With July 4 Weekend, Weekly Natural Gas Prices Give Up Modest Ground

Spot prices declined for the first week of July gas delivery as expectations for near-term cooling demand eased because of the long July 4 weekend — a holiday stretch typically defined by outdoor activities and reductions in manufacturing and air conditioner use.

NGI’s Weekly Spot Gas National Avg. from trading Tuesday through Thursday for the July 1-6 flow period fell a penny to $1.510.

The coronavirus pandemic also continued to hang over markets, infusing further doses of uncertainty.

Concerns about demand resurfaced during the week along with new virus outbreaks that forced major cities and several heavily populated states to pause or even walk back portions of re-opening processes that got underway in late May and in June.

New daily cases in the United States eclipsed 50,000 for the first time Wednesday, according to Johns Hopkins University, with outbreaks emerging in Texas, Arizona, California and Florida, among other states.

The pandemic’s upswing “fueled fears of a second wave of infections and a more protracted economic recovery,” Raymond James & Associates chief economist Scott Brown said Thursday. A stalled recovery would dampen energy demand in the commercial and industrial sectors.

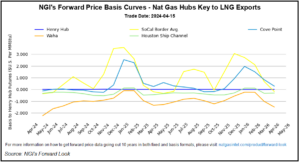

As the three-day trading week closed, PG&E Citygate’s weekly average was down 19.0 cents to $2.125, and SoCal Border Avg. was off 23.0 cents to $1.390. Kern Delivery was down 25.5 cents to $1.435.

Futures Strengthen

August natural gas futures started the week on firm footing, advancing on forecasts for strong summer heat to settle in across most of the Lower 48 through mid-July.

The prompt month gave up ground on Wednesday amid softening liquefied natural gas (LNG) feed flows that punctuated lingering supply/demand imbalance concerns.

Meager LNG feed gas demand and low U.S. export levels, induced by coronavirus outbreaks and the resulting global recession, have weighed on markets since the onset of the pandemic. Dozens of U.S. cargo cancellations have been reported in recent weeks, making the LNG decline unsurprising.

“Industry chatter suggests 10 more U.S. cargo cancellations in July versus June, which would represent 1.0-1.5 bcf/d and drop total U.S. feed gas demand into the 2.5-3.0 bcf/d range,” Tudor, Pickering, Holt & Co. analysts noted. “That said, a near-term heat wave likely keeps a bid in pricing, but if the heat fades, we expect Henry Hub pricing to go with it.”

Forecasts for heat, however, remained bright.

In addition to 90s and 100s over much of the country over the second week of July, Maxar’s Weather Desk, in its Thursday forecast, continued to see strong heat into mid-July.

“Above normal temperatures favor a wide portion of North America,” the forecaster said. “Warm support comes from numerous sources, which include seasonal forcing from warm sea surface temperatures. … As models are also broadly hotter than normal, confidence remains on the higher side of moderate for the period.”

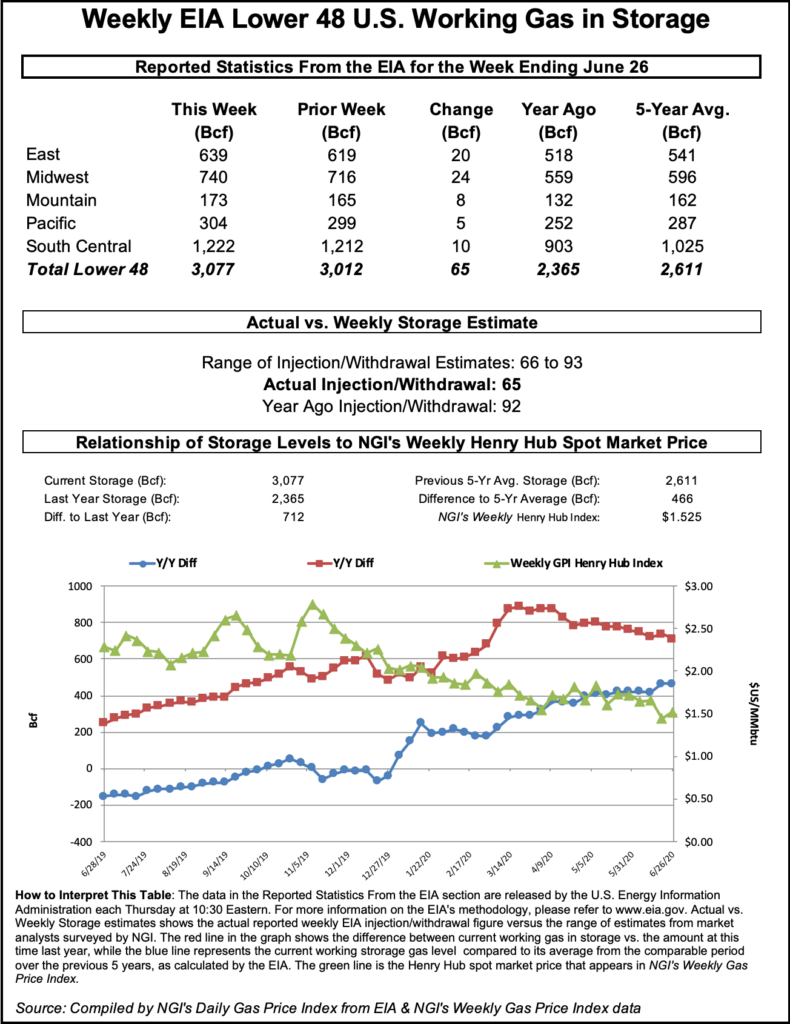

Futures rebounded Thursday to finish the holiday-abbreviated trading week in the green, in part because of favorable weather and in part because of an improved balance picture. The Energy Information Administration (EIA) on Thursday reported an injection of 65 Bcf for the week ending June 26, below analysts’ expectations and far lower than the prior week’s injection of 120 Bcf.

A Bloomberg poll found an injection estimate median of 78 Bcf, while a Wall Street Journal survey produced an average of 79 Bcf. A Reuters poll landed at 78 Bcf. NGI estimated a 71 Bcf build.

The latest injection was widely viewed as bullish, supported by the onset of summer heat and stronger cooling demand, and it overshadowed lingering worries about LNG and, more broadly, the global economic malaise brought on by the pandemic.

The print brought total storage to 3,077 Bcf and decreased the year-over-year surplus by 24 Bcf to 712 Bcf.

Raymond James analysts said that, excluding weather-related demand, the 65 Bcf injection implies that market demand was 1.6 Bcf/d tighter versus the same week last year and has averaged 0.9 Bcf/d tighter over the past four weeks.

The August Nymex contract settled at $1.734 /MMBtu Thursday.

Cash Cools

With Independence Day approaching, spot prices sputtered Thursday to finish the shortened week, even as forecasts called for more heat in ensuing days.

Cash cruised notably lower in West Texas and California.

El Paso Permian shed 29.0 cents day/day to average to $0.925, while Waha dropped 25.0 cents to $0.960.

SoCal Citygate fell 16.0 cents to $1.345.

Elsewhere, declines were less pronounced.

In the Midwest, Chicago Citygate was down 3.5 cents to $1.515, and in the Northeast, Algonquin Citygate dipped 5.5 cents to $1.470.

Looking ahead, expectations for lofty July temperatures were broadly predicted to drive seasonally strong energy demand.

Building off robust temperatures ranging from the high 80s to 100s across most of the Lower 48 over the holiday weekend, NatGasWeather also sees even stronger heat in the second week of July.

“The pattern is forecast to be most bullish” from Wednesday to July 14, “as upper high pressure increases in strength and expands to cover most of the U.S., with highs of 90s, while also becoming quite humid across the central and southern U.S. to push heat indexes into the very uncomfortable 95-105 degree range,” the forecaster said. “We expect this hot/bullish pattern to last through at least July 17.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |