Woodside’s Western Australia Floating LNG Project Scrapped

Woodside Petroleum Ltd. and its partners have postponed indefinitely the Browse joint venture floating liquefied natural gas (FLNG) project off the coast of Western Australia.

The decision by Woodside and partners, including Royal Dutch Shell plc and BP plc, comes amid a glutted market for LNG and depressed commodity prices (see Daily GPI, Jan. 13). Woodside cited the “current economic and market environment” in its announcement Wednesday. The decision follows the completion of front-end engineering and design work on the proposed $40 billion project.

“While significant progress was made to improve project value, this has been offset by an extremely challenging external environment,” Woodside management said.

Woodside CEO Peter Coleman said the company “remains committed to the earliest commercial development of the world-class Browse resources and to FLNG as the preferred solution, but the economic environment is not supportive of a major LNG investment at this time. Accordingly, we will use the additional time to pursue further capital efficiencies for Browse.”

The company said it would work with project partners to prepare a new work program and budget to advance development.

“Woodside remains focused on satisfying its work program commitments under the Browse retention leases,” the company said. “The Browse retention leases were renewed in 2015 and the current term of the leases ends in mid-2020.”

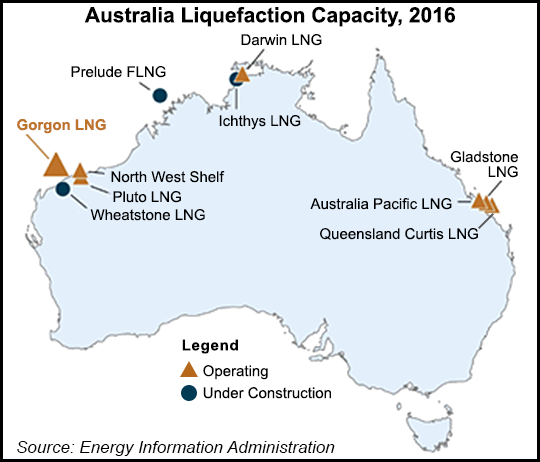

Chevron Corp. executives said earlier this month that they were prepared to begin shipping natural gas from the Gorgon Project offshore Western Australia (see Daily GPI, March 8). Gorgon, considered one of the largest gas export facilities ever built, is designed to export up to 15.6 million metric tons/year of LNG from Barrow Island; some contracts have been secured with Asia Pacific buyers (see Daily GPI, Jan. 29; Jan. 19). A carbon dioxide injection project and a domestic gas plant with the capacity to supply up to 300 terajoules/day to Western Australia also are part of the project.

Meanwhile in the United States, the Alaska LNG project, which would commercialize the state’s North Slope gas reserves, has also stumbled on glutted markets and depressed commodity prices. The state and its project partners are currently rethinking development costs with an eye toward bringing them down in order to make the exports competitive (see Daily GPI, Feb. 17).

In Canada, three export projects have been scuttled this year. Earlier this month Repsol Energy Canada and Irving Oil put on hold their project, Saint John LNG, which would have converted an import site in New Brunswick into an export terminal (see Daily GPI, March 17). In British Columbia, an international consortium led by AltaGas Ltd. halted work on DC LNG (see Daily GPI, Feb. 26). TransCanada Corp. also suspended a C$1.9 billion ($1.4 billion) export addition to its Nova Gas Transmission Ltd. western supply network (see Daily GPI, Feb. 5).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |