Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

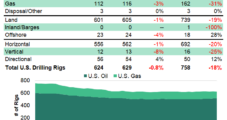

Haynesville Down Four Rigs in Latest Baker Tally as Natural Gas Count Drops

The U.S. natural gas patch dropped four rigs for the week ended Friday (March 22), including a notable reduction in drilling numbers for the gassy Haynesville Shale, according to the latest figures from Baker Hughes Co. (BKR). The United States ended the period with 112 active natural gas-directed rigs, down from 162 in the year-earlier…

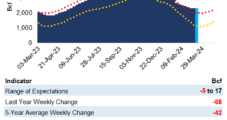

Natural Gas Futures Called Slightly Lower as Early Injection Confirms Lack of Weather

With an unusually early storage injection seemingly confirming market assumptions around balances following a stretch of extremely mild weather, natural gas futures were treading water early Friday. The April Nymex contract was off 0.6 cents to $1.677/MMBtu as of 8:40 a.m. ET. May was trading at $1.828, off 0.3 cents. The U.S. Energy Information Administration…

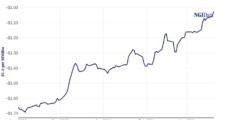

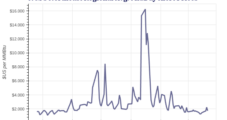

Permian Natural Gas Forward Prices Plummet; Other Markets Seeing Basis Improvement

Natural gas forward prices pushed modestly higher at the front of the curve during the March 14-20 trading period, particularly in the Northeast and Appalachia, data from NGI’s Forward Look show. Meanwhile, spring contracts at hubs near the congested Permian Basin struggled under the weight of weak near-term fundamentals. Fixed prices for April delivery at…

Natural Gas Futures, Cash Down as Market Mulls ‘Massive’ Storage Surplus — MidDay Market Snapshot

Natural gas futures remained lower through midday trading Thursday as the latest U.S. Energy Information Administration (EIA) storage report underwhelmed, confirming further expansion of an already sizable Lower 48 inventory surplus. Meanwhile, some late-season chills for northern portions of the country failed to prevent falling physical prices. Here’s the latest: April Nymex contract trading at…

Early Injection Expected from EIA as Natural Gas Futures Slide

With the latest government inventory data expected to further expand the storage surplus and potentially reveal an unseasonably early net injection, natural gas futures fell in early trading Thursday. The April Nymex contract was off 0.8 cents to $1.691/MMBtu as of 8:47 a.m. ET. May was down 1.4 cents to $1.831. Estimates for the U.S.…

Storage Glut Pressures Natural Gas Futures; Northeast Cash Climbs — MidDay Market Snapshot

As another unseasonable storage result loomed, threatening to further expand an already huge inventory surplus, natural gas futures retreated through midday trading Wednesday. Meanwhile, with snow in the forecast for the Northeast, spot prices there rallied. Here’s the latest: April Nymex contract down 5.1 cents to $1.693/MMBtu as of 2:09 p.m. ET After going as…

Natural Gas Futures Steady Early as Market Mulls Supportive Late-Season Cooling

Natural gas futures hovered close to unchanged early Wednesday as modest late-season cooling remained supportive for a market working through a significant storage glut exiting winter. After turning in two straight positive sessions to open the work week, including a 4.1-cent gain on Tuesday, the April Nymex contract was trading flat at $1.744/MMBtu as of…

Natural Gas Futures Up Modestly; West Texas Cash Still Negative — MidDay Market Snapshot

Natural gas futures remained modestly higher at the front of the curve through midday trading Tuesday as prices continued to draw support from a relatively cool forecast and flagging production. Meanwhile, West Texas spot prices remained on the wrong side of zero. Here’s the latest: April Nymex contract up 3.2 cents to $1.735/MMBtu as of…

Natural Gas Futures Advance Amid Late Season Cooling, Production Weakness

A cooler weather outlook and continued evidence of receding production volumes helped lift natural gas futures in early trading Tuesday. Building on a 4.8-cent rally in the previous session, the April Nymex contract was up 4.9 cents to $1.752/MMBtu as of 8:43 a.m. ET. Natural gas futures “caught a modest bid on Monday, with a…

Cooler Weather Outlook Bolsters Natural Gas Futures; Cash Rallies — MidDay Market Snapshot

Natural gas futures pull back from early highs but still in positive territory as weather models seen cooler over weekend April Nymex contract trading at $1.713/MMBtu as of 2:10 p.m. ET, up 5.8 cents “Changes over the weekend were colder, particularly for the Plains and Midwest” throughout 15-day projection period, according to Maxar meteorologist Brad…