With Stronger Heat Looming, Natural Gas Futures Rebound with Double-Digit Avance

- New outlook for more extreme heat fueled optimism about seasonally stronger energy demand

- Monday’s gain marked a stark contrast from the prior week, when the July contract plummeted to a 25-year low before moving off the board

- Spot prices surged Monday

Natural gas futures posted a strong double-digit advance Monday, lifted by updated outlooks for more extreme July heat that could drive seasonally stronger energy demand.

The August Nymex contract surged 16.5 cents day/day and settled at $1.709/MMBtu.

It marked a stark contrast from the prior week, when the July contract plummeted to a 25-year low on supply/demand worries before moving off the board at Friday’s close.

September rose 14.9 cents to $1.754 on Monday. NGI’s Spot Gas National Avg. popped 19.0 cents to $1.585.

Forecasts shifted notably warmer over the weekend, and the outlook “is very impressive in terms of national demand,” Bespoke Weather Services said. Gas-weighted degree days (GWDD) “are projected to run well above normal into the first half of July, thanks to persistent stronger heat in the Midwest and East. Even a near-normal second half of July would allow the month as a whole to rank in the top five in terms of highest July GWDD totals.”

Bespoke also noted news of Chesapeake Energy Corp.’s filing for bankruptcy protection Sunday. While the independent had long struggled with lofty debt and the filing was expected, the move could affect gas production and influence balance data. It has downsized in recent years, but the producer still has substantial operations in the Eagle Ford, Haynesville and Marcellus shales, along with the Midcontinent and Powder River Basin.

“There may also be some buying on the news about Chesapeake,” Bespoke said, “although there is no clear sign at this time that production levels will see a material impact from this.”

Meanwhile, liquified natural gas (LNG) demand, hampered by a coronavirus that shows few signs of abating, remains a key area of focus for markets. Poor LNG feed gas demand and weak U.S. export levels persist as demand from important pre-pandemic export destinations in Europe and Asia remains soft.

“Over the next two to three days, the gas market will be waiting anxiously for indications of the level of LNG feed gas flows during the first week in July,” EBW Analytics Group said Monday. “If flows fall significantly from the 3.7-3.8 Bcf/d level that applied during much of June, the August contract could still retreat.”

What’s more, “even if feed gas flows in early July remain stable, natural gas cash market demand is likely to fall significantly heading into the July 4th holiday, limiting the upside potential this week.”

Bank of America Merrill Lynch (BofA) analysts said in a report Monday they see “some improvement in European gas prices on tightening balances in the coming months, though the upside is mostly to winter prices as inventories remain at seasonal record highs headed into their seasonal October peak.”

The BofA analysts also noted signs of a demand recovery in Europe, as countries gradually re-open economies. “The demand picture has improved very rapidly since countries started easing the lockdown in May and June. Looking at power demand growth in Europe, we see a very clear V-shaped recovery as we come out of the lockdown, and that means demand will continue to recover sequentially from here as we are still not fully out of lockdown in most European countries.

“Inventory builds have been materially below the seasonal norm since mid-May, in stark contrast to March-April when builds were significantly above seasonal norms,” they added.

In the Lower 48, attention is bound to shift this week to the next U.S. Energy Information Administration (EIA) storage report on Thursday. Last week’s report, which showed an injection of 120 Bcf natural gas storage for the week ending June 19, sent gas prices tumbling. The build far exceeded analysts’ average expectations and raised concerns about a supply glut.

Early projections for this week’s report call for a double-digit build, with improving weather-driven demand and some modest LNG optimism forming. Bespoke estimated an injection of 75 Bcf for the week ended June 26.

“This will be an interesting week in terms of where the EIA number falls, to see if last week’s massive bearish number was a one-off or a sign of something lasting,” Bespoke said. “We lean to the former, which if correct, should support prices.”

Cash Cruises

Spot prices surged Monday following the strengthened heat forecasts, with double-digit increases in every region of the country.

Temperatures are expected to climb across much of the central United States this week and then become more extensive over the coming holiday weekend and into next week, Maxar’s Weather Desk said.

Some of the biggest gains in spot price were in Appalachia, the Southeast, the Midwest and in East Texas.

Columbia Gas climbed 23.5 cents day/day to average to $1.530, while Dominion Energy Cove Point jumped 27.5 cents to $1.725.

Chicago Citygate surged 19.5 cents to $1.640, and Katy advanced 22.5 cents to $1.620.

Elsewhere, OGT climbed 21.0 cents to $1.530, and SoCal Citygate increased 22.5 cents to $1.765.

In its latest forecast looking out to July 8, Maxar said “hot conditions are steady in the Midwest throughout the period with low 90s in the forecast for each day in Chicago and Minneapolis. Meanwhile, a backdoor cold front is over the East at the onset, leading to a sharp temperature gradient between the Mid-Atlantic and Northeast. As troughing lifts out of the East, heat builds during the latter part of the period with widespread aboves early next week.”

Further out to July 13, Maxar’s forecast continued to be bullish for gas. “A broad coverage of aboves is seen from the Southwest to the Midwest and East, hottest relative to normal in the Upper Midwest and Interior Northeast,” it said.

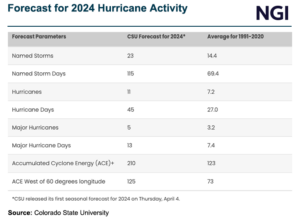

The National Hurricane Center, meanwhile, was watching a pair of thunderstorm masses in the Atlantic, but each had only limited potential to become named storms. One was east of the Caribbean Sea’s Windward Islands early Monday, and the other could emerge from a low-pressure system off the East Coast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |