Story of the day

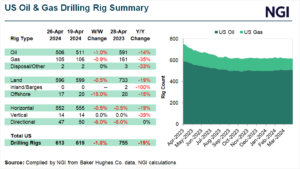

U.S. Natural Gas Count Eases to 105; Oil Rigs Down Five, BKR Data Show

Markets

Weekly Natural Gas Cash Spot Prices Move Higher as Futures Stumble

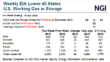

Weekly natural gas cash prices gained ground on the back of strong gains in West Texas in a week that was marked by stronger LNG feed gas flows and modestly higher weather-driven demand. NGI’s Weekly Spot Gas National Avg. for the April 22-26 trading period climbed 9.5 cents to $1.230/MMBtu. Among the top weekly gainers,…

April 26, 2024Markets

May Natural Gas Futures Narrow Losses on Expiry Day; Cash Prices Fall

Natural gas futures fell Friday, with the May contract touching lows below $1.500/MMBtu before bouncing back on its last day as the front month. The June contract also fell, under pressure from milder weather patterns taking over and delaying expectations for summer’s heat to arrive. At A Glance: May Nymex rolls off board LNG exports…

April 26, 2024Earnings

Equinor Expects Asia, LNG Competition to Drive European Natural Gas Prices

Equinor ASA expects competition for LNG with Asia and weather to be the largest drivers of European natural gas prices as markets continue to shift, creating a floor for global benchmarks. After another mild winter helped Europe exit its second heating season without major Russian pipeline gas supplies and sizable storage inventories, CFO Torgrim Reitan…

April 26, 2024Energy Transition

TotalEnergies Amplifying U.S. RNG for Industrial Decarbonization

TotalEnergies SE has inked an agreement with BlackRock Inc.-backed Vanguard Renewables to advance nearly a dozen U.S. renewable natural gas (RNG) projects over the next year with total annual production capacity of 2.5 Bcf. Boston-based Vanguard, funded by BlackRock’s Diversified Infrastructure segment, plans initially to develop 10 projects. The first three from the joint venture…

April 26, 2024Trending News

Regulatory

Mexico Energy Under Sheinbaum Could Follow Similar AMLO Model, Expert Analyst Says

Apr 26, 2024

Markets