NGI The Weekly Gas Market Report | E&P | M&A | NGI All News Access

With Eye on Northeast, Williams, Canada Pension Plan Complete JV

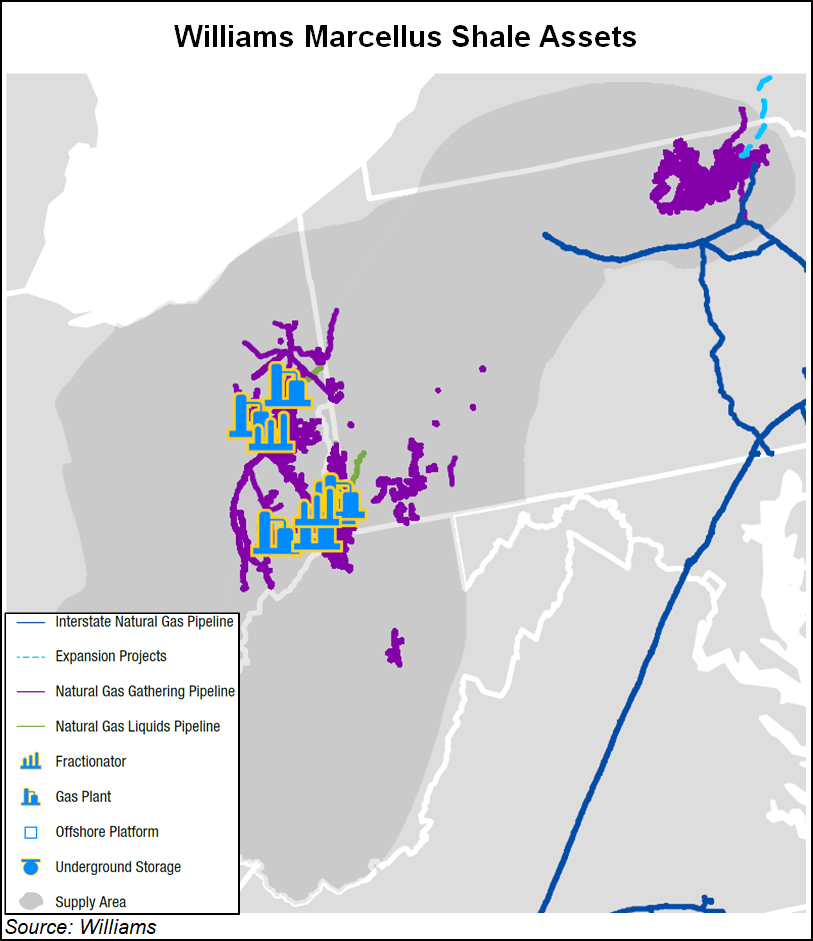

Oil and natural gas midstream giant Williams can “hit the ground running” expanding its capital spending in the Northeast after completing a $3.8 billion joint venture (JV) with Canada Pension Plan Investment Board (CPPIB).

Under the JV, first announced in March, CPPIB invested about $1.33 billion for a 35% ownership stake in Williams’ owned and operated Utica East Ohio Midstream system (UEO) in the Utica Shale in eastern Ohio, as well as its Ohio Valley Midstream system (OVM) in the western Marcellus.

A portion of the CPIB funds are being used to offset the purchase price from Williams’ purchase of the remaining 38% ownership interest in UEO from Momentum Midstream, with the balance of proceeds used for debt reduction and to fund Williams’ extensive portfolio.

“Closing this transaction is another significant milestone in enhancing our position in the Northeast and accelerating ongoing strengthening of our balance sheet,” Williams CEO Alan Armstrong said. “We now turn our focus to hitting the ground running with our new partner CPPIB, and look forward to growing our partnership and together, realizing the shared benefits of the combining of assets in the basin.”

The deal also expands Canada’s exposure to the North American natural gas market, and in particular the Marcellus/Utica plays. UEO consists of natural gas gathering pipeline/compression, roughly 1 Bcf/d of processing capacity, 160,500 b/d of fractionation capacity and other stabilization/storage/terminalling assets. OVM consists of 216 miles of pipeline (including an ethane pipeline) and 800 MMcf/d of inlet capacity.

CPPIB in 2017 also invested in Encino Acquisition Partners, an anchor customer on UEO and other Williams assets.

Morgan Stanley and CIBC Capital Markets acted as financial advisers to Williams for the transaction. Gibson Dunn served as legal counsel to Williams.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |