Shale Daily | E&P | NGI All News Access | Permian Basin

WPX Closes Felix Acquisition, Adding 60,000 boe/d of Permian Output

WPX Energy, Inc. has closed its $2.5 billion acquisition of fellow Permian independent Felix Energy LLC, WPX said Friday.

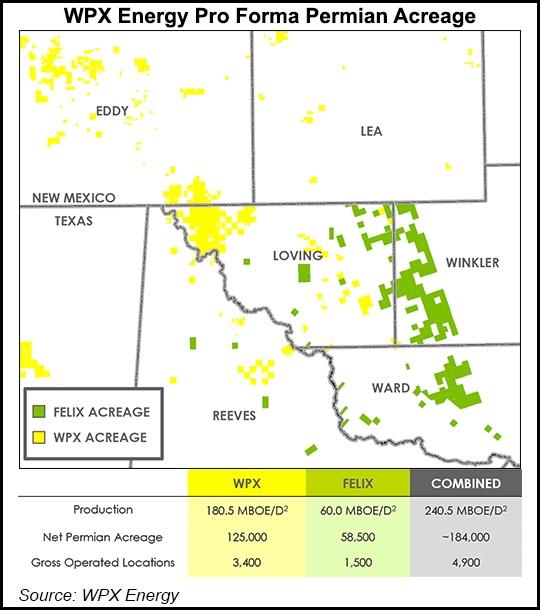

WPX shareholders overwhelmingly approved the transaction to acquire Felix’s assets in the Permian’s Delaware sub-basin, which are currently producing 60,000 boe/d (70% oil).

The closing brings Tulsa-based WPX’s total crude output from the Permian and Williston Basins to more than 150,000 b/d.

Felix’s financial sponsor, EnCap Investments LP, received about 153 million shares of WPX and $900 million in the transaction.

“We remain absolutely convinced about the accretive nature of the transaction and the outstanding quality of these assets,” said WPX CEO Rick Muncrief. “They overlie a tremendous resource that clearly gives us the means for accelerating our ability to achieve our five-year targets for shareholders.”

In the company’s 2019 fourth quarter results, WPX management said it based the economics of the Felix transaction on a $50 West Texas Intermediate oil price.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |