Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

WPX Slaps Down $2.5B for Felix Energy, Boosts Permian Delaware Prospects

Tulsa-based independent WPX Energy is wrapping up the year in style with a $2.5 billion cash-and-stock deal to buy Permian Basin operator Felix Energy LLC.

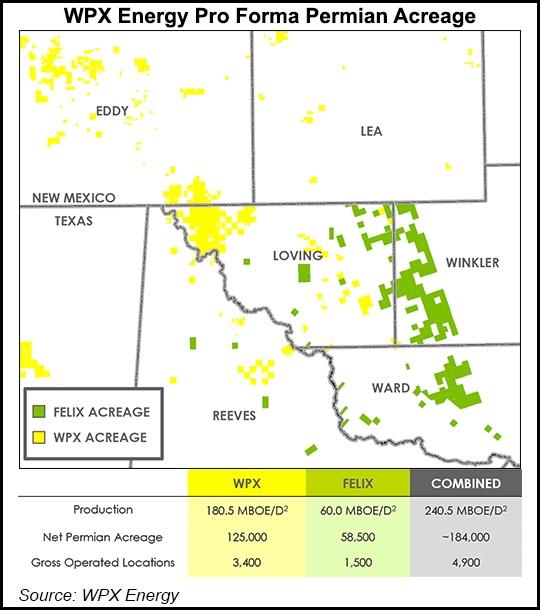

Denver-based Felix, a privately held portfolio company of EnCap Investments LP, has around 1,500 gross undrilled locations in the Delaware sub-basin that compete with the returns from an existing position in the core Stateline area, WPX management said.

“The transaction we’ve announced…checks all the boxes for us,” CEO Rick Muncrief said during a conference call early Monday.

Once the transaction is completed, the exploration and production company (E&P) expects to set aside $1.68-1.80 billion in 2020 for development capital. Pro forma production should be around 240,000 boe/d-plus, 64% weighted to oil.

The Felix deal is opportunistic, Muncrief said. WPX also works in the Williston Basin, but the Permian today is the priority.

“Meeting the five-year targets we communicated is the absolute standard and benchmark for any investment we make,” the CEO said. “Now we can accomplish these objectives for shareholders more quickly and efficiently with the irrefutable benefits of the Felix transaction.”

Felix in total has 58,500 net acres in an over-pressured, oily portion of the Delaware with six productive benches. About 25 additional wells are required to hold nearly all Wolfcamp and Third Bone Spring rights, with half of the wells set to be drilled in 2020.

Recent multi-well pads drilled by Felix that have at least 12 months of cumulative gross production are averaging 240,000 bbl per well, with pad averages of 213,000-260,000 bbl per well. Lateral lengths are averaging 9,200 feet.

Pending the transaction’s completion, WPX plans to add two board members from EnCap.

“This is an exciting day for both Felix Energy and EnCap,” said Encap managing partner Doug Swanson. “Over the past four years, the Felix team has worked tirelessly to build what we consider to be a world-class Delaware Basin asset. Given the current market environment, we are strong believers in consolidation and feel that the Felix asset base is a clear strategic fit for WPX.”

WPX agreed to pay $900 million upfront for Felix and provide 153 million shares worth an estimated $1.6 billion as of last Friday (Dec. 13). The transaction, unanimously approved by the board, still requires WPX shareholder approval. The deal is expected to be completed by mid-2020.

Once the combination is completed, WPX expects to generate free cash flow in 2020 at $50/bbl oil. Post-closing, WPX also plans to implement a 10 cent/share dividend and continue to buy back shares.

Delaware prospecting within the West Texas sub-basin has proved successful for WPX, with production from the sub-basin averaging 96,700 boe/d in 3Q2019, 28% higher year/year. Oil and gas/liquids volumes were nearly evenly split from the basin, with oil production comprising 49% at 47,200 b/d, up 10% from a year ago.

Natural gas liquids output from the Delaware jumped 93% from 3Q32018, benefiting from a joint venture gas plant in Reeves County, which did not start up until the end of 3Q2018. Physical natural gas volumes also climbed from increased gas capture and reduced flaring.

WPX’s average realized oil price in the Delaware during 3Q2019 was West Texas Intermediate (WTI) minus 50 cents, including Midland basis swaps. The average realized natural gas price in the Delaware was New York Mercantile Exchange less 40 cents for the quarter, including basis swaps, which increased the average realized price by 51 cents/Mcf.

WPX also realized $3 million in net commodity management margins, or 20 cents/Mcf in 3Q2019, related to further risk management activities around Delaware natural gas pricing exposure.

WPX completed 18 Delaware wells during the third quarter, including nine in the Wolfcamp A interval, five wells in the Third Bone Spring formation and four in the Wolfcamp XY interval.

Siebert Williams Shank & Co. LLC managing director Gabriele Sorbara called the transaction a positive “all the way around,” as it as it has attractive valuation metrics at $50/bbl WTI and is accretive on all key metrics including cash flow. Sorbara noted the deal also would expand WPX cash margins, as well as improve the oil mix and free cash flow profile. In addition, it should relieve “investor concerns” about the leasehold inventory.

“The acquisition of a large, private equity funded E&P by a public company is reminiscent of the Permian land rush in 2016/2017, when public companies were rapidly building up inventory,” said Enverus’ Andrew Dittmar, senior merger and acquisition analyst.

“Acquisitions of large, private equity funded positions haven’t really been in play during 2019, with public companies focused on restraining spending and combinations with other publicly listed peers potentially providing more attractive pricing. However, WPX is taking a page out of the playbook from a couple years ago.”

Adjusting for production value, Everus estimated the Felix leasehold is selling for around $10,000/acre. “That compares to many deals pricing over $30,000 per acre during the height of the Permian land boom,” Dittmar said.

WPX last did a deal in the Permian in early 2017, when it acquired Delaware acreage from Panther Energy for $775 million, or around $30,000/acre.

WPX’s deal history, Dittmar noted, “shows how land pricing has shifted in the Permian with current market dynamics.”

How the market reacts to the news in the next few days may be interesting, he said.

“In general, investors have not been kind to E&P companies that announce major acquisitions in 2019 and skeptical of how these will feed into cash flow. However, there have been some deals that met more favorable responses lately and WPX is actually up a bit in the early trading.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |