Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

Falling Natural Gas Prices Lead Slowdown in Overall U.S. Inflation

Natural gas prices, under persistent downward pressure early in 2023 amid stout supplies and weak demand, dropped in March more than any other category measured by the federal government’s key inflation reading. Slumping prices – both in the futures and cash markets – resulted in a 7.1% drop in consumer natural gas prices in March…

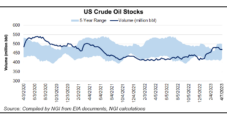

Domestic Crude Production Returns to 2023 High; EPA Aims to Jumpstart EVs

U.S. oil producers ramped up output last week even as near- and long-term demand grew increasingly uncertain amid recession fears and a new push to shift American drivers to electric-powered cars and trucks. Domestic exploration and production (E&P) firms generated 12.3 million b/d of oil for the week ended April 7, according to the U.S.…

Oilfield Services Employment Hits Highest Level Since Onset of Pandemic

Employment in the U.S. oilfield services and equipment sector (OFS) increased by 2,907 jobs in March and reached its highest level in three years, according to an analysis of federal data by the Energy Workforce & Technology Council. Total OFS jobs climbed to 656,368 last month, a high mark since the onset of the coronavirus…

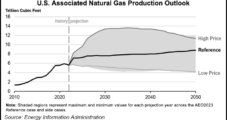

U.S. Associated Gas Production Projected to Expand Through Mid-Century, EIA Says

U.S. associated natural gas output – a byproduct of oil production – is expected to grow through 2050, continuing and amplifying a long-term trend, according to a federal outlook. The Energy Information Administration (EIA) said in a research note Tuesday that, in its benchmark scenario that considers only the laws and regulations adopted through mid-November…

Weekly Natural Gas Cash Prices Trade Sideways, Futures Fail to Find Momentum

In an abbreviated stretch of trading, weekly cash prices eased slightly. The spot market made gains at times during the week alongside hits to production and chilly temperatures in the Mountain West and central United States. But those advances were more than offset by a pullback on the West Coast. NGI’s Weekly Spot Gas National…

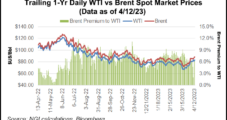

Natural Gas Futures, Spot Prices Drop as April Weather Outlook Grows ‘Exceptionally Bearish’

Natural gas futures flipped lower Thursday, snapping a modest two-day winning streak after the latest government inventory data confirmed robust supplies heading into the shoulder season and forecasts pointed to benign weather through most of April. Cash prices slid in tandem. The May Nymex gas futures contract shed 14.4 cents day/day and settled at $2.011/MMBtu.…

Natural Gas Futures Seek Momentum Amid Supply Interruptions

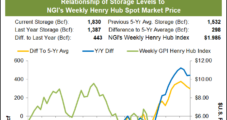

Utilities withdrew 23 Bcf of natural gas from storage for the week ended March 31, the U.S. Energy Information Administration (EIA) reported Thursday. The result was essentially on par with market expectations, leaving Nymex natural gas futures to drift lower. At A Glance: BREAKING: U.S. EIA reports 23 Bcf withdrawal from stocks Production slowed by…

Natural Gas Futures Trade Negative Following In-Line Storage Withdrawal

Utilities withdrew 23 Bcf of natural gas from storage for the week ended March 31, the U.S. Energy Information Administration (EIA) reported Thursday. The result was essentially on par with market expectations, leaving Nymex natural gas futures to drift lower. “Overall neutral release,” said one participant on the online energy platform Enelyst. Ahead of the…

Natural Gas Futures Rally Second Day as Market Looks For Bullish Storage Print; Cash Prices Climb

Natural gas futures, under heavy pressure most of 2023 amid mild weather and strong production, found a path forward for a second consecutive session on Wednesday as traders focused on export strength and expectations for a bullish inventory report. At A Glance: Prompt month posts 4.9-cent gain Analysts see low 20s Bcf withdrawal Production slowed…

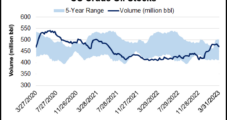

U.S. Oil Production Flattens as Saudi Arabia, Russia Cut Output

U.S. exploration and production (E&P) firms kept crude output even last week amid an uncertain demand outlook and expectations for steep cuts to global supplies. E&Ps produced 12.2 million b/d for the week ended March 31, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report (WPSR) on Wednesday. The result was flat…