government Storage Print

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 59 Bcf natural gas into storage for the week ended April 26. The result came close to expectations but was notably below historical averages. The print reflected lighter production volumes and supported upward momentum for Nymex natural gas futures. Ahead of the 10:30…

May 2, 2024E&P

Mexico Natural Gas Production Continues to Slide as Cheap U.S. Supply on the Rise

Mexico’s natural gas production averaged 3.90 Bcf/d in March 2024, down from 4.35 Bcf/d in March 2023. State oil company Petróleos Mexicanos (Pemex) accounted for 3.70 Bcf/d of the total, compared to 4.13 Bcf/d in the year-ago month, data from upstream regulator Comisión Nacional de Hidrocarburos (CNH) show. Private sector operators supplied the remainder. Pemex…

May 1, 2024Trending News

Natural Gas Prices