M&A | International | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

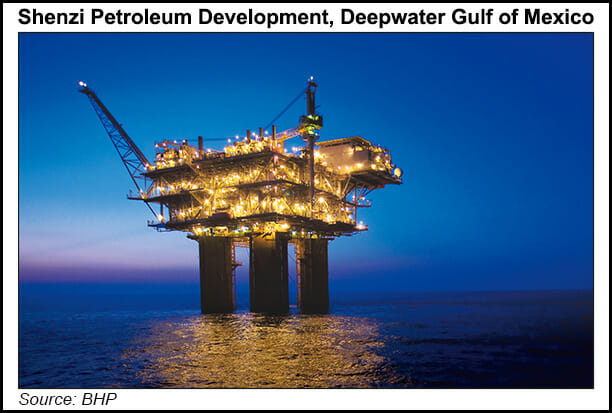

Woodside, BHP Agree to Merge in $28B Deal, Creating LNG Giant with Estimable Deepwater GOM Portfolio

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |