Story of the day

Natural Gas Futures Slide as Hefty Wind Generation Plumps Up Weekly Storage Print

Earnings

Baker Hughes CEO Heralds ‘The Age of Gas,’ Touts LNG as Climate Solution

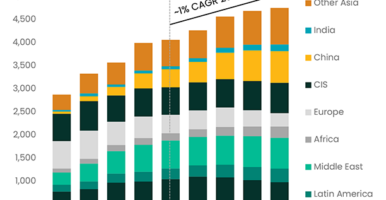

The world’s energy companies are becoming more pragmatic in their approach to reaching net-zero emissions and Baker Hughes Co.’s customers plan to boost their natural gas exposure in the coming years, CEO Lorenzo Simonelli said. It is “becoming clearer just how complex the undertaking is for the transition of the world’s energy ecosystem,” Simonelli said…

April 25, 2024

Earnings

Range Resources Sees Strong Natural Gas Demand, Keeps Production Steady

Range Resources Corp. kept natural gas production steady through the first quarter, even as others pulled back, and it expects to maintain the same pace through 2024. The Appalachian Basin pure play’s executives reiterated to analysts during a call to discuss first quarter earnings on Wednesday that they intend to hold output flat this year.…

April 25, 2024

LNG

Freeport LNG Reports Second Train 3 Outage in Two Weeks as Maintenance Continues

Freeport LNG Development LP has reported another outage of its third train, currently the only one not under extensive maintenance at its Texas terminal, days after production appeared to resume, according to pipeline data and regulatory filings. The firm told Texas environmental regulators the unit experienced a system trip on Tuesday afternoon that lasted until…

April 25, 2024

Earnings

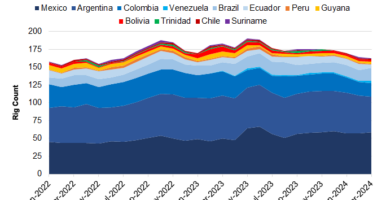

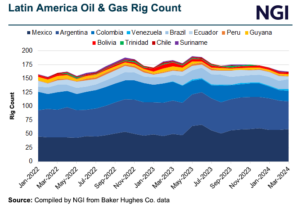

Latin America Oil, Natural Gas Activity Climbs for Halliburton, SLB and Weatherford

Performance in Latin America during the first quarter proved to be strong for Halliburton Co. and Weatherford International plc, with each reporting double-digit revenue gains from a year ago. The oilfield services giants joined SLB Ltd. and Baker Hughes Co. in reporting their quarterly results. SLB reported a 2% gain in sales year/year across its…

April 25, 2024

LNG

Hammerfest, Freeport Outages Send Global Natural Gas Prices Higher – Three Things to Know About the LNG Market

NO. 1: A gas leak at the Hammerfest LNG export terminal in Norway that occurred during maintenance has shut the plant down until Friday. The facility, which is operated by Equinor ASA was evacuated Tuesday, and the leak has since been stopped. The cause is under investigation. Hammerfest is Europe’s only large-scale export terminal. It…

April 25, 2024

Energy Transition

Premium Too High for Customers Requesting Renewable Fuels, Natural Gas Suppliers Say

Natural gas end users are increasingly focused on sustainability and have shown a keen interest in the availability of low carbon fuel options. Still, the question often arises – are they willing to pay a premium? At the recent LDC Gas Forums Southeast in Ponte Vedra Beach, FL, executives of local distribution companies and natural…

April 25, 2024

Markets

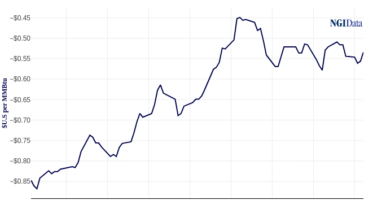

Natural Gas Forwards Slide Overall as West Texas Outlook Brightens for Bulls

With excess storage inventories continuing to hang over the market through the shoulder season, natural gas forwards declined notably at the front of the curve for most regions during the April 18-24 trading period, data from NGI’s Forward Look show. May fixed prices at benchmark Henry Hub exited the period at $1.653/MMBtu, down 6.1 cents…

April 25, 2024

LNG

Navigating the New LNG Regulatory Landscape – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow podcast. Neil Chatterjee, a former FERC chairman and commissioner, joins NGI’s Jamison Cocklin, managing editor of LNG, to discuss the political and regulatory aspects of President Biden’s pause on authorizing new liquefied natural gas export projects. Chatterjee, an environmental and energy attorney…

April 25, 2024

Earnings

EQT Plans MVP Expansion to Serve Data Center Boom in Southeast

EQT Corp. said it would continue cutting 1 Bcf/d of production as U.S. natural gas prices remain near four-year lows, but management anticipates strong power generation demand in the coming years that has it planning an expansion of the Mountain Valley Pipeline (MVP). After a seven-year battle and a congressional mandate rescued the system from…

April 24, 2024Recent News

Markets

Natural Gas Futures Slide as Hefty Wind Generation Plumps Up Weekly Storage Print

Apr 25, 2024

Earnings

Latin America Oil, Natural Gas Activity Climbs for Halliburton, SLB and Weatherford

Apr 25, 2024

Natural Gas Prices

Mild Weather and Supply Woes Weigh on May Natural Gas Bidweek Prices

Apr 25, 2024

Energy Transition

Premium Too High for Customers Requesting Renewable Fuels, Natural Gas Suppliers Say

Apr 25, 2024Daily Gas Price Index

As one of only two price reporting agencies that include ICE trade data to determine natural gas price indexes, NGI delivers robust indexes at a competitive price.

• Daily physical spot natural gas price indexes at 170+ locations

• News and analysis of key market events

• Daily breakdown of physical market natural gas price activity

Markets

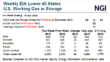

Natural Gas Futures Slide as Hefty Wind Generation Plumps Up Weekly Storage Print

Natural gas futures tried to shake off a stronger-than-expected government inventory print Thursday but settled lower as benign weather and LNG hiccups weighed. At A Glance: EIA reports 92 Bcf injection West Texas cash flips negative Freeport LNG stays down Following a nearly 16-cent decline, the May Nymex contract settled down 1.5 cents day/day at…

April 25, 2024Mexico Gas Price Index

Daily news and natural gas pricing information service focused on price transparency in Mexico.

• Experienced insight into Mexican regulatory requirements, process guidelines and governmental oversight

• Regular interviews with Mexico natural gas subject matter experts

• NGI-calculated cost-plus-transport pricing, as well as official IPGN pricing

Earnings

Latin America Oil, Natural Gas Activity Climbs for Halliburton, SLB and Weatherford

Performance in Latin America during the first quarter proved to be strong for Halliburton Co. and Weatherford International plc, with each reporting double-digit revenue gains from a year ago. The oilfield services giants joined SLB Ltd. and Baker Hughes Co. in reporting their quarterly results. SLB reported a 2% gain in sales year/year across its…

April 25, 2024Energy Transition

Mexico’s Sheinbaum Promises Energy Continuity Amid Sector Challenges

April 24, 2024Shale Daily

Impactful news and transparent pricing for shale and unconventional plays across the U.S. and Canada.

• Natural gas prices at 20+ North American shale basins and unconventional plays

• Quickly understand major factors affecting on of the world’s largest natural gas supplies

• On-the-ground news coverage of crucial market events impacting supply and demand fundamentals

Markets

Natural Gas Futures Slide as Hefty Wind Generation Plumps Up Weekly Storage Print

Natural gas futures tried to shake off a stronger-than-expected government inventory print Thursday but settled lower as benign weather and LNG hiccups weighed. At A Glance: EIA reports 92 Bcf injection West Texas cash flips negative Freeport LNG stays down Following a nearly 16-cent decline, the May Nymex contract settled down 1.5 cents day/day at…

April 25, 2024