With Extreme Heat Yet to Materialize and Big Storage Build Expected, July NatGas Futures Extend Slide

Natural gas futures traded in a narrow range most of Wednesday, as markets weighed the prospects of heat-driven demand against continued liquefied natural gas (LNG) export weakness. But the prompt month ultimately finished in the red, dragged lower along with bearish storage injection estimates.

The July Nymex contract settled at $1.597/MMBtu, down 4.0 cents day/day. August fell 3.0 cents to $1.661. Futures have yet to finish in positive territory this week.

NGI’s Spot Gas National Avg. rose a half-cent cents to $1.565.

Summer heat has taken hold across most of the Lower 48, leading to stronger power burns. But futures markets have looked for indications of extreme temperatures to drive lofty cooling demand and offset the shocks of the coronavirus pandemic and the global recession it induced.

Weather models have, so far this week, instead produced modestly cooler outlooks than what forecasters had projected over last weekend, leaving markets to focus on simmering LNG challenges and the effects of overall demand destruction inflicted by the pandemic despite governments lifting restrictions on businesses and consumers.

“After cooler trends the past few days for early next week, the data was back a little hotter, but still with several weather systems preventing impressive or widespread heat,” NatGasWeather said in a Wednesday afternoon forecast. Data also “trended cooler for the Fourth of July weekend” with weather systems over the eastern U.S. set to prevent upper high pressure “from getting quite as strong as previous runs.”

Additionally on the weather front, traders had been watching Tropical Storm Dolly on Tuesday, with the potential for 45 mph winds, and eyeing whether it could make landfall in the United States with some force. But Dolly weakened in the north Atlantic by Wednesday morning and the National Hurricane Center said it no longer posed a threat to any land areas.

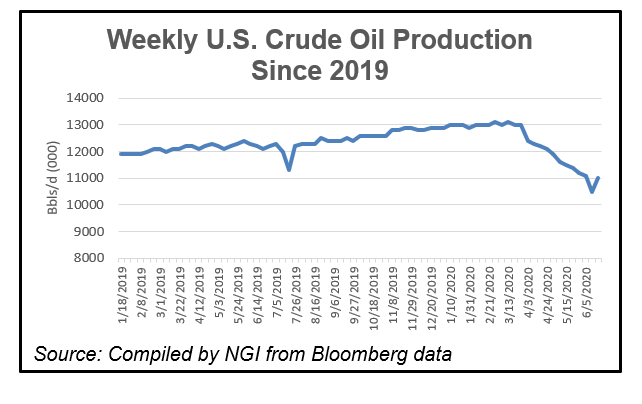

Gas production, meanwhile, increased back over 87 Bcf/d this week amid reports of associated gas production coming back online with resumed oil drilling. U.S. crude oil production hit a 2020 low of 10.5 million b/d on June 12, but it rebounded to 11.0 million b/d on June 19, according to an NGI analysis of Bloomberg data. That is still well below the 2020 high of 13.1 million b/d reached on March 13, just prior to the onset of pandemic-response measures in the United States, but it marks a notable increase, nonetheless.

At the same time, LNG export levels hover near 4.0 Bcf/d, up from recent lows but still soft, as demand from formerly reliable destinations in Europe and Asia remains anemic due to slow economic recoveries and modest industrial energy needs. The threat of a virus resurgence also weighs on demand. In the United States, the rate of increases in Covid-19 cases has accelerated in June amid the reopening of local economies, with several states, including Texas and Arizona, reporting daily record highs this month, according to Johns Hopkins University data.

“While further progress on treatments and vaccines for Covid-19 could lead to added confidence on lifting of lockdowns … these are unpredictable times,” shipbroker Fearnleys AS said. As such, LNG sentiment remains “flat.”

Expectations for a triple-digit storage build did nothing to lift market optimism.

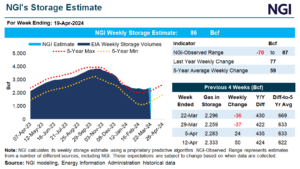

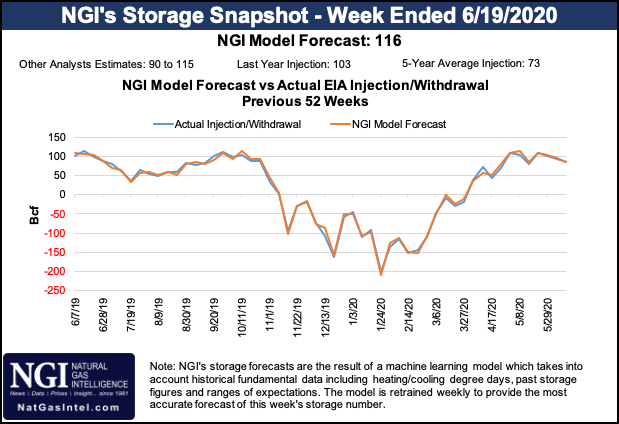

The U.S. Energy Information Administration (EIA) on Thursday is set to issue its storage report for the week ended June 19. A Bloomberg poll found injection estimates ranging from 100 Bcf to 114 Bcf, with a median of 108 Bcf. A Wall Street Journal survey produced an average build expectation of 105 Bcf, while a Reuters survey of 17 analysts produced a 90 Bcf to 115 Bcf injection range and a median 106 Bcf injection. NGI estimated a 116 Bcf build.

The bearish expectations compare with a build of 103 Bcf during the same week a year earlier and the five-year average build of 73 Bcf for that week.

If the final figure is close to average expectations, it would lift surpluses over the five-year average above 450 Bcf and supplies to around 3 Tcf with more than four months of injections to go, NatGasWeather noted. “Also of importance,” the firm added, July futures expire at the close of this trading week, “which could lead to quick price swings.”

Cash Climbs

Spot prices advanced across a majority of regions in the Lower 48 on Wednesday.

“Power sector gas burn is recovering strongly this week from last week’s subdued levels” as returning heat adds 26 cooling degree days week/week and carries gas burn 4.7 Bcf/d higher than week-ago levels, according to EBW Analytics Group.

“Further gains are likely as summer heat ramps up — potentially helping tighten the spot market,” the firm said. “National gas burn may rise as much as 7.0 Bcf/d from current levels into the heart of summer to new record highs, particularly if warm anomalies spread to gas-heavy Texas and the Gulf Coast.”

The potential for a rebound in coal generation “to meet peak summer loads, however, may put a ceiling on increases in power sector gas demand,” EBW noted.

Solid gains were made in the Midwest, South Texas and the Midcontinent, while prices fell in California and the Northeast.

Chicago Citygate advanced 5.5 cents day/day to average $1.585, while Tres Palacios prices climbed 6.5 cents to $1.585, and Northern Border Ventura gained 4.5 cents to $1.565.

SoCal Citygate, meanwhile, lost 6.5 cents to $1.905, and Algonquin Citygate declined 8.0 cents to $1.590.

On the pipeline front, Texas Eastern Transmission (Tetco) on Tuesday declared a force majeure over its entire 30-inch diameter system, spanning from Kosciusko, MS, to Uniontown, PA. The announcement was tied to an amended corrective action order, under which Tetco last week started to reduce capacity at its Wheelersburg, OH, interconnect with Tennessee Gas Pipeline (TPG) to 49 MMcf/d to prevent further accumulation of shipper imbalances at the location, according to Genscape Inc.

The force majeure, most notably, is expected to reduce export capacity to M3 at Uniontown from 4.2 Bcf/d to 2.5 Bcf/d, Genscape said. “Capacity through Uniontown is immediately constrained right before summer power demand peaks over the next two months.”

Also on Tuesday, TPG notified customers of an emergent repair issue at Station 325 near Liberty, NJ, with flow impacts likely in the range of 100 MMcf/d, Genscape estimated. Nearby, flows at MLV324TOMLV336 have been reduced by nearly 103 MMcf day/day to 1.28 Bcf/d on Wednesday.

“These flow impacts have resulted in decreased deliveries to Algonquin Gas Transmission (down 55 MMcf day/day) and Transcontinental Gas Pipeline (down 34 MMcf day/day) throughout New Jersey, the firm said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |