Story of the day

May Natural Gas Futures Narrow Losses on Expiry Day; Cash Prices Fall

Earnings

Equinor Expects Asia, LNG Competition to Drive European Natural Gas Prices

Equinor ASA expects competition for LNG with Asia and weather to be the largest drivers of European natural gas prices as markets continue to shift, creating a floor for global benchmarks. After another mild winter helped Europe exit its second heating season without major Russian pipeline gas supplies and sizable storage inventories, CFO Torgrim Reitan…

April 26, 2024Energy Transition

TotalEnergies Amplifying U.S. RNG for Industrial Decarbonization

TotalEnergies SE has inked an agreement with BlackRock Inc.-backed Vanguard Renewables to advance nearly a dozen U.S. renewable natural gas (RNG) projects over the next year with total annual production capacity of 2.5 Bcf. Boston-based Vanguard, funded by BlackRock’s Diversified Infrastructure segment, plans initially to develop 10 projects. The first three from the joint venture…

April 26, 2024LNG

LNG Said Vital for Argentina’s Vaca Muerta to Reach Potential

Argentina’s vast natural gas resources would only be fully developed with an LNG export facility, according to experts who spoke at a recent energy conference. “Clearly we think we need to develop the regional market,” said Pampa Energía’s director of commercialization and midstream, Santiago Patrón. The executive at one of Argentina’s top natural gas producers…

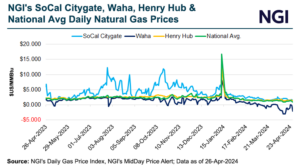

April 26, 2024Natural Gas Prices

Natural Gas Forwards Mostly Lower as MVP Startup Impacts Summer Pricing

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

April 26, 2024Recent News

Earnings